2020 Challenges: export of metal products in the seaports of Ukraine

Stark Shipping, together with USM, analyzed the transshipment of metal products in the seaports of Ukraine in 2020.

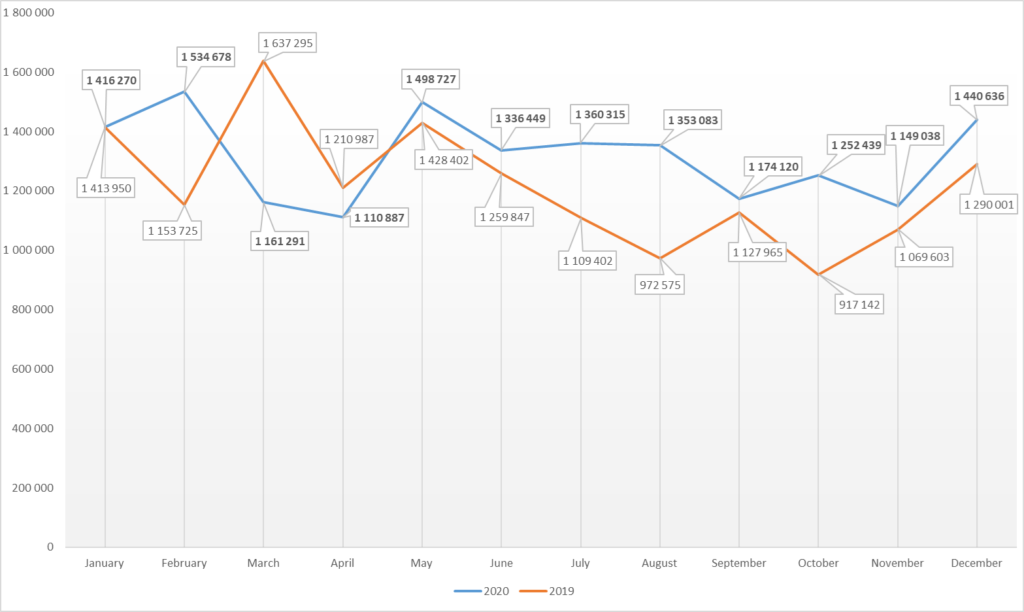

The COVID-19 pandemic has made its own adjustments to the global economy and affected, in particular, the demand for steel in the second quarter of 2020. However, further recovery in demand and growth of prices made it possible to compensate for the drop in exports. The spring of 2020 turned out to be a difficult period for the domestic metallurgy due to a decrease in capacity utilization, a partial shutdown of main equipment due to repairs, as well as an increase in the cost of organizing staff work in a pandemic.

The drop in demand for steel in the established markets for Ukraine (MENA countries and the European Union) forced Ukraine to reorient its sales to China, where it had not previously supplied steel products. China recovered fairly quickly from the COVID-19 outbreak and renewed demand for steel.

The import of metal products in Ukraine is limited due to the policy of protectionism, as well as due to the fact that only 20% of the produced steel is consumed in the country, and the rest is exported. Also in Ukraine in 2020, the supply of fittings from domestic manufacturers to the domestic market decreased. The reason is a decrease in the volume of construction work: due to quarantine, the construction of many facilities was stopped, some construction companies had to leave the market.

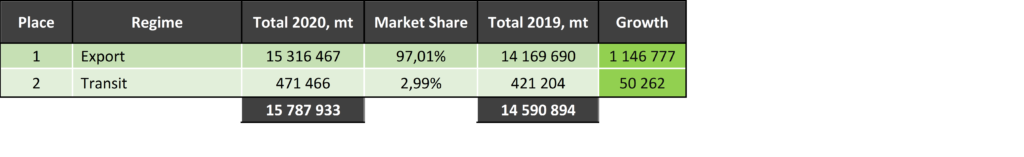

In 2020, the volume of shipments of metal products from Ukraine through seaports amounted to 15.78 million tons. This is 8% more than in 2019. The indicator of shipments of steel products (rebar, wire rod, billets, various types of steel) in Ukrainian ports increased by 7% compared to the result of 2019. Pig iron transshipment rates increased by almost a quarter (24%). But pipe shipments in 2020 decreased by 50% – probably due to a decrease in demand amid falling world oil and gas prices.

Monthly volumes of steel products transshipment (excluding containers and Danube ports)

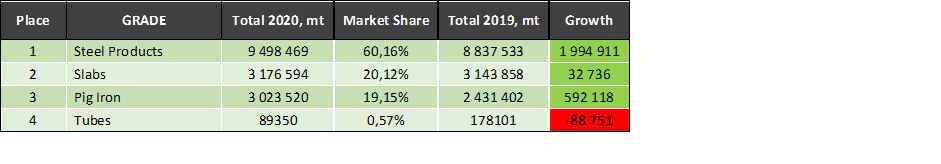

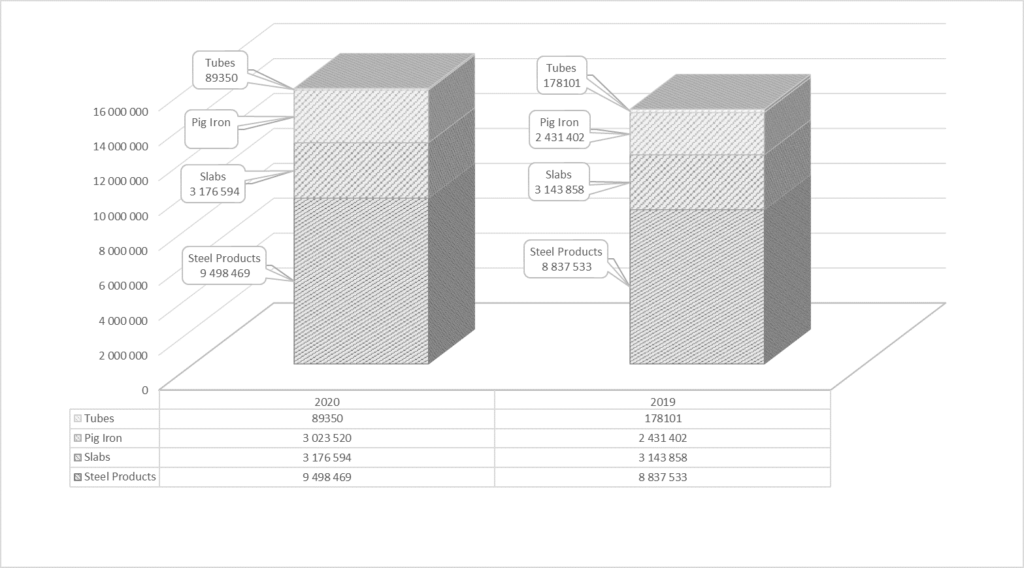

Steel products accounted for most of the export of metal products in 2020 – 9.5 million tons, which is almost 2 million tons more than shipments of this type of cargo in 2019. Slabs are in second place in terms of the number of shipments – 3.1 million tons, which is 32.7 thousand tons more than in 2019. This is followed by cast iron with an export indicator of 3.02 million tons, exceeding the result for 2019 by 592 thousand tons. But the export of pipes in 2020 decreased to 89.3 thousand tons, which is 88.7 thousand tons (i.e., almost 50%) less than in 2019.

Rating of types of steel products by transshipment (excluding container shipments and Danube ports)

Net export of metal products from Ukraine through seaports in 2020 amounted to 15.3 million tons, which is 1.14 million tons more than a year earlier. Transit through Ukraine transported 471 thousand tons, 50.2 thousand tons more than in 2019.

Exports of metal products grew by only 8% compared to last year. The low demand for metal products was likely associated to the interruptions of infrastructure projects and the freezing of construction around the world due to the COVID-19 pandemic.

The main importing country for metal products from Ukraine in 2020 is Turkey, which increased its imports by 40% compared to 2019. The main shippers of metal products in this area were Metinvest and Belorussian Steel Works.

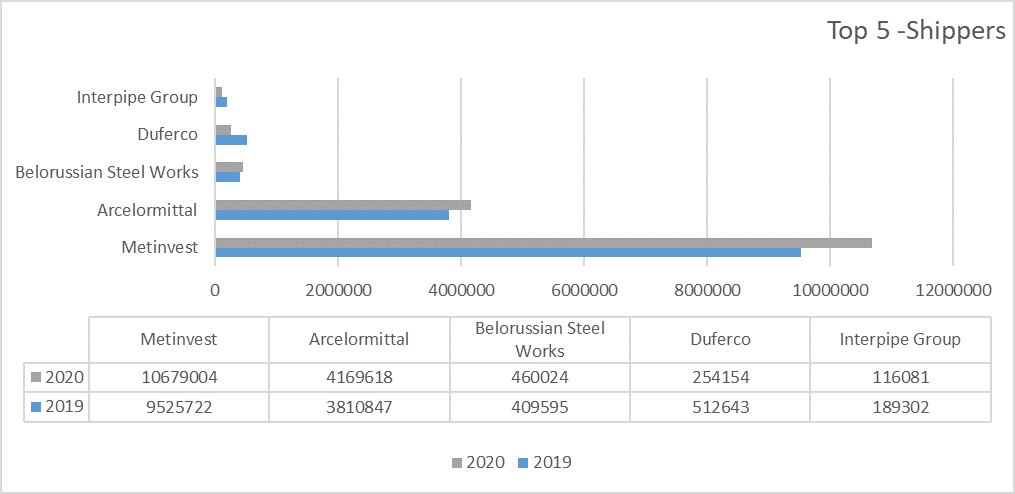

Main shippers of metal products from Ukraine in 2020

As in 2019, the main shipper of metal products, was Metinvest, which increased the volume of exports of its products by 12% in 2020. ArcelorMittal ranks second – plus 9% compared to 2019.

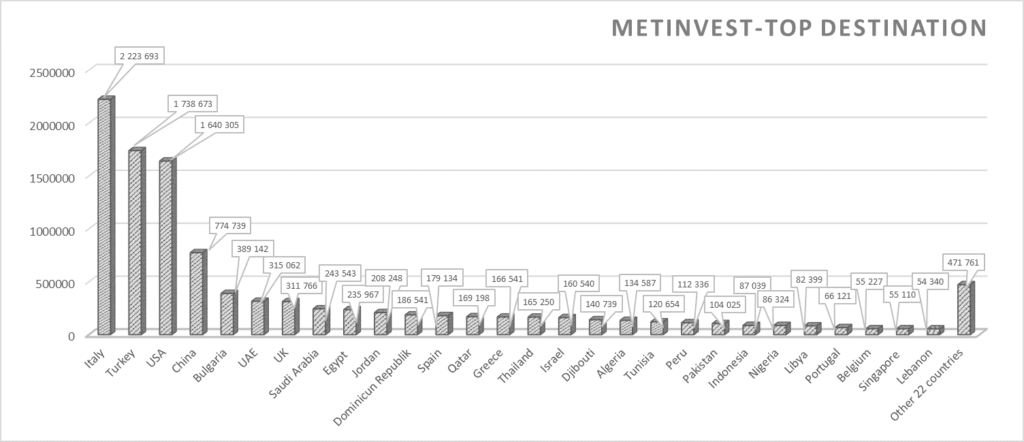

The main importing country for Metinvest products is Italy. The factories of the Metinvest group (Ferriera Valsider and Metinvest Trametal) are located in this country. Most of all, slabs are exported to Italy – 89%, the second place is taken by cast iron – 7% of exports.

The United States, which ranked second in imports of metal products from Ukraine in 2019, gave way to Turkey in 2020, despite an increase in imports by 32%.

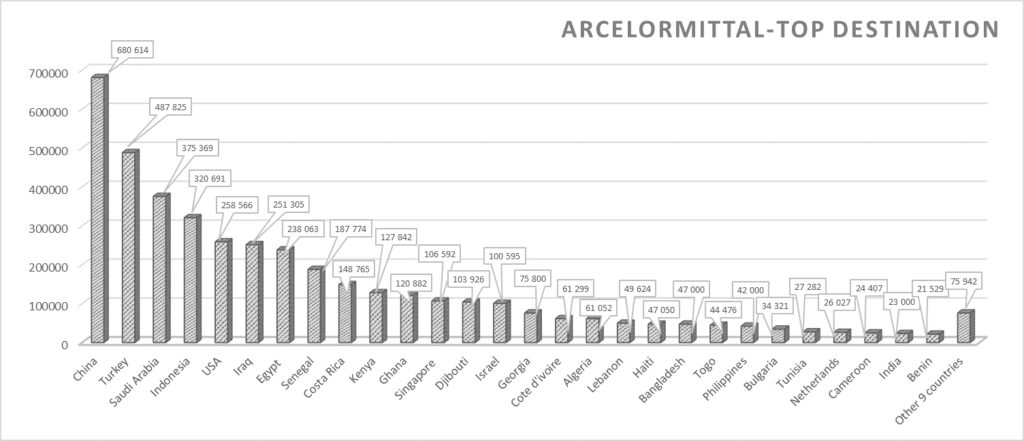

In 2020, ArcelorMittal delivered the most of its products to China – 680.6 thousand tons against 48.5 thousand tons in 2019. The main cargoes exported to China are: pig iron – 45%, steel products – 35%, metal procurement – 19%.

Egypt, the leader in imports in 2019, cut supplies by 60% in 2020 and yielded first place to China. ArcelorMittal significantly increased the supply of steel products to Saudi Arabia – 375.3 thousand tons against 107 thousand tons in 2019.

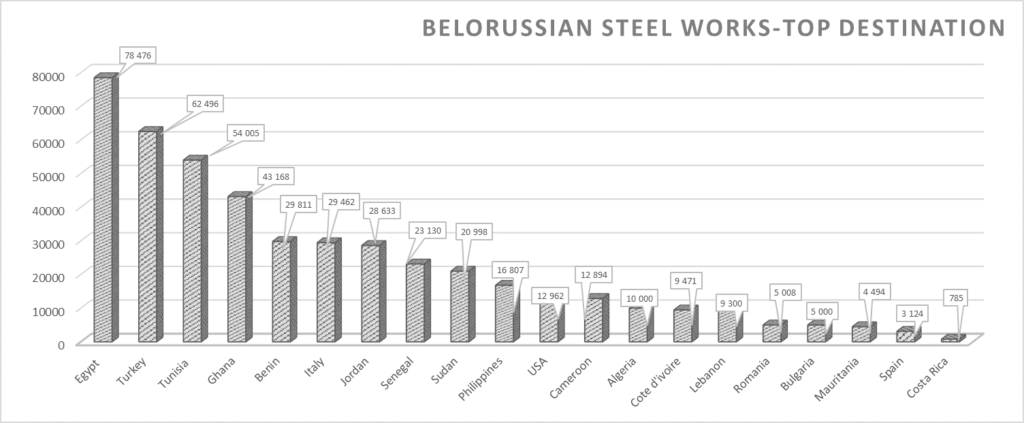

Belorussian Steel Works increased the transit of its products through Ukrainian ports by 12% in 2020. Almost 17% of Belorussian Steel Works’ total transit goes to Egypt and 14% to Turkey. In 2020, Belorussian Steel Works completely suspended the supply of products to Iraq, which in 2019 ranked second in the ranking of the countries-importers of the company’s products. The manufacturer also increased supplies to Tunisia – 504 thousand tons against 15.6 thousand tons in 2019.

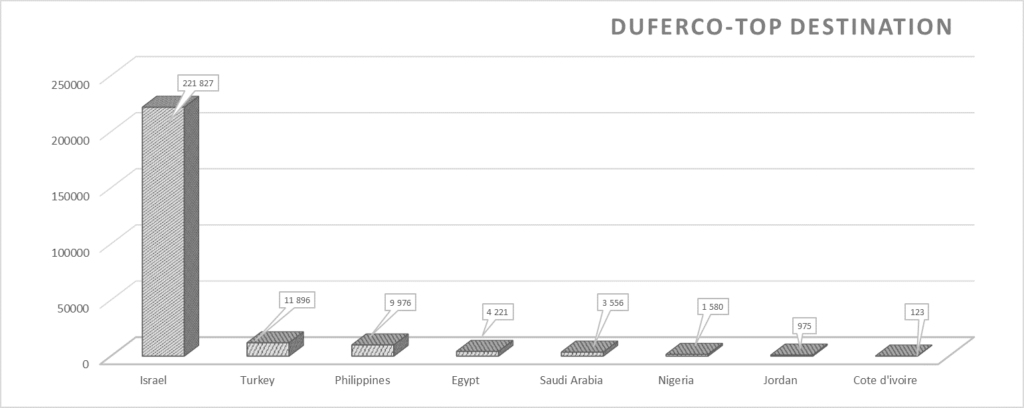

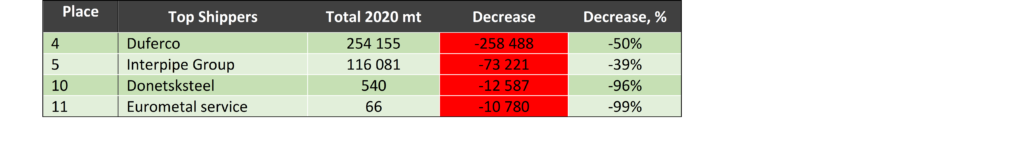

In 2020, Duferco almost halved its exports. Duferco’s main products are exported to Israel – 87% of cargo. Also in 2020, the company significantly reduced the export of products to Egypt (the main direction in 2019) – 4.2 thousand tons against 246.3 thousand tons a year earlier.

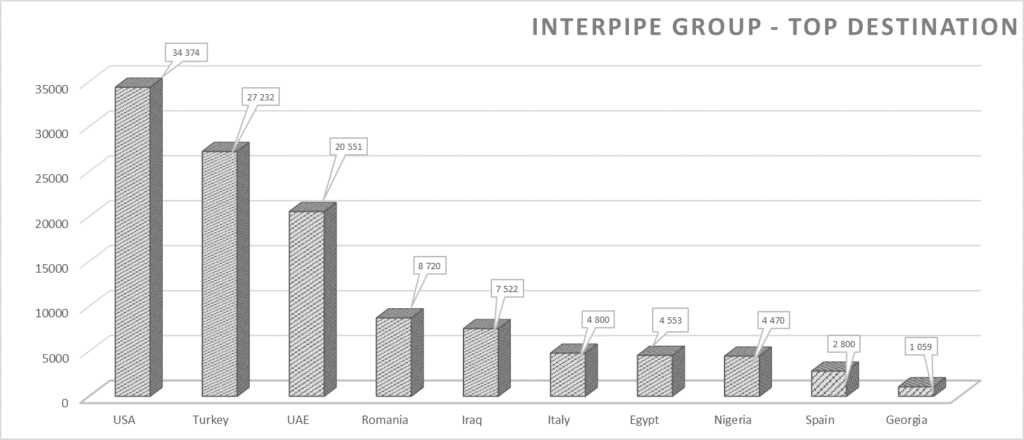

The Interpipe Group last year reduced its exports by 39%.

The main country to which Interpipe pipes are exported is the USA. In 2020, the company reduced shipments in this direction by 70%. Perhaps the reason was that the US International Trade Commission (USITC) decided to extend the anti-dumping duties on the import of oil and gas pipes from five countries, including Ukraine, for five years. In 2020, the Interpipe Group began supplying line pipes for the Abu Dhabi National Oil Company – ADNOC under a long-term contract. As a result, 20.5 thousand tons of pipes were delivered to the UAE in 2020.

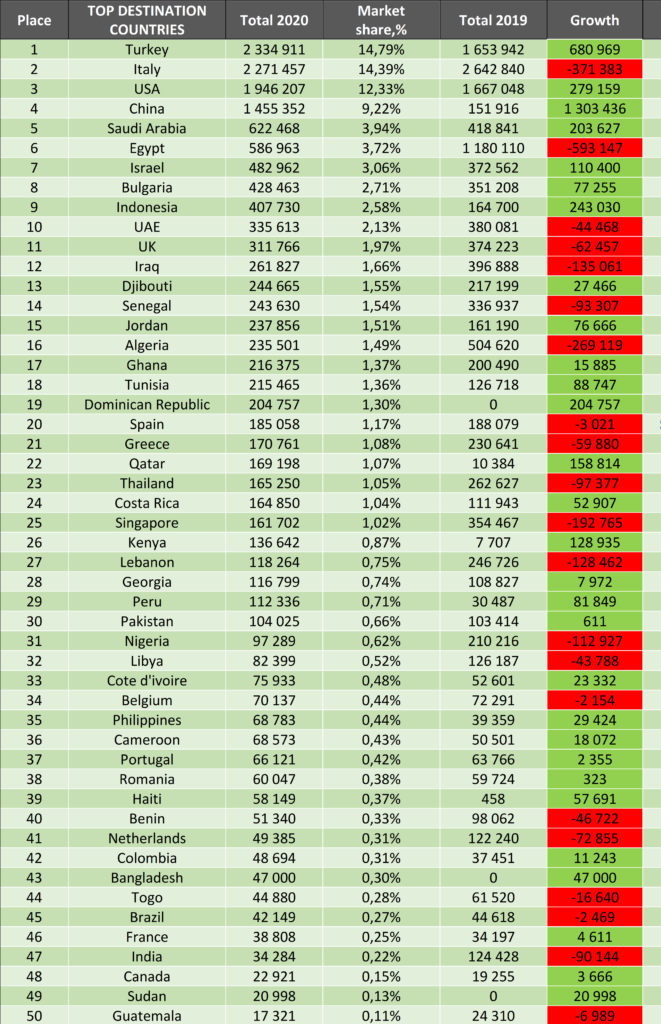

Countries importing metal from Ukraine

Ukraine exports metal to 59 countries of the world. The five leaders of our rating import 54.6% of the total volume of all types of metal.

Rating of countries-importers of metal products (all types of metal, excluding container shipments and Danube ports)

Turkey increased the import of metal products from Ukraine by 41% in 2020, which is why it climbed two lines in our rating and took 1st place.

There was a significant jump in Turkey’s ranking as an importer of rolled metal products in 2020, despite the increased import duties. Initially, the country imposed duties on the import of several types of metal products in order to protect the domestic market for preserving jobs. In September, Turkey extended protective measures til the end of 2020, promising to revise additional import duties on these cargoes in 2021.

Italy, the leader of 2019, reduced imports by 14% in 2020, yielding first place to Turkey.

In 2020, unfortunately, many of the country’s metallurgical enterprises were idle due to the COVID-19 pandemic. The Italian plants of the Metinvest group, which closed at the request of the government, were no exception. In the previous year, Metinvest sent 97% of all exports of metal products from Ukraine to Italy.

In 2020, China took 4th place with a record volume of metal products from Ukraine – 1.45 million tons against 152 thousand tons in 2019. Since the beginning of the pandemic, many companies have been able to take advantage of the active recovery of the Chinese economy and increase their ore shipments, and thereby resume the sale of metal products in this market.

Supplies to Qatar increased significantly – 169.2 thousand tons against 10.3 thousand tons in 2019.

Also, supplies to Indonesia increased – 9th place in the ranking with an import rate of 407.7 thousand tons against 164.7 thousand tons in 2019. The main companies shipping metal products to Indonesia are ArcelorMittal (79%) and Metinvest (21%).

Metinvest in 2020 resumed shippings to the Dominican Republic – 204,757 tons.

In 2020, ArcelorMittal opened a new direction to Gabon, shipping 2.1 thousand tons of metal products. The company also resumed deliveries to Guinea – 5.9 thousand tons.

Belorussian Steel Works also opened a new direction – Sudan, supplying 20,998 tons of billets to this country.

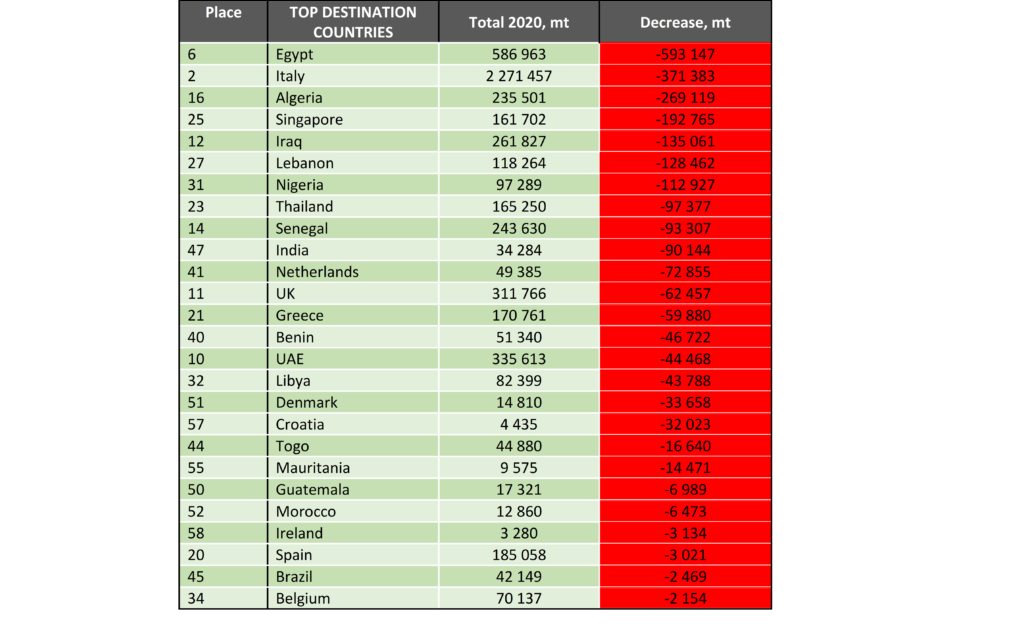

Falling volumes of transshipment of metal products from Ukraine

Growth in the volume of transshipment of metal products from Ukraine

Rating of shippers, transiters and charterers of metal from Ukraine

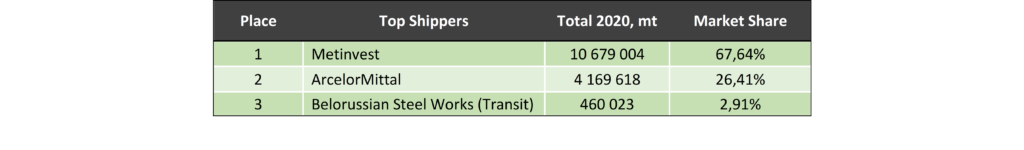

Rating of shippers and transit countries (all types of metal, excluding container shipments and Danube ports)

The five leaders among the senders sent more than 95% of the total volume of metal products.

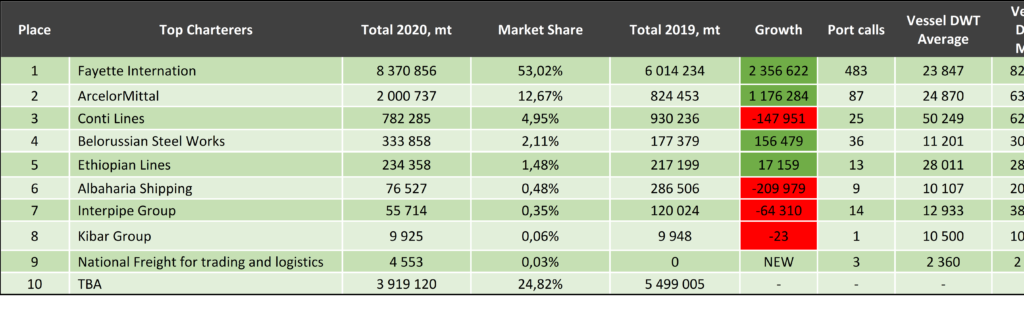

Charterers rating (all types of metal, excluding container shipments and Danube ports)

TOP shippers (all types of metal, excluding container shipments and Danube ports)

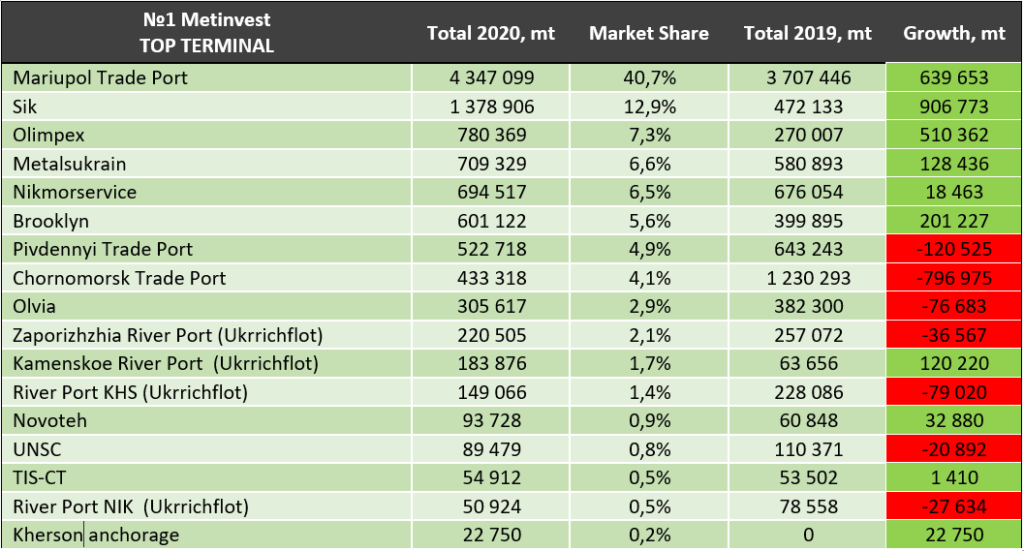

1st place in the TOP shippers is taken by Metinvest, which in 2020 sent 10,679,004 tons of metal products. The main share (40.7%) is sent by the company from the Mariupol commercial port.

The Port of Mariupol is considered one of the main ports for transshipment of products for the Metinvest group, since metallurgical plants and companies are located there: “Mariupol Metallurgical Plant named after Ilyich ”(the enterprise produces cast iron, steel and rolled products) and “Azovstal”(produces flat, section and shaped steel).

At the SIK terminal in Mykolaiv, the company has increased the volume of transshipment, having more than doubled the export volume. The growth in volume was facilitated by the fact that in 2020 the company stopped working at the NEC terminal (Mykolaiv).

In 2020, Metinvest increased river transportation (Zaporizhzhya river port, Kamenskoe port, Dnipro port) by 29% compared to 2019.

The company significantly reduced shipments from the seaport of Chornomorsk, while increasing the volume of exports through the terminals of the Odessa port.

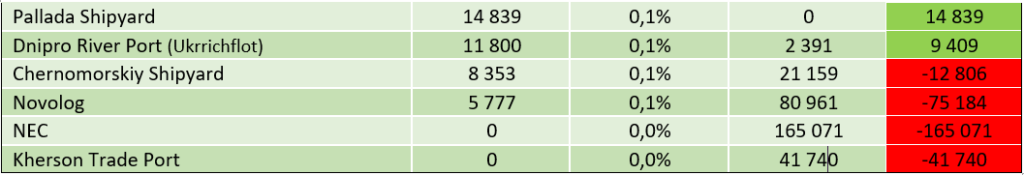

Distribution of Metinvest cargo by terminals (all types of metal, excluding container shipments and Danube ports)

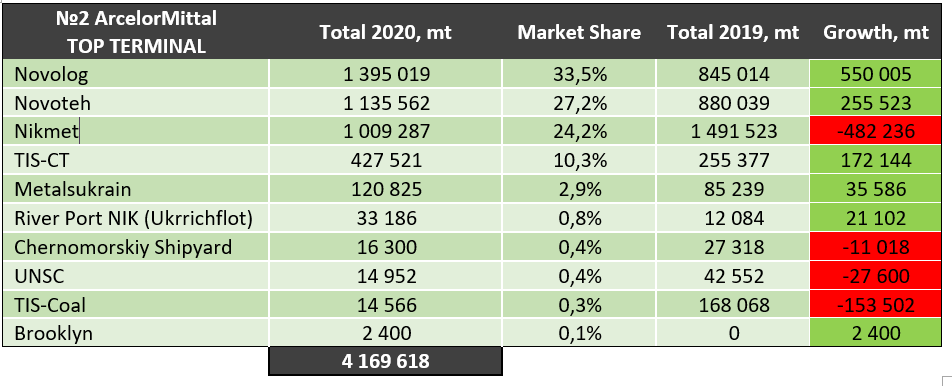

ArcelorMittal is on the 2nd place in our TOP. The company has increased the volume of shipments through the terminals of Odesa (Novolog, Novoteh, Metalsukrain, UNSC, Brooklyn) by 44% compared to 2019.

In 2020, the company’s shipments from the TIS-CT terminal increased significantly (plus 67%), while shipments from TIS-Coal decreased by 90%: this was facilitated by an increase in ore transshipment at the terminal and a dense line-up.

ArcelorMittal reduced shipments from Nikmet terminal by 33% in 2020.

ArcelorMittal cargo distribution by terminals (all types of metal, excluding container shipments and Danube ports)

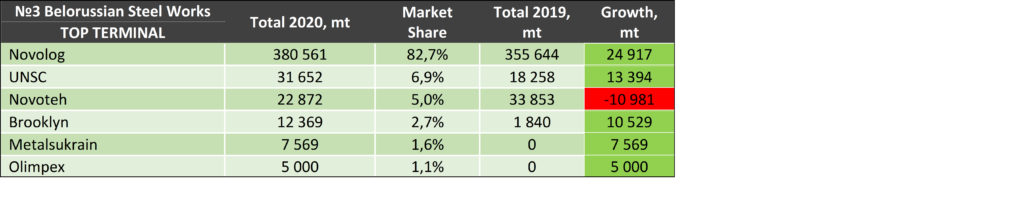

The top three is concluded by Belorussian Steel Works. The company transships its products through Odesa terminals.

The company’s shipments from the Brooklyn terminal increased significantly (plus 10.5 thousand tons). From this terminal Belorussian Steel Works together with Interpipe Group ship their products to the USA.

Distribution of Belorussian Steel Works cargo by terminals (all types of metal, excluding container shipments and Danube ports)

Moldova Steel Work showed an increase in transit indicators through Ukrainian ports in 2020: 11.4 thousand tons against 791 tons in 2019. The plant produces steel billets, small sections and wire rod. OJSC “Moldavian Metallurgical Plant” transships its products through Odessa terminals (Novoteh, UNSC, Metalsukrain, Novolog).

The companies with the lowest results are:

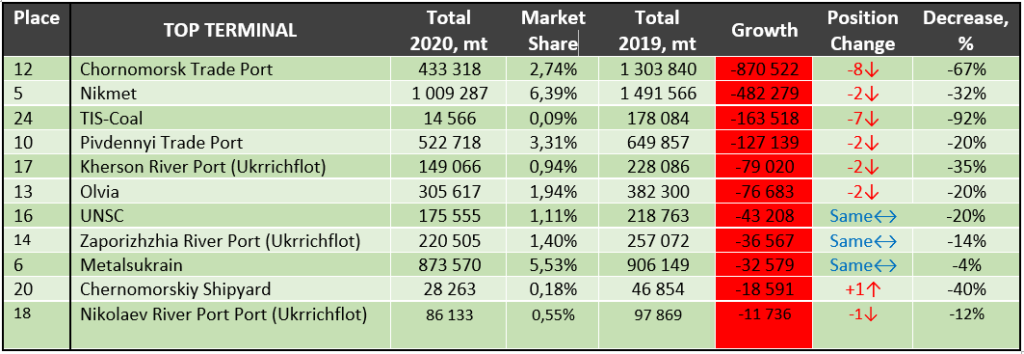

Analysis of Ukrainian terminals

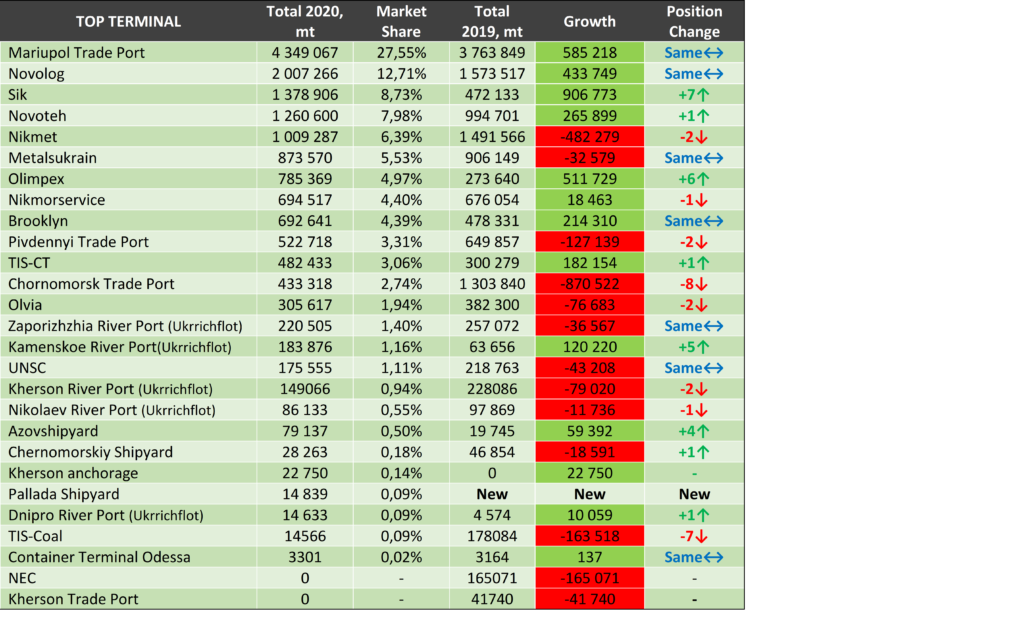

Rating of Ukrainian terminals (excluding containers and Danube ports)

For the second year in a row, the terminal of the Mariupol commercial port remains in 1st place in the rating, having transshipped 4.35 million tons of metal products in 2020, which is 16% more than in 2019. The main client of the terminal is Metinvest.

The Novolog terminal takes 2nd place in our rating in 2020, having transshiped 2 million tons of metal products, which is 28% more than in 2019. The main clients of the terminal are ArcelorMittal, Belorussian Steel Works (transit), Duferco, Metinvest.

SIK terminal managed to move up 7 positions and take 3rd place in our rating, due to an increase in transshipment volumes by Metinvest.

The Azov shipyard (Mariupol) increased the transshipment volumes by 59.4 thousand tons, compared to 2019. This terminal is used to transship the products (billets) of the Elektrostal enterprise (Kurakhovo), which, unfortunately, operated only a third of its capacity in 2020, but still managed to increase the volume of exports.

Drop in volume

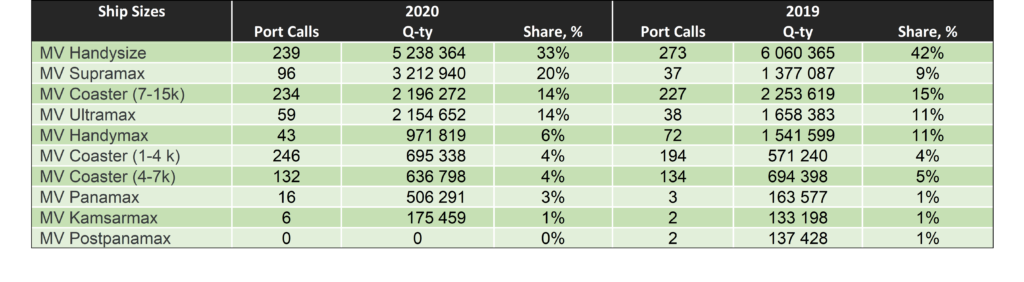

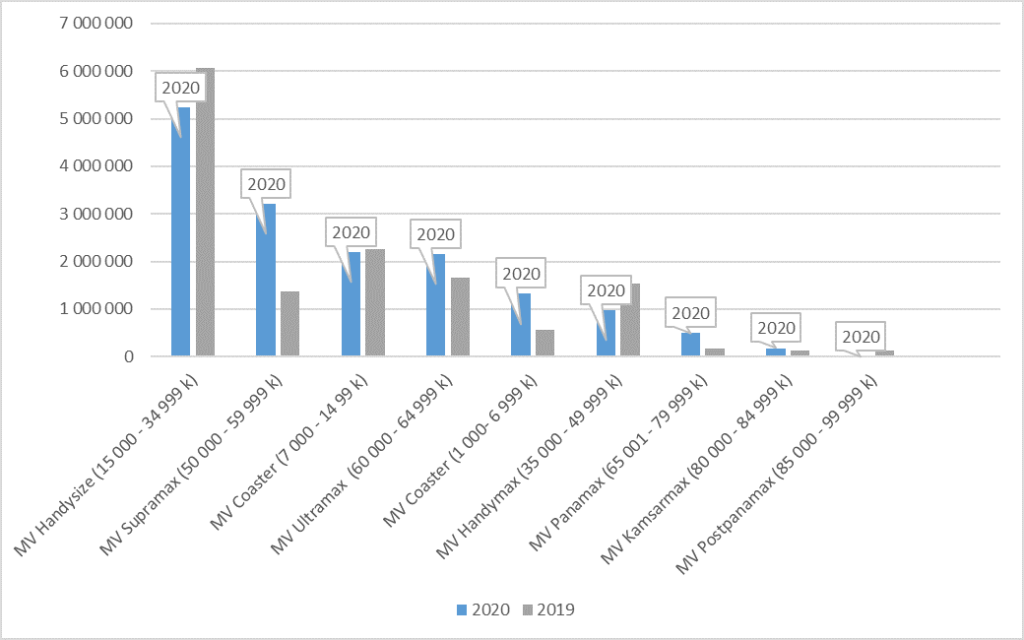

Market research by ship size

Market demand for Supramax size vessels more than doubled in 2020, while demand for Handymax fell by 37% and Handysize fell by 14%

Supramax-sized vessels were most frequently chartered by such companies as Fayette International in 2020 – 1.3 million tonnes against 535.7 thousand tonnes loaded in 2019. The company shipped cargo to China, USA, Qatar, Indonesia and Peru.

ArcelorMittal also increased the freight of Supramax-sized vessels: 1.04 million tonnes loaded in 2020 against 120.7 thousand tons in 2019. The vessels went to China, Indonesia, Saudi Arabia, Bangladesh and the Philippines.