Grain in ports: Mykolaiv remains the busiest port in the new season

This season Ukraine is waiting for an almost record grain harvest, which will be the second largest in the entire history of Independence – after 2019. It is expected that in this regard, the volume of exports will also grow. Therefore, USM asked the question: is the desire to increase grain transshipment capacity justified, and how will this affect transshipment rates? What was the capacity of grain facilities 5 years ago and what is it now? What is the current reserve of transshipment capacity at deep-water terminals, will the plans to increase these capacities be justified in the near future?

As in Poland: what does the recent past teach us?

A small excursus. Obviously, history tends to repeat itself. About 15 years ago, there was an extremely popular idea – class A warehouses. Rates for renting such warehouses reached $15-20 per square meter, and it seemed that during the construction and operation of such objects, earnings would be huge.

Poland, fortunately, managed to pass this path before us. A huge number of warehouses were built there and rental rates fell sharply to $ 6-7 – on the break even level. Perhaps, in the future, the growth of trade turnover and the need for such warehouses will increase, and rates will go up, but the need for these capacities was clearly overestimated at that time.

Ukraine did not have time to “twitch” in this direction. The 2008 crisis cut off the leverage along with the volume of credit trade turnover. Container transshipment fell by 60%. By the way, the situation with containers was similar to the Polish one with warehouses. By mid-2008, in Ukraine were announced projects for the construction of container terminals for 50 million TEU of annual throughput. Two terminals – in the Black Sea fishing port and the TIS-container – were idle for several years without work. These are the projects that were launched for their proper function only after the recovery of the market. The rest did not have time to start.

Power reserve: what grain terminals are capable of

With grain terminals, a story similar to the one with container terminals can be observed. The boom in terminals followed the rise in yields, with transshipment rates reaching $ 20 per tonne promising an extremely fast return on investment.

The record harvest of 2016 gave a new impetus to increasing the capacity of grain terminals and the formation of new projects. If you look at Big Odesa ports, then since 2016 there has been a sharp increase in throughput. The new 2019 bumper crop has kick-started the next group of projects, which are partly announced and partly under discussion.

A little background on what is considered the throughput of the grain terminal is needed. Technically, with rhythmic work, it is capable of colossal turnover. That is, the throughput of the berth / acceptance can be 20-25 warehouse turnovers per year, with normal berth occupancy rates, stops for scheduled equipment repairs, and so on. The question is that it is extremely difficult to fully realize this potential commercially and operationally.

Only 3 terminals in Ukraine – Transbulk terminal (Kernel), Greentur Ex (Bunge) and DSSK (Cofko) – have reached high turnover (more than 20 warehouse turnovers per year) this season.

Last season (2019/2020), among mentioned above only the Illichivsk grain terminal had more than 12 turnovers, just due to the anchor client Glencore grain (now Viterra), and the Risoil terminal in Chornomorsk due to its own trade of Risoil.

The rest of the terminals, even operating on the basis of a terminal with a single client, had a turnover rate of 12 turnovers per year and below.

When approaching capacity planning and the formation of adequate expectations from the work of a future asset, it has to be kept in mind that an average client, even a large one, does not have full control over railway shipments (their own silos / their own or rental cars), as well as not trading on CIF ( i. e., without controlling the approach of the vessel to the terminal for handling), have an extremely limited technical ability to influence the delivery and shipping of cargo from the terminal.

In addition to the purely technical possibility of influence, even those who have such an opportunity have no financial interest in increasing the terminal’s turnover. Often such influence comes at a cost: the nearest vessel in terms of dates may be more expensive than the one that appears later. And the rhythmic shipment by railway is the cost of a significant human resource, which also has to be paid for. But why try if the rate does not change from this and the reserve capacity is in excess?

For the trader’s own terminals, the economy is clear: when trading through his terminal, the trader counts the terminal’s profit into the end-to-end transaction margin and can afford to trade at zero or even negative on the trade itself, just to turn the terminal over. This leads to a massive increase in turnover and a focus on logistics rather than trading. But this is such a business model. Not all traders use it. For those who do not have their own asset, it either does not make sense, or the company’s policy is focused on achieving certain marginality rates, which are prioritized over volume growth.

As a result, more than 12 turnovers per year for grain terminals operating on the market is an incredible luck and a fortunate coincidence.

If we omit the issues of railway and auto infrastructure to the ports (USM will return to these topics later), then the main “bottleneck” for increasing the throughput of grain terminals will be the storage capacity.

When calculating the potential throughput, first of all, we took into account the terminal turnover factor and the possibility of increasing it to at least 12 turns per year in case of heavy workload (a technically and commercially justified increase in throughput).

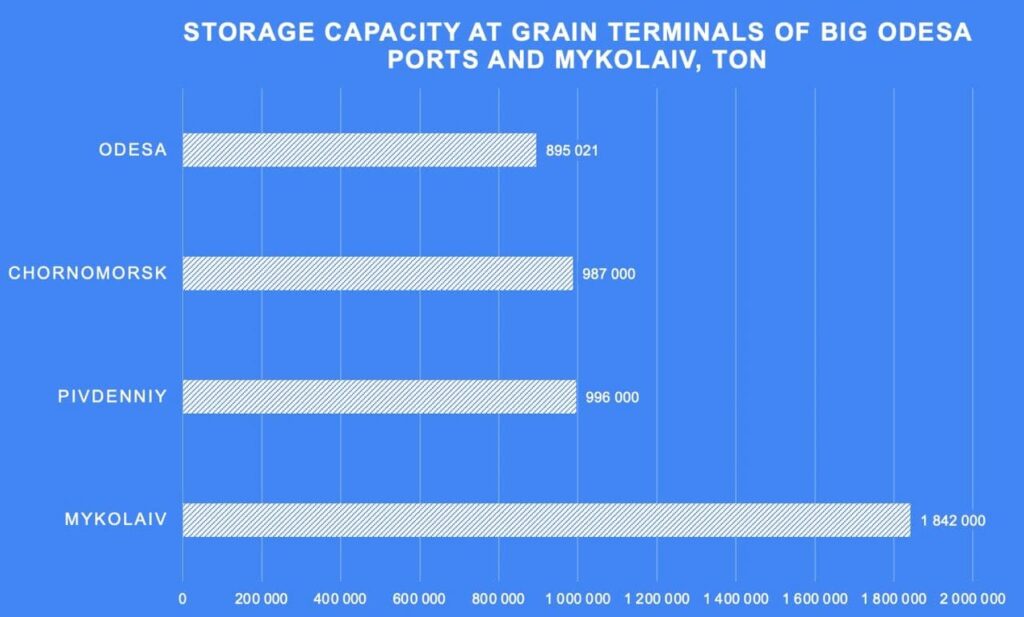

USM collected data on accumulation capacities in the ports of Big Odesa and the Mykolaiv region in order to calculate the theoretical throughput, taking into account the terminal turnover.

According to Stark Shipping. Data excluding some port warehouses, which can also be used for accumulation and transshipment of small consignments or additional loading. Most commonly, they are used for accumulation and subsequent stuffing of cargoes into containers. The ports of Mykolaiv also include the terminals of the port of Olvia.

As a result, we see that the total throughput of the ports of Big Odesa and Mykolaiv alone reaches 71.5 million tons per year.

Estimating of the throughput of grain terminals in the ports of Ukraine, thousand tons per year

The rest of the ports are numerous terminals of the Dnipro and Kherson, as well as terminals operating through the ports of Berdyansk and Mariupol. On the one hand, it is quite difficult to take them into account due to the large fragmentation, on the other hand, the limited draft significantly reduces the markets and the navigation area. At the same time, the potential throughput of such terminals can be used for grain crops, but for the most part it is used for processed products.

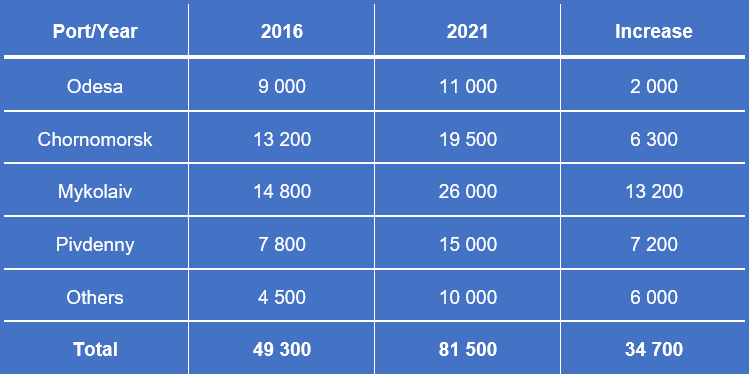

Here we note that the 2016/2017 season was quite intense in terms of transshipment. Some terminals showed miracles of turnover, which are then extremely difficult to repeat. On average, the terminal capacity utilization reached almost 90%. We are sure that it was this period that served as the impetus for increasing almost 35 million tons of throughput over the next 5 years.

At the moment, the total theoretical throughput of both grain terminals and those that can handle grain cargo is 81.5 million tons per year.

You need to understand that the technical potential of grain terminals in Ukraine, only in Big Odesa and Mykolaiv are almost 100 million tons per year. These are ideal technical conditions at the level of 100% utilization of facilities. About 15 million tons more are under the grain terminals of small ports, river, Azov ports – also have the potential of some fantastic load.

In any case, the excess capacity is pushing customers to negotiate with many terminals at once and try to get better terms at a lower rate.

Crop and export forecast: what to expect in the new season?

We are already seeing a supporting trend line throughout the current season, with transshipment rates falling by an average of $1 per year over the past three years. A drop in the rate to $7 per ton will jeopardize investments in new projects – with borrowed money, the payback period will clearly be more than 10 years.

At the same time, the increase in export volumes strongly depends on the yield, and this is not a linear increase, as many people would like. A bad year, in fact, may be followed by an even worse one, while capacity growth is almost linear as more and more new players become involved.

Both old players and those who have recently joined, understand how much the volume of accumulation limits them in the growth of transshipment. Despite all the customer focus, the transshipment volume does not increase in any way, except for the addition of new storage tanks.

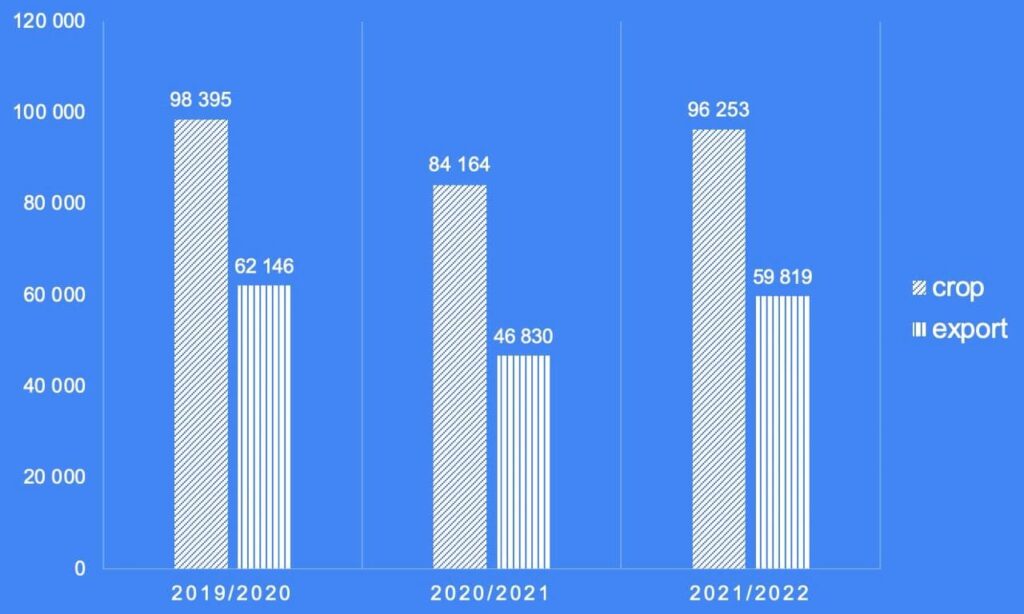

So what do yields and export volumes tell us?

Crop and export forecast for 2021/2022, thousand tons

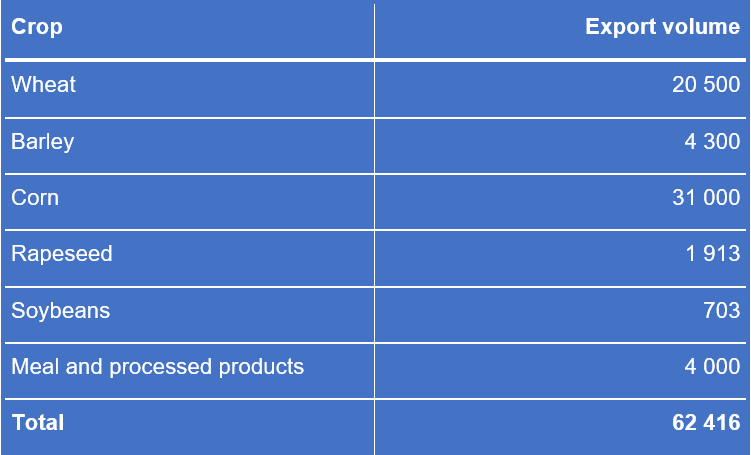

In order not to make unsubstantiated statements in our forecast of transshipment, we are based on the forecast volume of exports according to data from the consulting company Barva Invest. For the sake of completeness, the average export forecast for meal was also added.

Forecast of export of grains and processed products for 21/22 MY, thousand tons

Transshipment vs throughput, thousand tons

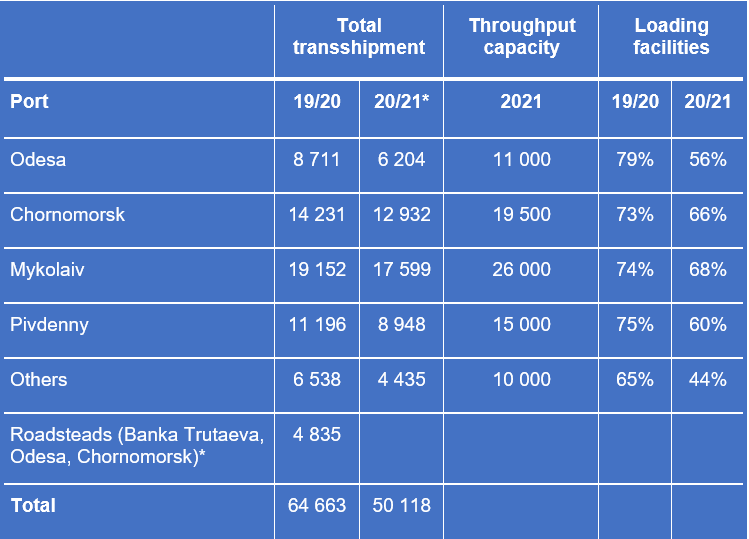

*in the season 20/21, additional loadings are included in the transshipment of ports, and the data also includes the currently available lineup of vessels. According to Stark Shipping.

We see that during the current 20/21 season, the capacity utilization of grain terminals has significantly decreased, compared to the 19/20 season.

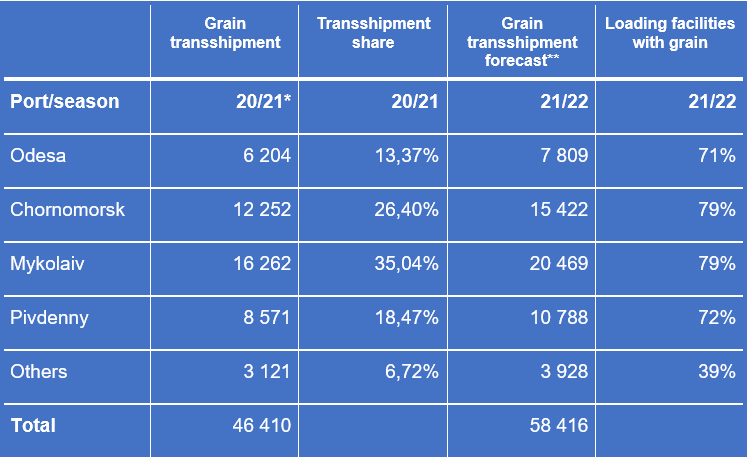

Based on the ports’ shares in transshipment in 2020/2021 and the general export forecast, we make a transshipment forecast for the next season 2021/2022, provided that the existing shares are maintained.

Grain transshipment in ports, forecast of transshipment and capacity utilization, thousand tons.

*taking into account the current lineup until the end of the season, according to Stark Shipping

**export forecast according to Barva Invest

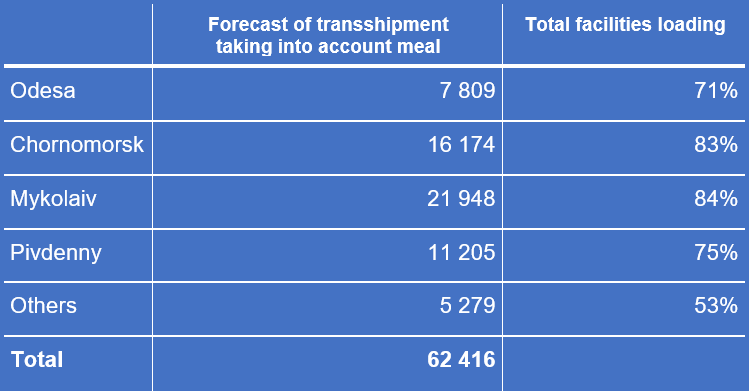

In the same way, the transshipment of meal by ports is added to the forecast, based on the distribution of transshipment in the 2020/2021 season.

General forecast of transshipment by ports in 2021/2022 MY, taking into account meal and processed products, thousand tons

Forecast from USM

As a result, we come to the best part. Taking into account the large forecast harvest, and, accordingly, export, Mykolaiv remains the busiest port. Moreover, even with the expansion of EVT (Evrovneshtorg) storage capacities, the loading can still be quite solid. The second busiest port is Chornomorsk, which is in line with Kernel’s ambitious plans to increase exports to 10 million tons. Pivdenny is returning to the 2019/2020 load level, and the ports of Kherson, Dnipro, the Sea of Azov – Berdyansk and Mariupol remain the most underutilized. High price competition is expected in small ports.

In the end, let us summarize: the strategy for maintaining transshipment rates in the market as a whole was correct. As far as we know, none of the terminals gave up their positions, no matter how much customers would like to shake this market. None of the terminals agreed to spot volumes at a low rate before the new season (and even if so, we will not know for sure). As a result, everyone entered the new season with give or take the same contract rates as in the previous one, which will now pay off with a new harvest.

Andrey Sokolov, Evgeny Belyy.