Interlegal commented on the situation with ships with Ukrainian grain stuck in the ports of Egypt

As of today, a systemic delay in payments has arisen in the grain market of Egypt due to changes in state procurement mechanisms.

This was reported by Artem Skorobogatov, a partner at the International Legal Service Interlegal, in a comment to Latifundist.

According to him, the new structure of interaction between state bodies, banks and intermediaries has created a chain in which any failure can stop the flow of funds.

At the same time, the difficulties are not associated with the bad faith of the parties, but are a consequence of the transformation of state procedures after the change of the body responsible for procurement.

“Previously, state procurement went through GASC, which had a well-established procedure: transparent tenders, verified banks, international creditors, predictable payment schedules. After the change of the managing body, the mechanism has become more branched,” explained Artem Skorobogatov.

Now contracts are signed by one structure, the currency is distributed by the central bank, and settlements are carried out by other financial institutions, which do not always have the resources or clear instructions. Additionally, local intermediaries intervened in the scheme, who bought grain for themselves and then resold it to the state. As a result, a multi-level system was formed, in which any stage could cause a delay in payment.

This time gap between the contract and payment creates a unique situation: the cargo arrives, but the documents “hang” in the system, and the losses from downtime (demurrage, port fees, etc.) are borne by the seller or charterer.

“Formally, no one violated the contract, but the time gap in payments already leads to financial losses. And this is where legal risks begin, which can develop into claims and arbitration,” the lawyer noted.

In practice, market participants choose different strategies: some wait and hope for payment, others resell the cargo, recording losses but maintaining control. The winner is the one who clearly documents his actions, because even one email can determine who will be the plaintiff and who will be the defendant in court.

Artem Skorobogatov emphasized that Egypt will continue to be a key market for Black Sea grain, and if conclusions are not made within the country, traders will be forced to cooperate with this destination “with increased legal caution” — anticipating unforeseen financial delays and operational risks and always having a plan B.

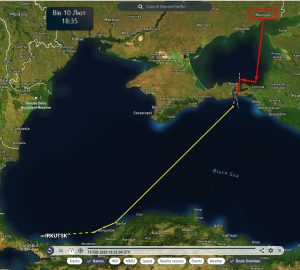

Recall, on October 23 it became known that 8 ships with Ukrainian wheat remain on the roads of Egyptian ports due to delays in opening letters of credit for the state buyer Mostakbal. According to market participants, about 200 thousand tons of grain remained unpaid.

As previously reported by USM, Ukraine’s share in wheat supplies to Egypt has tripled — to 1 million tons in 2025, compared to 334 thousand tons a year earlier.