Exporters, competitors and a record harvest of Ukraine’s: outlooks in the new season

Barva Invest together with USM assessed the current situation on the grain market in the European region and analyzed who might be interested in Ukrainian grain and who might compete with us for exporters.

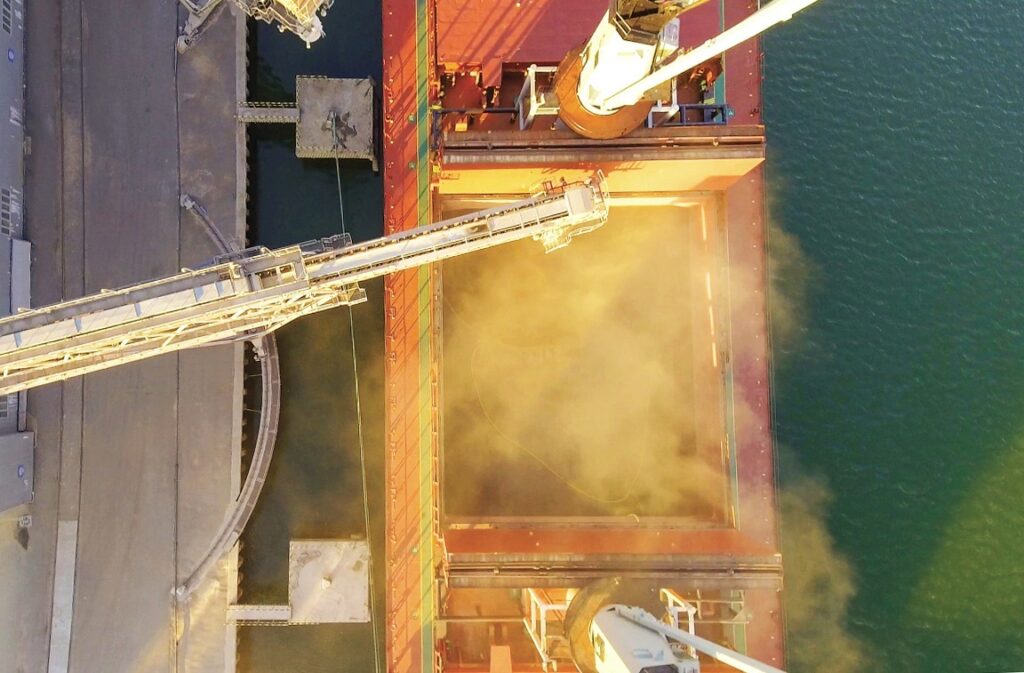

Together with Turkey, Algeria attracts special attention, where, due to dry conditions, grain harvest volumes may fall by 35-40%. This forces the local government to boost imports; at a recent tender, they have already purchased 480 thousand tons of wheat.

In addition to wheat, Algeria can buy barley and corn. As France’s monopoly on this market is weakening, Ukraine can take advantage of the situation and the heavy harvest to strengthen its position in this sales market.

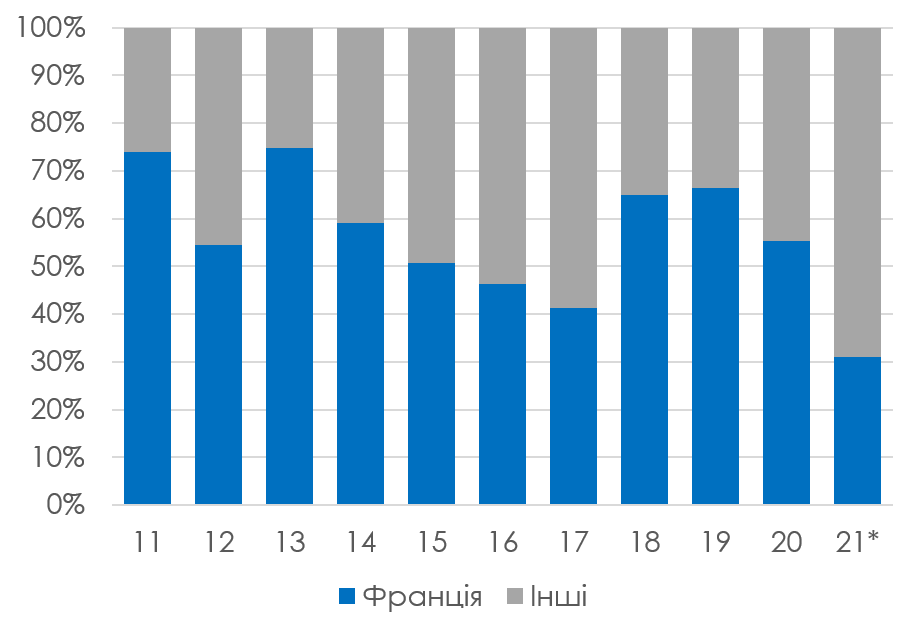

France’s share in wheat exports to Algeria (%)

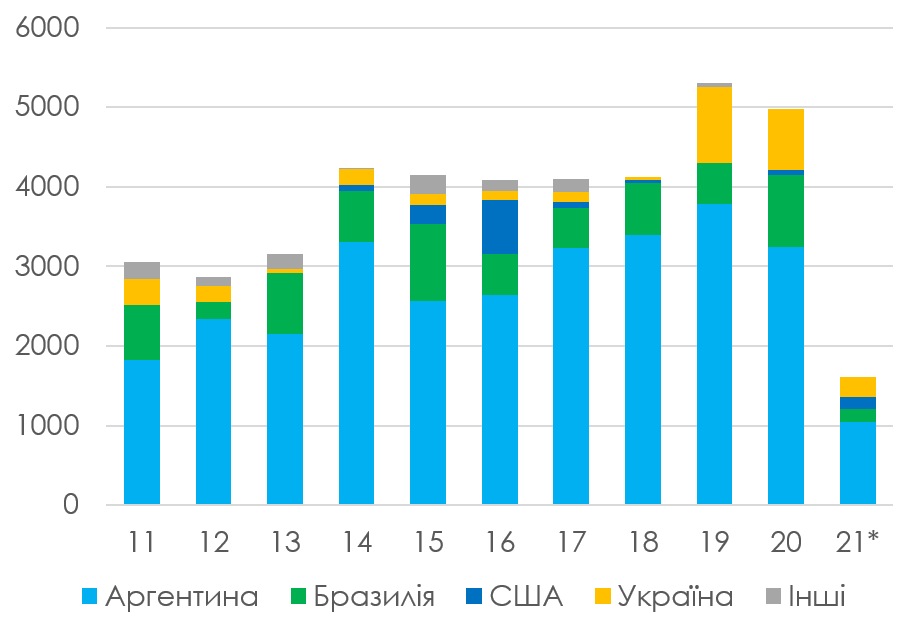

Major exporters of maize to Algeria (thousand tonnes)

Due to the lack of self-grown grains, South Korea is a major importer of both feed and food grains. However, these are quite separate markets with different suppliers. Ukraine does not ship significant consignments to Korea every year – the competition in this direction is significant. Last season, Romania sharply expanded its share in wheat exports to Korea, therefore, given the expectations of a large harvest, this season will not be easy for Ukraine, including in such distant sales markets.

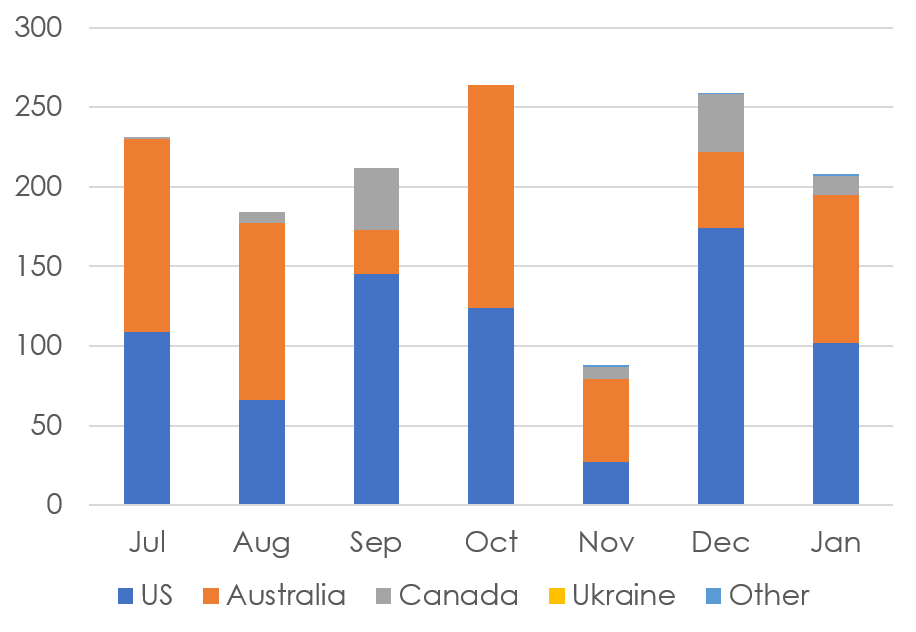

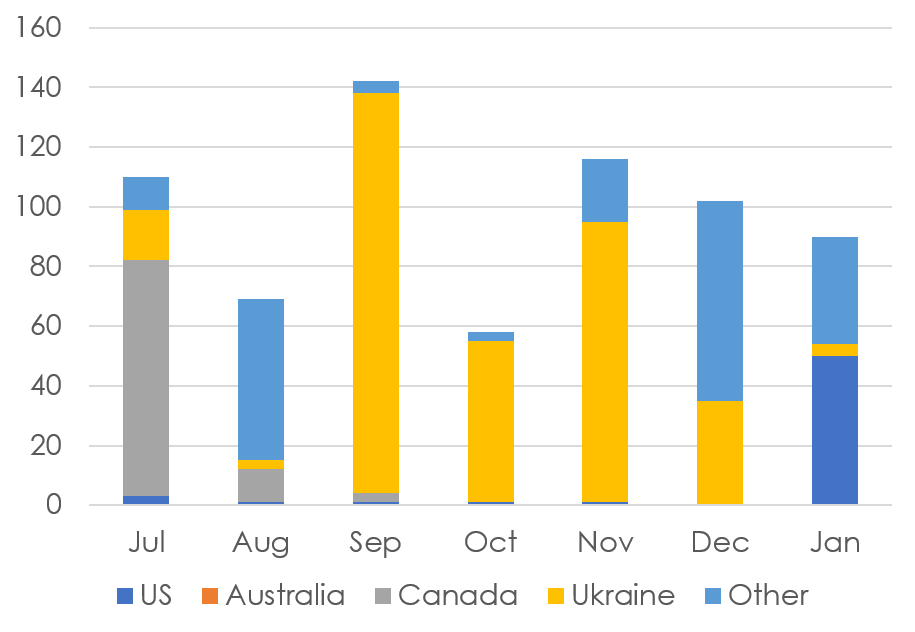

Dynamics of food wheat imports in the second half of 2020 (thousand tons)

Dynamics of imports of feed wheat in the second half of 2020 (thousand tons)

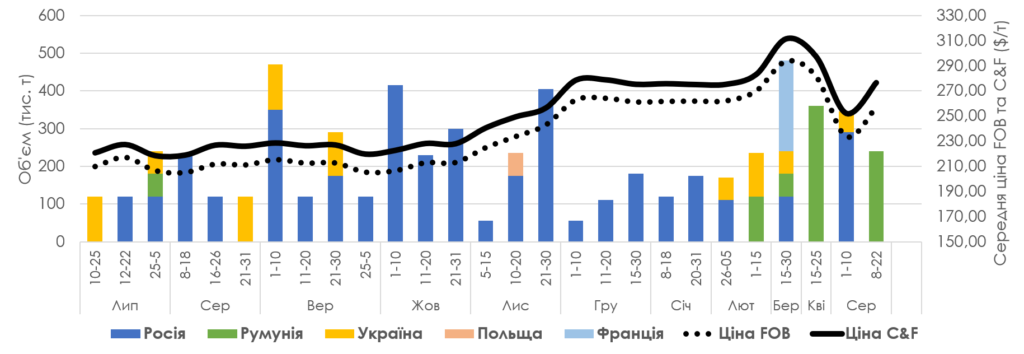

Since the beginning of 2021, the Egyptian government has initiated virtually no tenders, demonstrating that there is no need to purchase wheat. At the same time, private importers continue to be active, and by the end of spring, Egypt remained our key importer. For the new season, only two state tenders were initiated, notably in August (usually active purchases are planned for July). And here Romania also demonstrates its desire to actively compete for the sales market, offering large volumes. While Russia has been our main competitor in recent years, this time a fierce struggle is expected between all Black Sea wheat exporters, to which will be added the offer from France.

Results of GASC tenders. Old and new seasons

Black Sea region: record offer

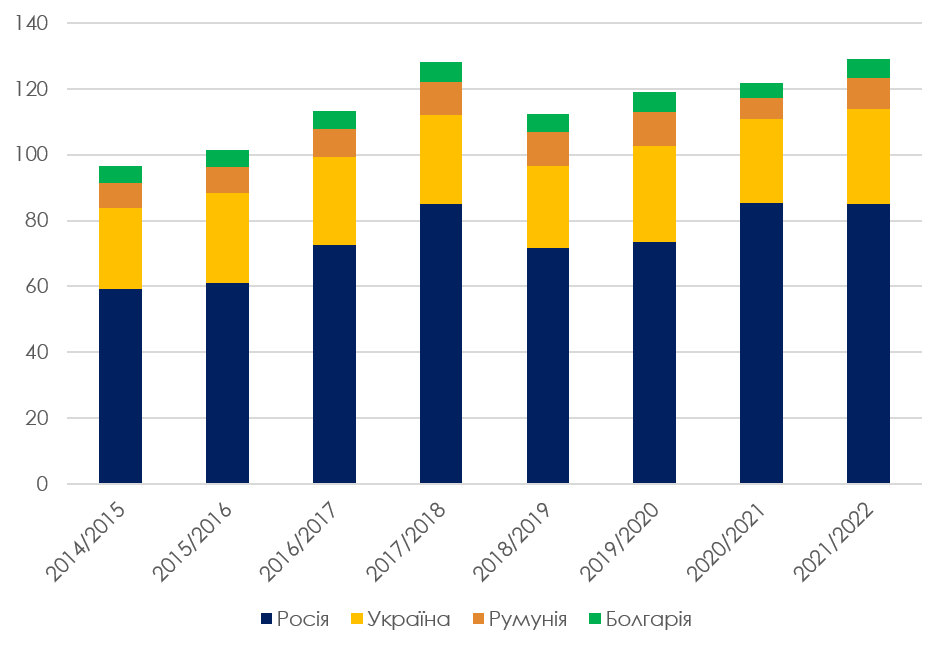

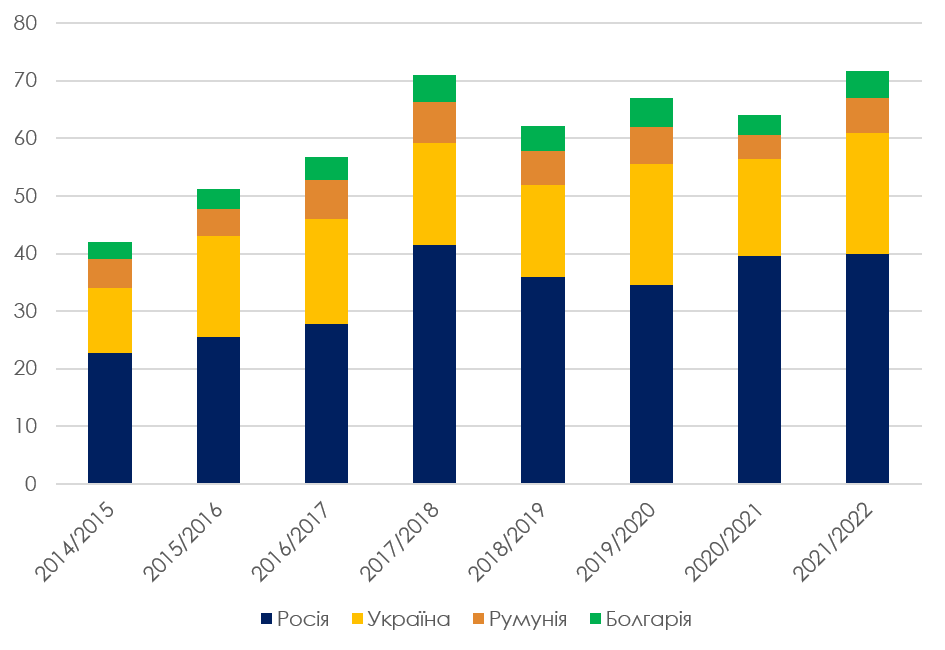

Most of the countries of the Black Sea region have weather conditions for winter wheat. It should be noted that in 2021/22 MY a heavy harvest is expected in the south of Russia, Ukraine, Romania and Bulgaria. The gross collection in Russia should be slightly below the USDA estimate (85 MT, versus the market estimate of 81 MT). Despite the fact that the gross harvest in this country should be lower than last season, the total supply will remain at a high level, which is also associated with large reserves in 2021/22 MY. Considering the fact that the main exporting countries of the Black Sea region may see rather intense competition for the same sales markets.

Gross harvest of wheat in million tons

Wheat exports in million tons

Black Sea region: quality issues

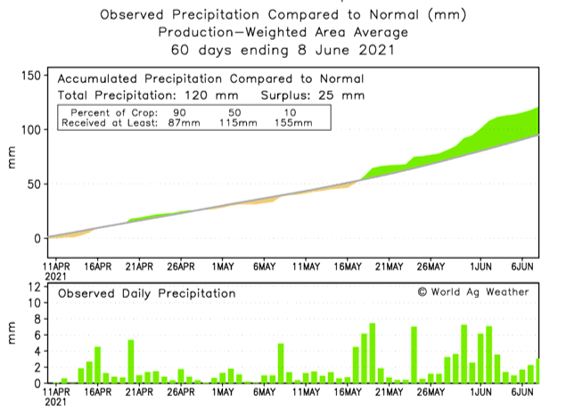

Together with the potential for a high yield in the Black Sea region, the issue of quality is becoming an acute issue. For example, in southern Ukraine, local producers report that they received a lot of rainfall, which, in turn, contributes to the spread of diseases and parasites. In addition, along with the increase in yield, a decrease in protein content is expected. A similar situation is observed in the south of Russia and in some regions of Romania. The weather factor is still decisive for quality indicators. At harvest time, we can see a high supply for the sale of fodder, which, in turn, will contribute to an increase in the price spread against milling wheat.

Precipitation in Ukraine for the last 60 days (mm)

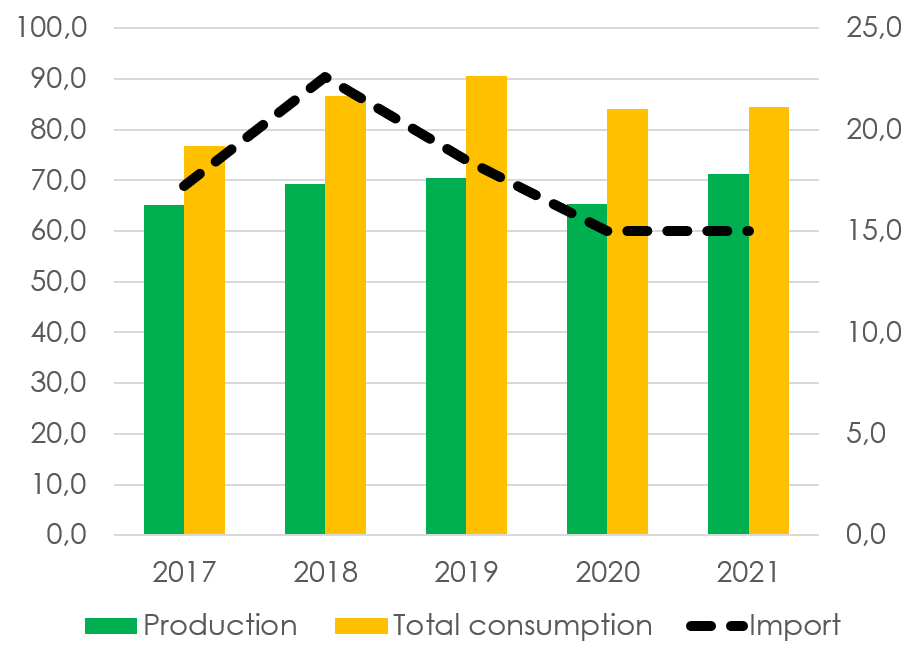

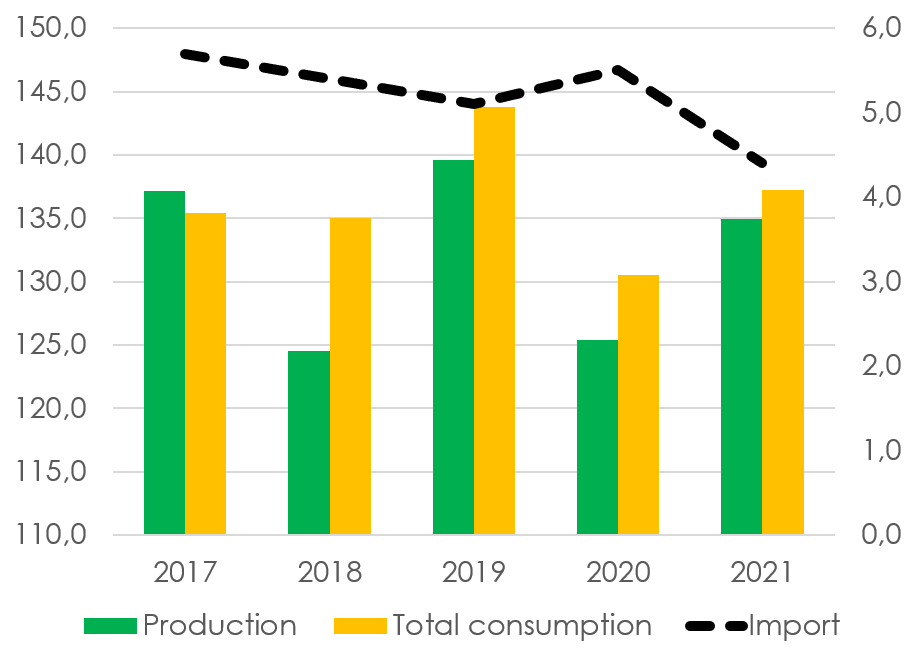

EU: increase in gross grain harvest

Good wheat harvests are expected not only in Romania and Bulgaria, but also in most other countries of the European Union. According to the European Commission estimates, the gross harvest in 2021/22 MY may exceed 135 million tons, which is 10 million tons more than the previous MY. Along with a high wheat harvest, the gross corn harvest may also increase. Now the weather conditions are conducive to the good development of crops in France, Serbia, Germany and Romania. In addition to the fact that the export market is expected to be highly competitive in the Black Sea region, it should also be noted that the import demand of the EU countries for corn should decline. This will put fundamental pressure on the Ukrainian corn base.

Corn balance in the EU, in million tons

Wheat balance in the EU, in million tons

Barva Invest