Shipping reform in the United States will change the “rules of the game” in ports

On Thursday, June 16, 2022, the 46th President of the United States, Joseph Biden, signed into law S. 3580, the Ocean Shipping Reform Act of 2022 (hereinafter OSRA 2022). The OSRA 2022 legislation has caused a stir in the container shipping industry. After reviewing the content of the document, experts from the cargo analytical and consulting firm Informall BG based in Ukraine decided to share their opinion on the newly introduced act, as well as assess the impact of OSRA 2022 on the industry.

The objectives of the OSRA Act 2022:

Mainly, the OSRA 2022 act’s objective is to stimulate container exports from the country. The act is providing needed protection for US exporters through new tools of control and regulations over the shipping lines that provide their services in the ports of the USA. In particular, the White House administration emphasized that it based its conclusions about the unscrupulous operation of shipping lines based on the data on “9 foreign carriers” that are direct members of the global alliances – THE Alliance, 2M Alliance and OCEAN Alliance. Also, the document provides for the control and independent assessment of invoices for container demurrage and detention charges issued by lines to shippers from the United States.

The government expects to reduce inflation in the country and decongest container terminals with the help of new instruments provided to the Federal Maritime Commission through the OSRA 2022 act.

Innovations of OSRA 2022:

• OSRA 2022 enables Federal Maritime Commission (hereinafter FMC) to launch investigation of carriers’ unfair and/or unreasonable practices, refusal in transportation service or any other unfair or discriminatory methods against US shippers;

• Allows investigation of unjustified refusal (by carrier) to deal with US shippers or negotiate for the allocation of cargo slots on the vessel;

• Introduction of a ban on unfair or discriminatory practices (by carrier), especially in relation to any commodity group or type of shipment, or in relation to tariffs or charges;

• OSRA 2022 enables the FMC to impose penalties on those ocean carriers which violate the introduced rules;

• OSRA 2022 requires ocean carriers to provide reasonable grounding on demurrage and detention invoices in the event of a complaint by shipper or hauler;

• OSRA 2022 prohibits a carrier’s retaliation against a shipper or intermediary (forwarder and NVOCC) or road carriers by refusing to place cargo on a ship; as well as

- The act enables FMC to query and publish import/export volumes of shipping lines in TEU (equivalent to a 20-foot container), as well as the volumes of full/empty containers on ships in TEU. A marine terminal operator, owner or chassis supplier with a fleet of more than 50 chassis that provides chassis for a fee at any of the top-25 US ports must submit the required data [monthly] to the FMC to publish statistics regarding the downtime of the equipment used in intermodal transport;

Informall BG experts say: “no quick improvements to expect”

Notably that the new rules do not affect or limit the rights of alliances to share container slots on container ships. Importantly that FMC will issue additional rules and clarifications to the already existing OSRA 2022 regulations over the next 3 years, and some clarifications to the law should be published in a shorter [rather ambitious] timeframe of 30-60 days after the law enters into force. The fact that OSRA 2022 was passed in such a short time (within four months) rather indicates that the bill will be revised by the FMC many more times.

It is doubtful whether congestion in US ports will really decrease just because this act was passed. Joe Biden, the President of the United States considers that OSRA 2022 will help to significantly reduce inflation in the near future, however, Informall BG experts believe that this act can only stimulate container shipments from the United States and, in the future, normalize the work of container terminals in terms of exports, while inflation will continue to progress due to its multifactorial nature. First of all, the US logistics system must adapt to new market conditions, invest in the development of container terminals, port and storage infrastructure in order to significantly affect congestion both on water and on land.

The White House reasoning:

It seems that legislators believe that ocean carriers have no right to increase freight rates without sufficient justification. Although OSRA 2022 does not directly affect freight rate formation, a sharp increase in freight prices could be regarded by the FMC as “unfair and/or discriminatory action against shippers” which allows for the lunch of an investigation against the carrier, which in turn will be forced to justify the legitimacy of increasing the cost of transportation for shippers.

The Biden administration regularly criticizes ocean carriers for making record profits at the expense of importers, exporters and “ordinary American families” by raising freight rates “by 1000%”, as J. Biden reported before signing the act on June 16, 2022. Indeed, ocean carriers in 2021 collectively made more profits than their total income for 10 years of previous work, however, it is worth noting that the shipping industry is one of the few that did not stop its business activities during the entire period of the Covid-19 pandemic and continued to transport goods while adapting to Covid-19 restrictions.

What is notable is that OSRA 2022 does not properly considers marine terminal operators, who also play a critical role in the overall congestion of the US logistics system and increase in shipping costs (not to mention smaller domestic carriers and dry port operators located outside the jurisdiction of this act, which also contributed to the problem of congestion).

The US container ports remain under pressure:

The World Bank and S&P Global Market Intelligence published “Container Port Efficiency Index 2020” reviled that the port of Long Beach, USA [throughput 9,2 mln TEU] ranked 333rdout of 351 while Los Angeles, USA [throughput 8,11 mln TEU] ranked 328th out of 351 other ports in the world.

For comparison, on the same year (2020) the port of Hamburg, Germany [throughput 8,5 mln TEU] took 280th place, and Shanghai, China [throughput 43.5 mln TEU] 63rd place out of 351 on the same list.

However, in the second half of 2021, after China exporters have stepped out from the lockdown and began actively shipping their products to the US, ports of Long Beach and Los Angeles were already at the bottom of the list ranking 369 and 370 among 370 ports in the world respectively. The worst indicator in the history of these ports.

The key US container ports on the west coast in 2020 did not demonstrate much efficiency long before there was any significant increase in container traffic similar to post-Covid period in 2021. As early as October 2021, US west coast ports found themselves in a situation where container terminals were overloaded to the critical levels when normal terminal operations became impossible, forcing terminal operators to call on the US government for help. As a result of terminal congestion, more than 100 ships lined up off the coast of Los Angeles waiting to unload at the terminals, while the east coast became an alternative destination for some shippers willing to avoid extreme waiting times. East coast container ports served well for the US shippers during post-pandemic times providing them with faster delivery of critical resources and other import goods.

Despite the fact that a significant part of the world’s container tonnage was out of circulation due to congestion in sea ports (30-45 days of waiting time for berthing), shipping lines still had enough capacity in order to continue actively transporting goods on major tradelines.

Understanding of the consumer patterns is crucial:

At the same time, US warehouses were overflowing with goods purchased before the Covid-19 pandemic. Large retail chains were actively ordering goods from China, anticipating the closure of many factories in Asia and the suspension of production in China particularly. However, the situation has developed in such a way that goods purchased before the pandemic no longer serve the interests of the US buyers during and after the pandemic. People have stopped working in offices, public spaces are closed for visitors and consumers have no opportunity for “normal shopping” in shopping malls. Instead, the vast majority of people is spending time at home and working remotely, which has led to a dramatic shift in consumer behavior. Buyers began to be interested in other categories of goods, which, often, were not available in warehouses.

As a result, China, which overcame the lockdown phase much earlier than the United States did, quickly responded to the market demand and began actively supplying needed goods to the American market. While the US terminals were clogging with containers, importers, on the other side, had no storage space to unload them and not enough workforce to do it.

Continuing China – United States “trade war”:

Informall BG experts suggest that the OSRA 2022 act is one of the many elements of the so-called “trade war” between the US and China, initiated during the tenure of former US President Donald Trump.

Vassiliy Veselovsky, CEO of Informall BG: “This Act [OSRA 2022] is a far-reaching tool for cargo owners and particularly for exporters which allows scrutinizing the legitimacy of invoices for equipment detention and demurrage charges. The very fact of emerging legal grounds for possible lawsuits and a prospect of their mass character will serve as a serious motivation for liner carriers not to get too involved with the issues of obtaining excess profits if any. Besides, in the absence of clear definitions of ‘fairness’ in the act, ocean carriers will be more thorough upon issuing demurrage and detention charges to customers”.

It is important to note that according to the FMC, shipping lines such as COSCO and OOCL have caused the most damage to the US economy by manipulating container equipment in US ports. Ocean carriers favored empty equipment while ignoring full US export shipments which was one of the factors contributing to the congestion on container terminals.

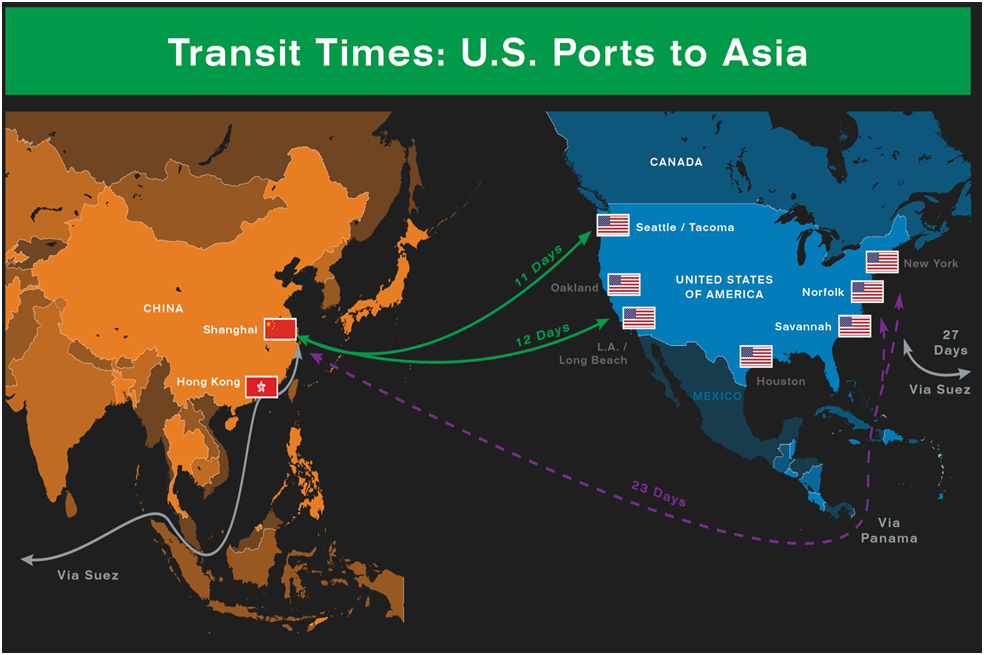

Alexander Khromov, project manager at Informall BG, comments: “The dairy and meat US industries shipping their perishable products to Asia and South America markets on weekly basis have suffered the most from these actions. Many of them bear huge financial losses due to significant delays in deliveries and congestion in ports.”

Market response to shipping lines practices:

Shipping lines, pursuing extra profits on the Trans-Pacific and Trans-Atlantic directions, have already lost part of the US market and at the same time created competition on the above-mentioned routes. Major US shippers such as Amazon, Walmart, Costco and others are chartering their own container vessels, minimizing the impact of shipping lines on freight rates while also increasing control over their own supply chains.

Daniil Melnichenko, data analyst at Informall BG continues: “The US ‘forceful’ policy towards sea freight carriers could potentially trigger an additional increase in today’s export rates from the US to Asia. Such an increase in freight rates could affect the competitiveness of some US goods in the Asian market, making them less cost-attractive. This is especially concerning for the US low-tech products and perishable groups of goods that are most sensitive to the shipping cost fluctuations”.

Overall, Informal BG experts suggest that the OSRA 2022 legislation will have a positive impact on US export shipments and will further support and protect US manufacturers supplying their goods to the Asian markets. However, significant changes for American business will be seen much later (over the next 3 years) and will largely depend on the effectiveness of the US Federal Maritime Commission (FMC) work. The FMC organization still needs more funding and human resources, which, in turn, will make it possible to effectively use the tools provided by OSRA 2022.

______________________________________________________________________________

About Informall BG:

INFORMALL BG, based in Odessa, Ukraine, is an independent consulting and private equity firm, established in 2005, that provides a full range of consulting and cargo analytical services required for decision making, planning and implementation of transport infrastructure projects in Ukraine.

Article authors:

Vassiliy Vesselovski – CEO of Informall BG

Alexander Khromov – Project Manager of Informall BG

Daniil Melnychenko – Data analyst at Informall BG.