Shipping risks: how companies are responding to the escalation between Israel and Iran

Global shipping companies have warned of risks to key shipping lanes after Israel’s strikes on Iran, including the Strait of Hormuz.

According to Bloomberg, on Friday morning, June 13, Israel launched strikes on key targets in Iran, including Tehran’s nuclear and military facilities. In response, Iran launched more than a hundred drones at Israel.

Shipping companies react

Japanese shipping companies Nippon Yusen KK, Mitsui OSK Lines Ltd. and Kawasaki Kisen Kaisha Ltd. were among the first to warn ships to exercise caution after the strikes.

Other shipping companies are expected to respond in a similar way, as the attacks have focused attention on the region’s bottlenecks – routes that transport oil, LNG and containers.

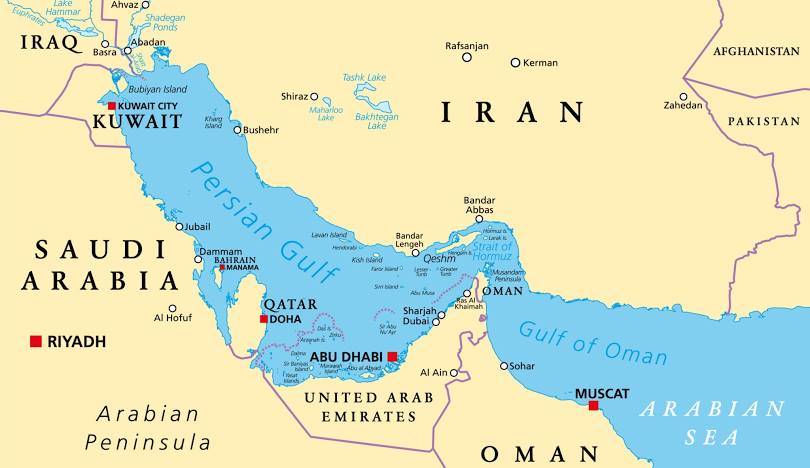

Yes, the Middle East is home to some of the world’s most important sea lanes – tankers load oil for Asia and Europe, and container ships head to consumers on both continents. One of the main narrow passages is the Strait of Hormuz, which carries about a quarter of the world’s oil trade and is heavily influenced by Iran.

One of the main narrow passages is the Strait of Hormuz, which carries about a quarter of the world’s oil trade and is under significant Iranian influence.

Read also: The Strait of Hormuz and its significance in the context of the Iran-Israel conflict.

Another critical region is the Red Sea, on both sides of which are the Suez Canal and the Bab el-Mandeb Strait. These areas are already under attack by Yemeni Houthi rebels, who are supported by Tehran.

Anup Singh, head of shipping research at Oil Brokerage, noted that about 10% of the global fleet of very large tankers, or about 90 vessels, are constantly in the Persian Gulf, of which about 20 pass through the Strait of Hormuz every day.

“The threat of war in the Middle East has a significant impact on freight rates. For now, owners will refrain from sending ships to the Persian Gulf in the usual way,” Singh emphasized.

Oil and gas prices surge

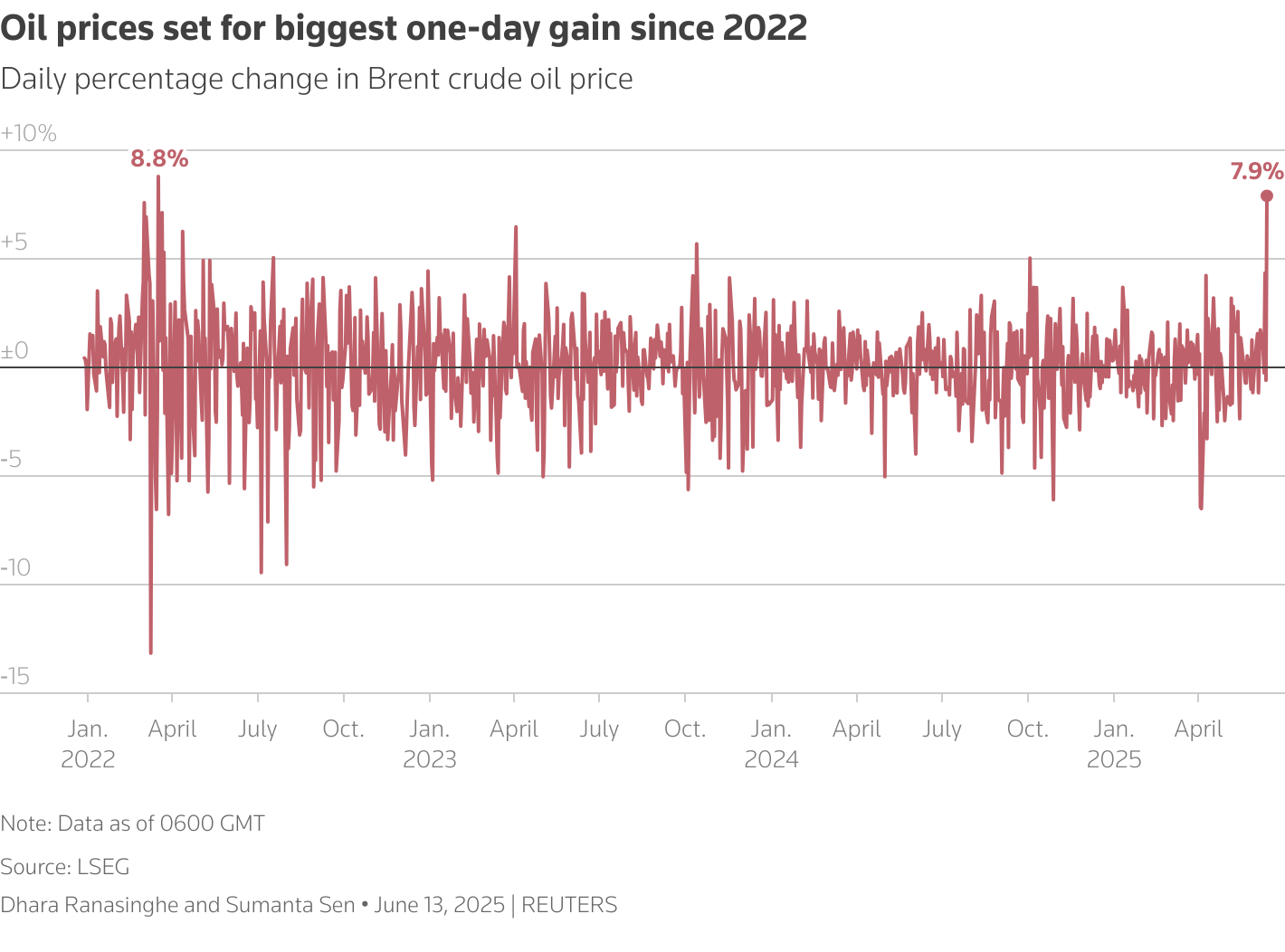

Oil prices rose on Friday, June 13, amid escalation between Israel and Iran. Crude oil prices jumped, with Brent rising $5.43 to $74.79 a barrel and WTI up $5.55 to $73.59. At one point, the price of oil jumped as much as 14%.

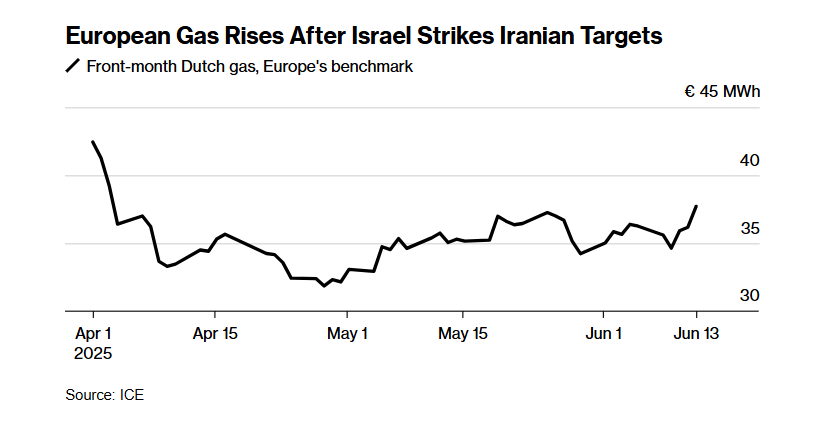

At the same time, natural gas prices in Europe rose sharply, as the Middle East is a key region for global energy supplies.

The underlying futures rose 5.7%, the biggest one-day jump in more than five weeks. Gas prices rose amid a general rise in the market, including oil prices.

“The main risk is that further escalation could disrupt transportation through the Strait of Hormuz, a vital artery for liquefied natural gas (LNG) and oil supplies,” the report said.

Physical LNG supplies have not yet been disrupted, but delays could occur if ships begin to avoid the Strait of Hormuz route.

“Investors are seriously concerned about a full-scale conflict in the region, which could keep markets volatile for a long time,” said City Index analyst Matt Simpson.

Analysts’s forecast

Blocking the Strait of Hormuz – the main route for tankers heading to oil-producing countries such as Saudi Arabia, the UAE, Kuwait or Iran – is seen as an extreme step that Tehran may be trying to avoid for now.

Hans Tino Hansen, CEO of security consultancy Risk Intelligence, stressed that the consequences could be far-reaching if Iran were to close access to the Strait of Hormuz.

Jorge Leon, an analyst at Rystad Energy A/S, said that a closure of the Strait of Hormuz, attacks on regional oil infrastructure or strikes on US military facilities could lead to a “strong” market reaction. In such a case, prices could rise by $20 or more.

Jayendu Krishna, CEO of Drewry Maritime Services, added that prices for dry bulk carriers would also rise – the Middle East accounts for more than 10% of global dry bulk trade.