The Butterfly Effect: How the russian invasion changed the gas carrier market

Over the past year, the volumes of orders for gas carriers have reached record levels. How the situation in the gas market has changed, who will become the new leader in LNG exports, and what russia has to do with it — read in the USM article.

In February 2022, russia unleashed the largest war in Europe in 77 years. The barbaric cruelty and baseness of the “mysterious russian soul” pushed civilized countries to distance themselves from the terrorist country.

Thus, russia’s close trade relations with the EU countries have come into question. After all, concerns about one’s own energy security are gradually outweighing the need to buy cheap russian gas. European countries began to look for an alternative to Russian gas pipelines. In the end, Europe chose to buy transoceanic liquefied natural gas.

The situation on the LNG market

The USA became the leading supplier of LNG to Europe. So, to replace gas pipelines from russian federation, EU countries increased their purchases of American liquefied natural gas to 140%. Imports of LNG from the US helped Europe compensate for a sharp drop in supplies from russia. By 2027, the US is expected to become the world’s largest exporter of LNG.

In turn, the rapid increase in LNG imports by sea to European countries is stimulating demand for floating storage and regasification plants. Thus, since the beginning of last year, 5 new LNG terminals have been put into operation, 8 more are under construction. According to Drewry experts, in the coming years, the global supply of LNG will reach about 25 million metric tons per year.

Australia currently ranks first in LNG exports. In 2022, the country sold a record 81.4 million metric tons of LNG, according to EnergyQuest. Thus, the country remains the largest seller of liquefied gas for the 5th year in a row. In 2021, Australia shipped slightly less — 80.23 million metric tons of the energy carrier. Also, in 2022, Qatar, russia and Malaysia have traditionally been among the largest LNG suppliers.

The volume of orders for gas carriers is breaking records

The increase in demand for marine transportation of liquefied natural gas has caused an increase in prices for new ships – up to 250 million dollars. Last year, the total value of orders for them amounted to $ 33.7 billion – 87% more, compared to $ 18,076.25 million in 2021.

The largest number of orders last year came from the shipyard in South Korea. Hyundai, Daewoo and Samsung shipyards are expected to be completely full by 2025. Because of this, China is capturing a share of the Korean shipbuilding market.

Thus, in December, the number of orders for gas carriers from Chinese shipbuilders tripled — due to the increase in freight rates. In total, Chinese shipyards received 45 orders for LNG tankers last year. The cost of building ships is $9.8 billion, which is five times the value of orders in 2021, Clarksons Research wrote.

As of the end of March this year, Chinese shipyards accounted for 21% of global orders, worth $60 billion. This is evidenced by Clarksons data. The number of orders is likely to increase due to the backlog of South Korean factories and increased costs of building tankers, ICIS analysts commented.

Out of a total of 308 ordered vessels, 285 gas carriers have a capacity of over 100,000 cubic meters. This is almost 93% of all shipbuilding orders placed at shipyards in South Korea and China.

At the same time, in 2023, 48 gas carriers will join the world fleet, of which 28 will have a capacity of 174,000 to 200,000 cubic meters. It is expected that the global fleet of gas carriers will reach the mark of 1,000 units by 2026, writes shipbroker Howe Robinson Partners.

As a reminder, until 2022, only one shipyard in China — Hudong-Zhonghua Shipbuilding of China — was capable of building large gas carriers. At the same time, the company occupied less than 10% of the market share. The rest of the market was occupied by three South Korean shipbuilders — Hyundai Heavy Industries, Samsung Heavy Industries and Daewoo Shipbuilding.

The French shipbuilder Gaztransport & Technigaz (GTT) is also expanding its portfolio of orders for gas carriers. In 2022, GTT received a record 162 orders for gas carriers and one FSRU, compared to 68 orders in 2021. Overall, GTT’s shipyards saw a 138% increase in order volumes last year, said GTT CEO Philippe Berterottier.

Who are the owners of the fleet of gas carriers

Due to the growing demand for LNG, major shipping companies have focused on adding new gas carriers to their fleets. So, last year, an average of 3 LNG carriers were ordered every week.

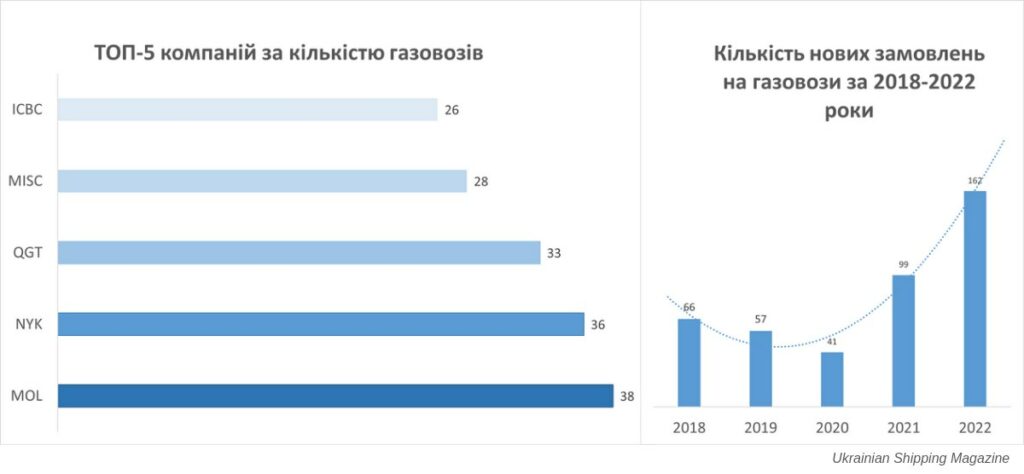

In total, the order portfolio for the year amounted to 162 gas carriers, which is 63% more than the previous year, when 99 new vessels were ordered. As of the end of the year, the global fleet of gas carriers already numbered 739 vessels, according to Drewry analysts.

More than a quarter of the contracts for the construction of gas carriers were signed by shipowners from Japan. In particular, 44 orders went to shipping companies MOL, NYK and Meiji Shipping. Currently, Japan owns the largest fleet of gas carriers with a total value of 30.3 billion dollars.

So, the ocean carrier Mitsui O.S.K. is the leader in the number of gas carriers in the world. Lines Ltd (MOL). In total, the company owns 38 LNG vessels worth $6.2 billion. These figures exceed MOL’s fleet estimate of $5.9 billion for 2020. Nippon Yusen Kabushiki Kaisha (NYK) is slightly behind with 36 vessels, Qatar Gas Transport has 33 gas carriers, Malaysia’s Malaysia International Shipping Corporation Berhad (MISC) operates a fleet of 28 units. The top five is closed by the Chinese state-owned enterprise Industrial and Commercial Bank of China (ICBC) with 26 gas carriers.

It is reported that in 2022, MOL purchased another 19 new gas carriers. The first place in terms of orders for new vessels was taken by the NYK company — 20 gas carriers per year, VesselsValue writes.

Qatar is also actively expanding its fleet of gas carriers. According to a report at the GECF Annual Forum, the country has booked slots at all major South Korean shipyards to order hundreds of new gas carriers over the next 5 years.

Away from moscow

Despite the gradual withdrawal of European countries from russian gas, the Kremlin was able to redirect supplies to Asian countries. Thus, Japan, China, South Korea and Indonesia became the largest importers of LNG from the terrorist country in 2022.

As a reminder, Japan is a co-owner of the Sakhalin-2 oil and gas project: the Japanese side receives 60% of the liquefied gas produced on the island.

However, on the Asian market, the russians are quite uncertain. So, in March of this year, Japan already reduced LNG imports from russia by 40%, giving preference to American gas.

In general, by the end of the year, russian gas exports may drop to 50 billion cubic meters – this was the forecast given by the Energy Commission of the russian State Duma at the end of March. Thus, the volume of gas exports from russian federation will be a record low since the end of the 1970s. It is expected that the share of russia in the world market will decrease. Having the largest gas reserves in the world, russian federation lost the opportunity to sell it.

To solve the problem, the russian government proposes to increase LNG exports by building 94 gas liquefaction plants by 2035. In this way, the terrorist country wants to maintain its position in the market, despite the loss of profits from gas pipelines. As a reminder, according to the results of 2022, the net profit of russian Gazprom amounted to 747.246 billion rubles – 3.6 times less than in 2021 (2.684 trillion rubles).

But the ambitious plans are unlikely to materialize — due to sanctions, russia cannot buy gas liquefaction plants, reminds director of Asian gas markets at S&P Zhi Xin Chong. Meanwhile, exports of russian energy carriers are steadily falling. In the coming decade, russian LNG supplies will decrease to 5%.

The russian economy is mostly dependent on the sale of oil and gas. As soon as the Kremlin increases its share in the world market, it immediately begins to dictate its terms. In order to reduce the appetites of russian federation, a simple rejection of russian energy carriers is not enough. moscow has repeatedly shown its ability to adapt to changes in the market. Therefore, it is necessary to constantly strengthen the sanctions pressure on russian federation.

The sooner russia loses the opportunity to earn profits from gas, the sooner the “great” state will start to worry about internal problems, and not solving wars.

Danylo Popov