EU fleets continue to profit from Russian oil

Despite sanctions, EU shipowners remain key players in Russian oil logistics.

In 2026, tankers owned or operated by EU companies will continue to play a significant role in transporting Rosneft to the world market. Gospodarka Morska writes.

According to the analytical companies Windward and Vortexa, in January 35% of crude oil loaded in Russian ports was transported by vessels affiliated with EU operators.

At the same time, a significant part of oil products made from Russian Urals oil at refineries in Turkey and India are ultimately purchased by EU countries – as “non-Russian” products.

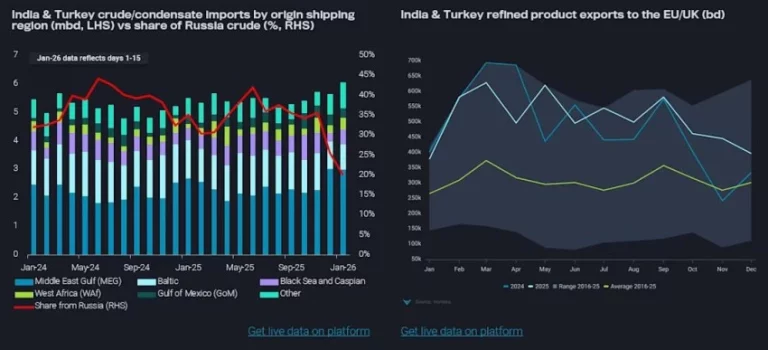

Turkey and India import crude oil and export its refined products. Source: Vortexa

Analysts call this a side effect of the sanctions policy. According to Michele Wiese Bockmann, an expert on maritime intelligence and shadow fleet tracking, the price restrictions imposed by the EU and the UK have led to a paradoxical result.

“The sanctions pressure has driven the price of Russian oil below the established limits, which has allowed EU tankers to legally and profitably participate in transportation, while preserving the Kremlin’s logistics chain,” Bockmann noted.

As early as December 6, 2025, European Commission President Ursula von der Leyen announced a complete ban on the maritime transportation of Russian crude oil, which was supposed to “further reduce Russia’s revenues and make it more difficult to find buyers.”

However, the 20th package of sanctions again left loopholes. Although it includes restrictions on banks, cryptocurrency transactions, technology exports, and additional sanctions against 43 tankers (640 vessels in total under sanctions), trade in Russian oil products is not covered by the sanctions.

As a result, more than 1,000 vessels of the “gray” and “shadow” fleet continue to operate, and European markets continue to receive fuel of Russian origin, but with a new passport.

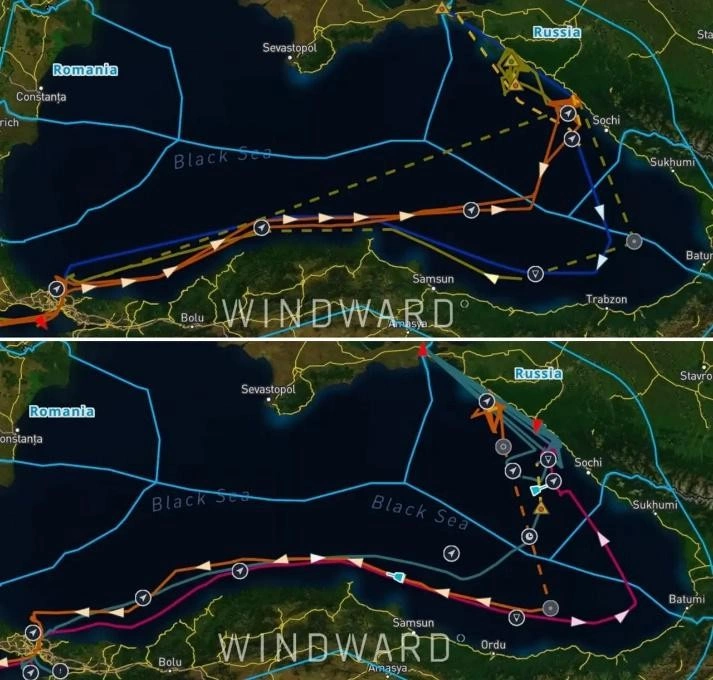

At the same time, Windward analysts record a change in logistics. To avoid the risks of attacks, tankers with Russian oil are increasingly sailing along the coast of Turkey, staying in its 12-mile territorial waters.

New routes for Russian oil tankers through the Black Sea. Source: Windward

This increases the route by ≈350 nautical miles (+70%), increases fuel costs, but reduces insurance risks and practically guarantees safety from attacks.

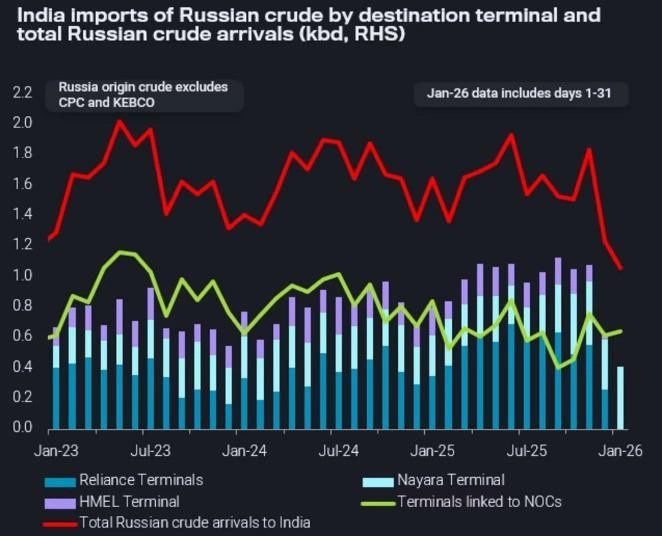

China, Turkey and India remain the main buyers of Russian oil, after which they export its refined products to the EU. Indian Oil, Bharat Petroleum, Nayara have been working with Urals for years, and Reliance Industries is resuming purchases – up to 150 thousand barrels per day.

Despite statements about reducing imports, India is still only preparing to reduce purchases of Urals to 600 thousand barrels per day – against a peak of 2 million barrels/day in the summer of 2025.

New routes for Russian oil tankers through the Black Sea. Source: Windward

Due to the fall in the price of Urals and the re-registration of companies in the UAE, European tankers quickly returned to the market (17% in November 2025, 29% in December and 35% in January 2026).

At the same time, according to Windward, the shadow fleet of the Russian Federation has already exceeded 1,900 vessels. Which is about 10% of the world’s tanker fleet.

Meanwhile, as USM wrote, India had detained three “shadow fleet” vessels the day before.