The agricultural market and the grain corridor: how did the Istanbul agreements affect Ukrainians?

USM investigated the main sentiments of the agricultural market of Ukraine. We are going to tell how the farmers were affected by the “grain corridor” and what problems should be solved in order not to suffer from a shortage of grain storage capacities.

Last year agricultural and food products compiled 40-50% of all state exports. The income that this export brought was about $2.3-2.84 billion every month. Of these, products of plant origin – $1.3-1.62 billion.

After February 24, export revenues decreased significantly: the export of agricultural products and food products decreased by 3.84 times (from $2.84 billion to $0.74 billion per month); the export of vegetable products decreased by 4.63 times (from $1.62 billion to $0.35 billion per month).

The reason for such a drop in export revenues is the war that russia has unleashed in Ukraine. Let’s find out exactly how the terrorist state affected the Ukrainian agricultural market.

Ports

The blockade of ports has become the biggest problem for exports since the beginning of russia’s full-scale war against Ukraine. During January-March last year, Ukrainian port operators handled 32.697 million tons of various cargoes. At the beginning of the current year, a trend of increasing cargo turnover was observed: in January, the ports handled almost 15 million tons of cargo. Only during the first month of the year (not yet the most productive month due to the holidays), the cargo turnover of Ukrainian ports increased by one and a half times.

Immediately after russia’s attack on Ukraine, the cargo turnover of Ukrainian seaports decreased by 420,000 tons per day. Almost all the country’s ports have closed. Initially, export transportation was carried out only by “Ukrzaliznytsia”, which was overloaded and could not carry out all the shipments on time.

However, russia could not stop the export of agricultural products in Ukraine. Entrepreneurs, together with the government, began to look for new alternative routes and “pump up” the sales channels that they already had.

First of all, Ukrainian ports on the Danube “revived”. During the first half of the year, cargo turnover through the ports of the Danube region increased by almost 5 times, compared to the same period last year. However, the capacities of the ports in the very south of Ukraine still turned out to be insufficient, so the government of Ukraine continued to look for options for unblocking the “big” ports.

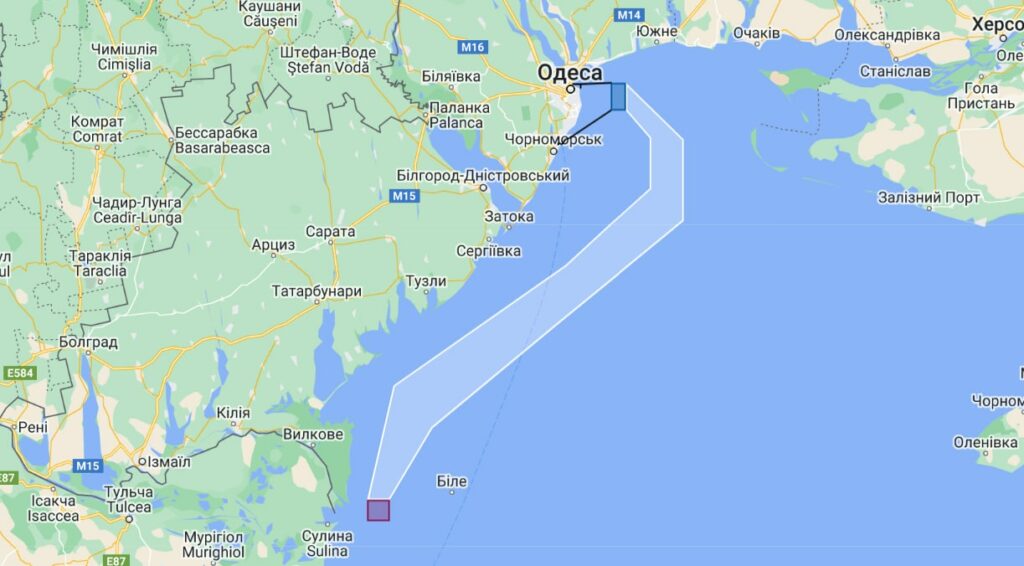

As a result of the liberation of Zmiiny Island from the terrorists and the opening of the Bystre estuary in the first half of July, negotiations with Turkey and the UN on the creation of a “grain corridor” began. The Istanbul Agreement was signed on July 22. The Agreement identified the ports of Pivdennyi, Odesa and Chornomorsk as key ports for the export of Ukrainian cargo. On the first day of August, it also became known that Mykolaiv ports can open after Odesa.

“I spoke with the Minister of Infrastructure Oleksandr Kubrakov. Perhaps in a few weeks there will be an idea whether the Mykolaiv ports can open,” reported Vitaly Kim, the head of Mykolaiv Regional Military Administration. Currently, the port is still blocked, and the city suffers from regular shelling and rocket attacks. However, the stevedores do not lose hope that the Armed Forces will do everything possible to protect the city and the water area, and the work of the port can be resumed.

Shortage in storage

The task of unblocking Ukrainian ports has become one of the main ones for the Ukrainian government since the beginning of the full-scale war. The reason is simple: a new harvest was on the way, and the amount of old stocks occupied huge warehouse areas. All market participants understood that no temporary solutions would help preserve the old grain and “pack” the new. There was only one way out – to return the export routes, otherwise Ukraine will face a shortage of storage capacity by autumn.

Analysts have estimated that by mid-autumn in Ukraine, the shortage of grain storage capacities will amount to 10-15 million tons. As a result of the destruction of the storage infrastructure and the occupation of part of the Ukrainian territories, about 60 million tons out of 75 million tons of storage capacity remained at the disposal of granaries, reported Deputy Minister of Agrarian Policy and Food Markiyan Dmytrasevich in July.

As Maxigrain’s business development manager Olena Neroba told USM, the storage capacity shortage may actually exceed forecasts.

“They think that we have 10 granaries for 100 tons. And these storages contain a total of 10 tons, so 90 tons are free. In fact, such calculations are incorrect: these 10 tons can be 1 ton in each “jar”. It should be remembered that loading corn with wheat will not work. The deficit lies in this: let’s say there are containers for wheat, but not for corn. You can’t just take the total storage capacity and select the amount of grain, it doesn’t work that way,” says Olena Neroba.

If we calculate using the “wrong” method, then the capacity deficit really amounts to 10-15 million, Olena Neroba explained. But in practice, the shortage is much greater.

“The total amount of storage capacity often includes flour mill elevators, which are not intended for long-term storage. The capacities of port elevators that are not intended for long-term storage are also counted. That is why we really need exports. Despite the “grain sleeves”, despite the fact that we export something across the Danube. Exports from sea ports are necessary,” the expert noted.

In general, such agreements as Istanbul have a positive effect on the agricultural market, Olena Neroba believes. Farmers who have nowhere to store grain will be able to sell part of their stocks for export in the fall.

“However, in the first days of operation of the “grain corridor”, the farmer has not yet felt the impact. The reason is that only those ships that were loaded before the war started were sent. And in the next stage, agricultural products are unloaded from the terminals, and only then new grain is exported. Therefore, this “wave” is coming slowly to the farmer,” Neroba said.

As the Minister of Agrarian Policy and Food Mykola Solsky announced in September, Ukraine has purchased almost all single-use systems for storing crops that were available on the world market. To store agricultural crops in the current season, one-time and mobile granaries with a total capacity of up to 20 million tons will be needed, and Ukraine has already managed to contract the necessary equipment.

Occupation, losses and logistics

It is also worth remembering that in Ukraine the invader occupied about 20% of the territories, and these are among the most fertile regions of Ukraine. We are talking about the captured Kherson and Zaporizhzhia regions, as well as Mykolayiv region , which has been the hottest spot in the South for a long time. Is it possible to estimate the average drop in farmers’ incomes due to the war? It is worth turning to the numbers.

As analysts of the Barva Invest company told USM, that if we talk about the prices at which the customs operates, from March to June 2021, 9.2 million tons of corn were sold for export at a price of 2,288 million dollars. This year, during the same period, 4.2 million tons were exported at a price of 1,133 million dollars. But these are fixed volumes. In fact, much less grain crossed the border – others are waiting in queues for many weeks. In addition, due to too expensive logistics, the seller receives significantly less funds “in his hands”.

Logistics problems are not compensated by record prices on the market. Even when prices in the world reached peak values, Ukraine did not feel it at all. During spring and summer, grain prices only fell.

The reason is that one problem begets another. Having lost sea logistics, we have lost the opportunity to earn from grain. In the absence of direct sea connection, we could not export goods to our customers: Egypt, Saudi Arabia, China, etc. Our grain is trying to make a big hook through land borders that were never designed for such a large amount of cargo (besides grain, hundreds and thousands of tons of other cargoes are exported). All this means significant expenses for transportation, waiting in long queues at the border, etc.

In addition, the possibilities of traders at a certain point were exhausted, according to Barva Invest. Traders bought grain from the producer to sell, let’s say, in Romania, and all their funds in the form of grain sat idle at the border. Producers had to deal with this direction themselves, which also made it difficult to sell the crop. We should not forget about competition: despite all our expenses, the final price for Ukrainian corn in the port of Romania should be the same as for Romanian corn.

Previously, grain delivery from the warehouse to the port cost 30-40 dollars per ton, in some cases – up to 50 dollars/t. With the beginning of the war, for the same money it was possible to deliver grain to the border of Poland or Romania by rail. Transportation to the port of Constanta cost the same amount. On average, logistics costs now amount to 90-105 dollars/ton. And to bring it from the border to Constanta is another 65 dollars. Accordingly, all logistics can be 160-180 dollars per ton of grain. As a result, half of the freight cost goes to logistics alone. For more expensive oil crops (and for sunflower oil), the “math” is a bit better, but still the profitability is too low.

This year’s grain yield also leaves much to be desired. According to data from Barva Invest, at the end of the summer the situation looked as follows:

- • corn — 26.4 million tons (up to February 24, the forecast was at the level of 38.2 million tons, -31%);

- • wheat – 16.5 million tons (pre-war forecast: 28.3 million tons, -42%);

- • sunflower – 9.2 million tons (by February 24, 15.3 million tons, -40%);

- • barley – 4.6 million tons (8.2 million tons before the war, -44%);

- • soybeans – 2.3 million tons (3 million tons, -24%).

In fact, before the start of the “grain corridor”, the agricultural market was not going through the best days. Low grain sales prices, limited opportunities to export and storage of the the crop, and the impossibility of long-term planning due to the war lead to the fact, that the farmer simply loses money and the desire to plant a new crop in the fall of 2022.

What is expected from the “grain corridor”?

Among the “big” ports on the Black Sea, only the ports of Odesa, Chornomorsk and Pivdennyi are operating. According to forecasts of the Ukrainian ministries, the three Ukrainian ports will be able to serve 80 ships per month – on average, one ship in each port every day. This adds about 3-3.5 million tons of products to the total export every month.

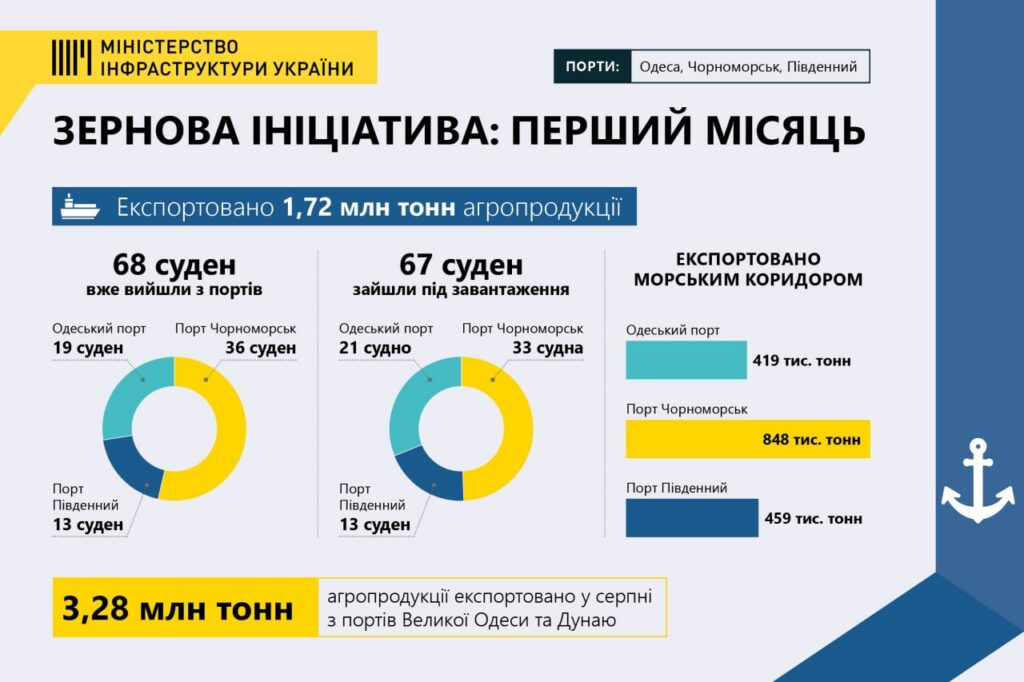

As of August 23, 22 days after the start of the “grain corridor”, 33 ships with 719,000 tons of agricultural products left Ukrainian seaports, and another 18 ships were loading or waiting for their turn. First Deputy Minister of Agrarian Policy and Food Taras Vysotsky shared that 3 million tons of agricultural products were exported in July, and 2 million tons in 15 days of August.

According to his forecasts, in August, exports should amount to at least 4 million tons. This, in turn, can lead to the extortion of at least 20 billion dollars by the end of the year.

Already on September 2, it became known that the total export of grain and oil crops for August amounted to 4.5 million tons. This is half a million more than Vysotsky predicted. More than 1.7 million tons of agricultural products were sent only from the ports of Great Odesa.

Of course, the “grain corridor” calmed the agricultural market a little, but it still hasn’t solved dozens of logistical problems. Among port workers and farmers, the question remains open, not “what to export and where?”, but “what to transport and for how much?”. Currently, the exact price of the підвищеного страхування судна, that will go to Ukraine is unknown — because the Black Sea and the Ukrainian region are covered by insurers in the war risk zone, which leads to an increase in the price of insurance. This, like other factors, reduces the number of people willing to work in a dangerous region.

The issue of a shortage of storage capacity has also not yet been finally resolved — export capacity does not cover the full volume of exports. We will remind you that the capacity deficit can be much larger than 10-15 million, and then Ukraine will have to look for additional ways to export. This, in turn, indirectly answers the question about the fate of the sale of grain through ports in the south of Ukraine, by rail and by road. Undoubtedly, the available alternative routes will not lose their relevance for a long time.

External factors such as war and drought also affect sentiment and, most importantly, prices in the agricultural market. This year, Europe faced an unprecedented drought, so the countries of the European Union may lose up to 10 million tons of corn at home. Therefore, the demand for Ukrainian corn will remain.

Therefore, at the moment, we see caution and attempts to predict risks and dangers as accurately as possible in the market, taking into account all the “elements”: the accumulation of grain and its storage deficit, the effective search for new buyers and methods of cargo delivery, and most importantly – the consolidation of Ukraine in the position of a demanded grain supplier in the world.

By Ruslan Soroka.