Bloody oil: russian federation continues to make money from sea supplies

In April, russian oil exports recovered, despite the rejection of raw materials by many European buyers. USM tells how now, during the war, russian federation continues to sell oil and who buys bloody raw materials.

Before the war, russia was the second largest oil exporter in the world, after Saudi Arabia. Almost 60% of the volume was transported by sea. Since February 24, when russia started a full-scale war in Ukraine, supplies have decreased sharply.

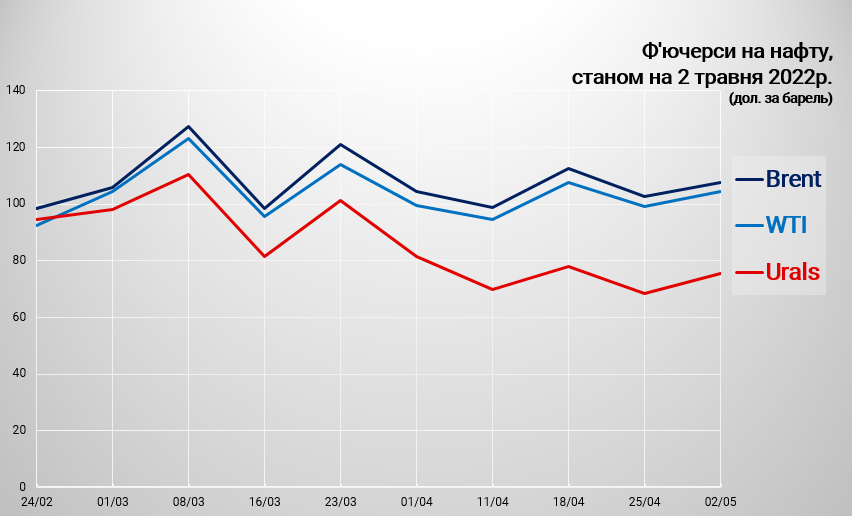

According to the Ministry of Finance of russian federation, the average price of russian Urals oil for the period from March 15 to April 14 was $79.81 per barrel. Urals trades at a discount to Brent due to density and sulfur content. This variety is a mixture of heavy high-sulfur oil of the Urals and Tatarstan and Siberian Light, produced in KhMAO. The base for Urals is oil produced by Rosneft, Bashneft, LUKOIL, Surgutneftegaz, Gazprom Neft and Tatneft. The main buyers of Urals are European countries, where it is delivered by sea through the ports of Ust-Luga, Primorsk and Novorossiysk in the south. Part of the raw material also goes through the Druzhba oil pipeline.

The income from oil and gas decreased so much that in March russian state budget received 300 billion rubles less than planned. It is worth noting that oil accounts for 85% of the income from the country’s budget from the oil and gas industry.

In general, after the start of a full-scale invasion of Ukraine, forecasts for russian oil sound without optimism. In russian federation itself, they believe that this year the production of raw materials may fall by 17% due to sanctions. Thus, the production of russian oil may decrease to the level of 433.8 – 475.3 million tons (8.68 million – 9.5 million barrels per day) in 2022 against 524 million tons in 2021.

This will be the lowest figure since 2003, when tussian oil production amounted to 421 million tons. According to forecasts, oil exports from russian federation will decrease this year to 213.3 – 228.3 million tons (4.27 – 4.57 million barrels per day) against 231 million tons in 2021 (provided that there won’t be oil embargo from the EU).

The price of oil rose slightly in the first half of April. In particular, oil exports reached approximately 4 million barrels per day (approximately 200,000 tons per day), and this is the highest indicator since the beginning of the year. However, in the second half of April, during the week from April 16 to 22, russia shipped 40 tanker shipments of oil, the total volume of which exceeds 28 million barrels. (≈5.5 million tons). Thus, the average export of oil from russia through sea terminals was about 4 million barrels per day. (≈540 thousand tons/day) — 25% more than a week earlier.

Correspondingly, revenues from export duties, which the russian state receives from foreign supplies, also grew. As of April 8, tariffs reached their highest level since the beginning of the year. Bloomberg analysts calculated that in just one week, the kremlin earned about 230 million dollars from the export of oil by sea.

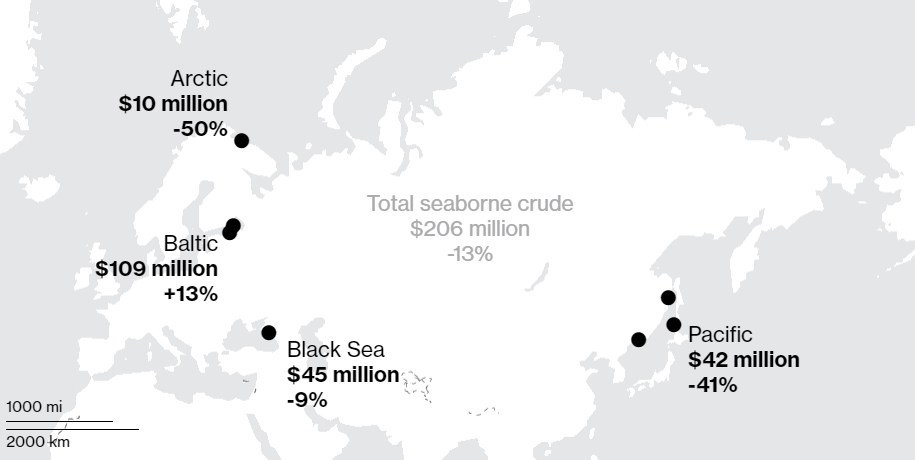

However, by the end of April, the situation had changed — the maritime export of oil from russian federation had significantly decreased. In the period from April 22 to 29, the volume of oil supplies from russia fell by 14%. Three of the four main export destinations, Pacific, Arctic and Black Sea ports, showed negative dynamics: -41%, -50% and -9%, respectively. The graph below shows only the period from April 22 to 29.

It is worth noting that last year (February-April 2021) Urals traded much cheaper than in 2022 — the average price fluctuated around $59-62 per barrel. This year, Urals is more expensive, but it seems that this is a temporary phenomenon. In russian federation itself, they are already talking about reducing production, as well as giving discounts to those countries that are not afraid of sanctions. As we can see, the bold calculations and forecasts of russian federation are not justified, and there are fewer and fewer countries willing to trade with russia.

Earlier, European oil companies announced that they would stop buying russian oil because of the war in Ukraine. The USA has completely stopped purchases, the UK will stop imports by the end of the year. The EU is considering the possibility of “saying goodbye” to russian oil already in the next, sixth package of sanctions.

However, not all countries and companies have finally severed ties with russian federation. So, for example, the largest European oil company Shell Plc, despite a public statement about the refusal of russian oil, continues to receive it under the cover of so-called mixing.

The essence of such a scheme is that in each barrel sold by the company, only 49.99% of raw materials are produced in russia, and 50.01% are supplied from other sources. From Shell’s point of view, such cargo is not of russian origin. After public attention to this issue, the company announced that it would stop trading oil with any percentage of russian origin. Who else besides Shell uses such an approach is currently unknown.

EU sanctions are still not working in full force. The fifth package of sanctions prohibits the import of many goods from russian аederation and Belarus, as well as the entry of russian-flagged ships into European ports. And this would be a full-fledged embargo, if Europe did not leave “loopholes” to bypass its own sanctions. A number of exclusions remain in the new EU sanctions against russia, creating opportunities for their circumvention.

Five packages of sanctions did not affect oil transactions

Thus, the decision of the European Commission states that the EU member states may, at their discretion, allow russian and Belarusian enterprises to transport certain categories of cargo. Among them are cargoes that bring the most revenue to the budget of russian federation, in particular: natural gas and oil, including oil refining products, as well as titanium, aluminum, copper, nickel, palladium and iron ore. Also, on a private basis, it is possible to import agricultural products, fertilizers, etc. to European countries.

All these “exceptions” make up 80% of russian exports. Oil and oil products account for 50% of all export sea transportation of russia. And if in the sixth package of sanctions there will be a ban on the import of oil with similar “loopholes” and half-measures, there will be no full-fledged embargo.

Asia

All sorts of restrictions from the governments of European countries, as well as “self-sanctions” from international companies have changed something. In particular, the geography of russian oil supplies is changing.

From February 24 to April 18, at least 380 oil tankers left russian ports — 8% more than in the same period last year, Nikkei Asia reports.

According to the Refinitiv data analysis, oil supplies did not decrease even after the news about the brutal killings of civilians by the occupiers in Bucha near Kyiv. From April 2 to 18, 119 oil tankers left russia, compared to 109 in the same period last year.

Of the 380 tankers that have left russian ports since February 24, 115 have gone or are headed to Asia: 52 — to China, 28 — to South Korea, 25 — to India, nine — to Japan and one — to Malaysia. And oil goes to Asia, because buyers are offered big discounts on raw materials.

Half of the ships loaded in the north-western russian ports of Primorsk and Ust-Luga in April are either headed to Asia or do not show their final destinations. Bloomberg suggests that they can go to Asia through the Suez Canal.

Of the 21 Ural oil vessels docked in Primorsk, Ust-Luga and Novorossiysk in the first week of April, six are headed for India, four have an undisclosed destination, and the rest hope to unload within Europe.

It is worth noting that the EU has not yet introduced an oil embargo, but some European countries are already refusing to accept tankers in their ports. So, for example, at the end of April, the whole world watched the scandal with the tanker Sunny Liger, which transported russian oil. First, they refused to unload the ship in Sweden, and then the Netherlands.

Cheap russian oil, which is sold at record discounts, finds buyers in India. Analysts of the Royal Bank of Canada have calculated that India’s oil imports from russia have grown from less than 100,000 barrels per day in 2021 to 800,000 barrels per day in April 2022. It is also expected that India will continue to increase imports until Washington will introduce secondary sanctions. Moreover, India is currently negotiating a six-month deal with russia that will allow the country to increase imports of russian oil even more.

India is the world’s third largest oil consumer, with consumption needs of about 5 million barrels of oil per day. In total, in the period from February 24 to the end of April, India placed an order for at least 40 million barrels of russian oil with delivery in June.

China

Deliveries from three russian ports in the Pacific Ocean are mainly sent to China, are only occasionally sent to other places. The latest BIMCO data indicate that since February 24, deliveries of oil and petroleum products by tankers from the Russian Federation to China have increased by 94%. According to data from the analytical center CREA, in the two months since the beginning of the war, russian federation has earned €5.21 billion from oil exports to China, which makes it the largest importer of russian oil at the moment.

Due to the logistical blockade from Europe, russian federation wants to increase sea freight turnover with China. At the end of April, the occupiers even created a new working group that deals with this issue, and also adopted a document that looks like a request to China to allocate additional capacity for cargo transportation.

This document also talks about the possibility of transporting russian goods through third countries. The reason is the same — refusal of European ports to russian ships.

“At present, a special working group on sea logistics routes has been created and is functioning. Possible measures for the normalization and stabilization of the situation on the maritime liner shipping market are considered at the specified site. “In particular, we are working on the issue with transport companies (marine shipping lines) of the People’s Republic of China on the possibility of allocating additional tonnage for the transportation of russian cargo, as well as exploring the possibility of creating new ports – hubs on the territories of friendly countries,” the document says.

It is logical that russia plans to reorient cargo flows blocked by EU sanctions to the PRC. Including the upcoming sanctions on the import of oil, which the EU must approve in the near future. However, russian federation’s plans to increase cargo turnover with China are under question — the Chinese economy is experiencing difficulties due to the new outbreak of COVID.

In March, due to a new peak of infected people, a number of cities in the PRC imposed a lockdown to prevent the spread of the virus. Accordingly, Chinese ports and enterprises were temporarily suspended, which again led to traffic jams, and also affected the import of all goods to the PRC. How real are russia’s plans to increase oil exports to China and how long the heaviest lockdown will last is an open question.

What about Europe?

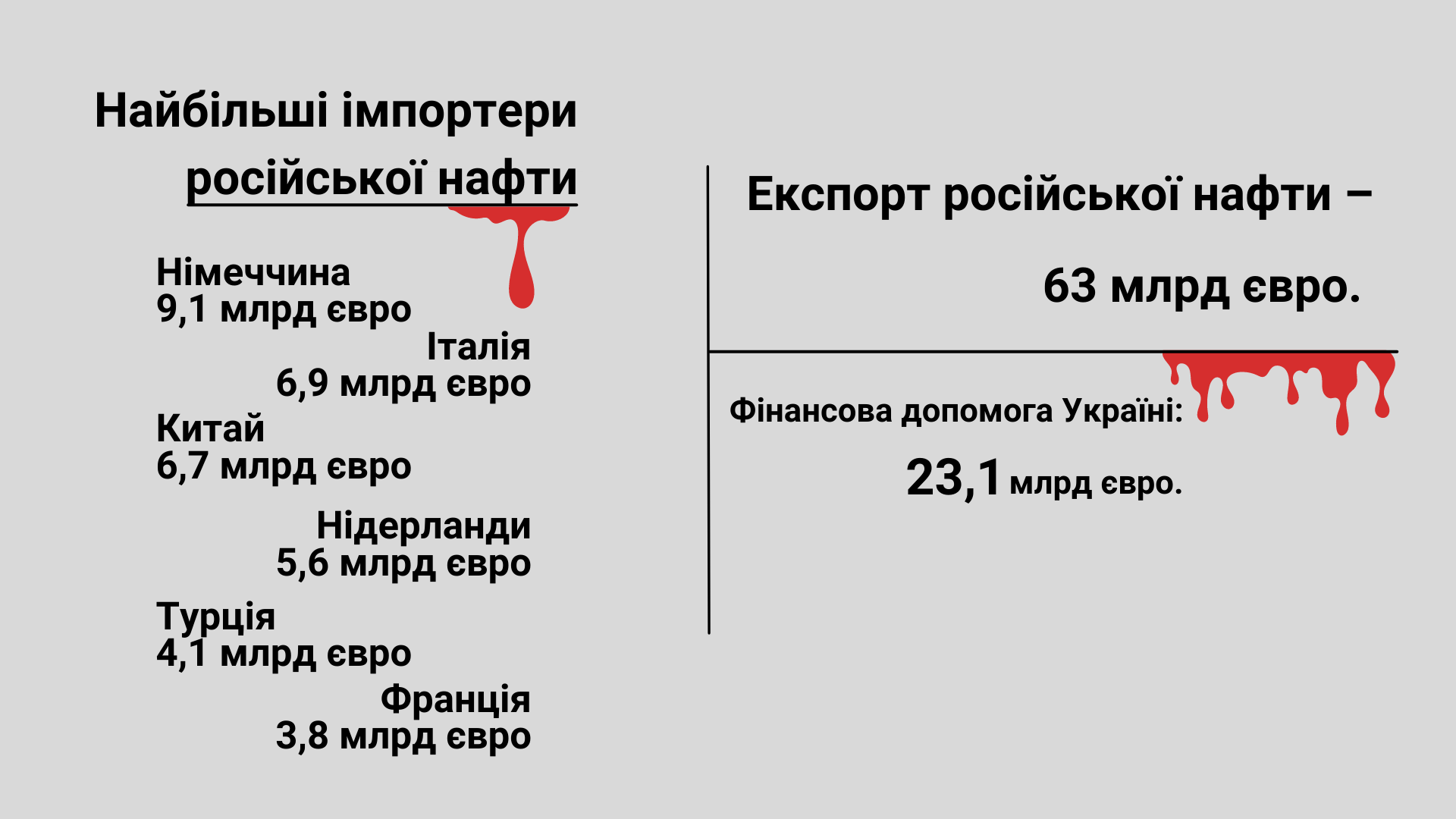

Analysts from CREA calculated the income of russian federation from the export of energy resources in the period from the end of February to the end of April. The study shows that sales of oil, petroleum products, pipeline gas, LNG and coal brought the aggressor €63 billion.

EU countries provided more than two-thirds of export revenues (approximately 71%), amounting to about 44 billion euros. If you ignore the fact that China is the largest importer of russian oil, then the Netherlands and Germany take the next places in the top list. During the two months that russian federation is attacking Ukraine, and the EU countries are thinking about giving up russian oil, the aggressor country has earned tens of billions of euros. For comparison: during the first month of the war, Ukraine received EUR 1 billion in aid from the EU, while russian federation received about EUR 35 billion from the EU for its oil.

All these figures are not betrayal of Ukraine, since technically the import of oil into the EU is critically decreasing. Europe is buying russian oil less and less, and the war in Ukraine has significantly accelerated this process. But these are still huge sums that ultimately finance the military industry of russian federation.

In general, the entire civilized world is gradually abandoning russian oil and russian tankers. Oil supplies from russia’s three eastern oil terminals fell to their lowest level in 11 weeks at the end of April. The decline may be connected with the reluctance of buyers to deliver cargo on ships belonging to russia.

There are already cases when the operators of the tanker fleet refused transportation due to the reluctance of foreign ports to work with russian cargo. Shipments from the oil project on Sakhalin are carried out on tankers of PJSC Sovkomflot, which has come under sanctions. As Bloomberg writes, the first non-russian tanker arrived on Sakhalin and got stuck at the beginning of May, and three Sovcomflot tankers were anchored at the oil terminal in De Castra for 15 days. The last 2 cargoes from the April loading program “Sokol” were not shipped at all.

In the worst case for russian federation, if the oil of the aggressor country is not needed by civilized countries, the tanker fleet may turn into a storage fleet. The world saw similar things in the spring of 2020 — when oil traded at negative values, and tankers became floating storage facilities.

While the world is transitioning to green energy and renewable energy resources, russia is trying to maintain its influence on the world economy through bloody “black gold”. But every action has an antidote, and such pressure on the world community causes very sharp resistance with irreversible consequences for russian federation. For the history of russia, the current oil manipulations will be one of the nails in the coffin of this woeful empire.

Ruslan Soroka.