Season 2020/21 what it was and what to expect from the next

Barva Invest has summed up the results of the marketing year 2020/21 for USM and assessed on which of the importers Ukraine should focus, which is more profitable for the exporter – wheat or corn, and in general – how the next export season might surprise.

Not only in Ukraine, but all over the world, the 2020/21 MY turned out to be very non-standard, comparing to many other seasons. If we recall the beginning of the season, then during the forward period, almost none of the analysts or traders expected such a rapid rise in prices for grains and oilseeds. However, along with the emergence of Chinese demand on prices for Chicago, and then in Ukraine, were able to receive fundamental support. How Ukrainian grain exports has changed in 2020/21 MY?

Wheat

According to USDA estimates, the gross wheat harvest in Ukraine decreased to 25.4 million tons, against 29.2 million tons in 2019/20 MY. In turn, this significantly limited the export potential. According to the Ministry of Agrarian Policy, Ukraine has exported 16.5 million tons of wheat, which is 4.5 million tons less than in the previous MY.

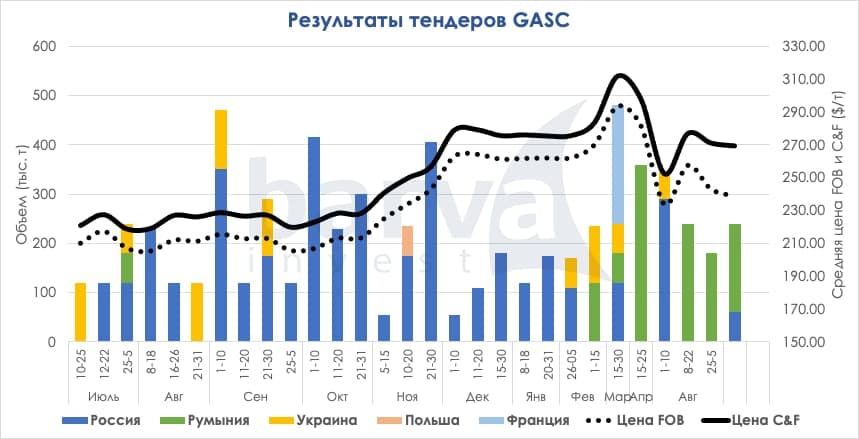

The mainstay consumers were Egypt, Indonesia, the Philippines, Bangladesh, as well as Tunisia and Thailand, traditional for the Ukrainian market. In the 2020/21 season, total exports from Ukraine towards these countries decreased, which is associated with a decrease in export potential in general. At the same time, Ukraine felt strong demand from Morocco, and we almost managed to double the export of wheat to this country, comparing to the previous season (1.1 million tons against 0.6 million tons in 2019/20 MY). Despite the fact that Egypt was our mainstay consumer of wheat, in general, the demand of this country has remained sluggish since October. The Egyptians preferred Russian wheat, and at the end of the season they bought several Panamaxes from Romania. If in MY 2019/20 Ukraine shipped 3.7 million tons to Egypt, then in 2020/21 we managed to export only 2.5 million tons to this country.

Special attention is paid to such issues as the rate of export and the formation of deferred demand from importers. Indeed, since the beginning of the season, Ukraine has shown good export rates, which was fueled by strong demand from our substantial importers. Nevertheless, starting from the second decade of August, the pace of exports began to slow down, and world prices came to the fore. The skyrocketing corn prices provided fundamental support for wheat as well. Thus, already in the fall, wheat of 11.5% on the FOB market cost about $ 250 / ton, which, on average, is $ 30-40 / ton higher compared to the autumn of 2019/20 MY. In turn, this had a negative impact on importers, who expected a downward price correction along with the new harvest in the Southern Hemisphere. Despite the restrained behavior of importers, by the new year prices reached the level of $ 280 / ton on a FOB basis for wheat of 11.5%. The Argentine harvest did not surprise anyone, but Australia managed to harvest 33.0 million tons, against 14.5 million tons in 2019/20 MY. Thus, the export potential of this country has increased significantly. Starting in the third decade of January, Australia has joined the global competition, and this allowed wheat prices to ease slightly. In the second half of the season, the rate of export from Ukraine remained rather low. On the one hand, as we indicated earlier, many importers did not want to buy at such high prices, they took them only in case of urgent need and tried to use internal stocks. On the other hand, the harvest in Ukraine turned out to be lower than in the previous season, while at the beginning of the season we showed very high export rates, therefore, there were not so many free volumes for sale on the physical market.

What should be expected in 2021/22 MG?

First of all, it should be an important note that the gross harvest of wheat this year may exceed the psychological threshold of 30.0 million tons. After the crop tour, our team of analysts estimates the harvest potential at 30.6 million tons. The increase in production is largely connected with expectations of higher yields in the southern regions. A large amount of precipitation was observed practically throughout the entire territory of Ukraine during the spring and summer, which contributed to the growth of plants, and the risks associated with drought were completely leveled. Along with the growth of the gross harvest, we may face an increase in the supply of feed wheat, which today has already a fundamental reflection in the price spread between milling and feed wheat.

Many Ukrainian producers report that there was enough and some to spare rain in 2021/22 MY. Moreover, the rains lingered and persisted throughout June, and in the forecasts we can see additional precipitation in the first half of July. Along with the rise in average yields, growers are reporting lower protein levels and in-kind problems in some regions.

Indeed, quality indicators, on average, may be worse compared to 2020/21 MY, however, high yields will compensate the loss in quality. As for exports, 2021/22 MY will not be easy for Ukrainian producers. Do not forget that not only in Ukraine, but also in Romania, as well as in the south of Russia (Southern Federal District), a high wheat harvest is expected. The physical appearance of a large supply in the Black Sea will contribute to increased competition for the main sales markets. We have already witnessed how the Romanians sold 180 thousand tons of wheat of the new harvest to Egypt, while the offers from Ukraine and Russia were too expensive and not competitive. The export potential of Ukraine is estimated at 21.5 million tons, which is an absolute record. We will need to export aggressively in the first half of the marketing year in order to reach this level. In addition to traditional sales markets, Ukraine will need to increase the supply of feed wheat to South Korea.

Traditionally, South Korea is a fairly flexible market and local traders are currently looking towards cheap feed wheat versus expensive corn. In 2020/21 MY, Ukraine exported only 325 thousand tons of wheat to South Korea, but in 2021/22 MY, together with the increase in the supply of fodder, we can increase exports by 2 times, or even more. Expectations of a large harvest should not scare market participants too much, since in 2020/21 MY, many importers formed a very large deferred demand. Along with high prices in the 2020/21 season, many importers tended to postpone purchases until later periods and buy only for basic needs. Now we are with you at the beginning of July, and we can already observe the activation of such importers as Egypt, Iran, Algeria, Turkey, Tunisia, South Korea. Many of these countries are in dire need of wheat, but they are also looking to lower prices at harvest time. Together, all these factors add up quite well to the traditional seasonality for the wheat market – when, together with the massive harvest, prices in the physical market decrease, but they begin to recover rather quickly due to the emergence of import demand.

Barva Invest