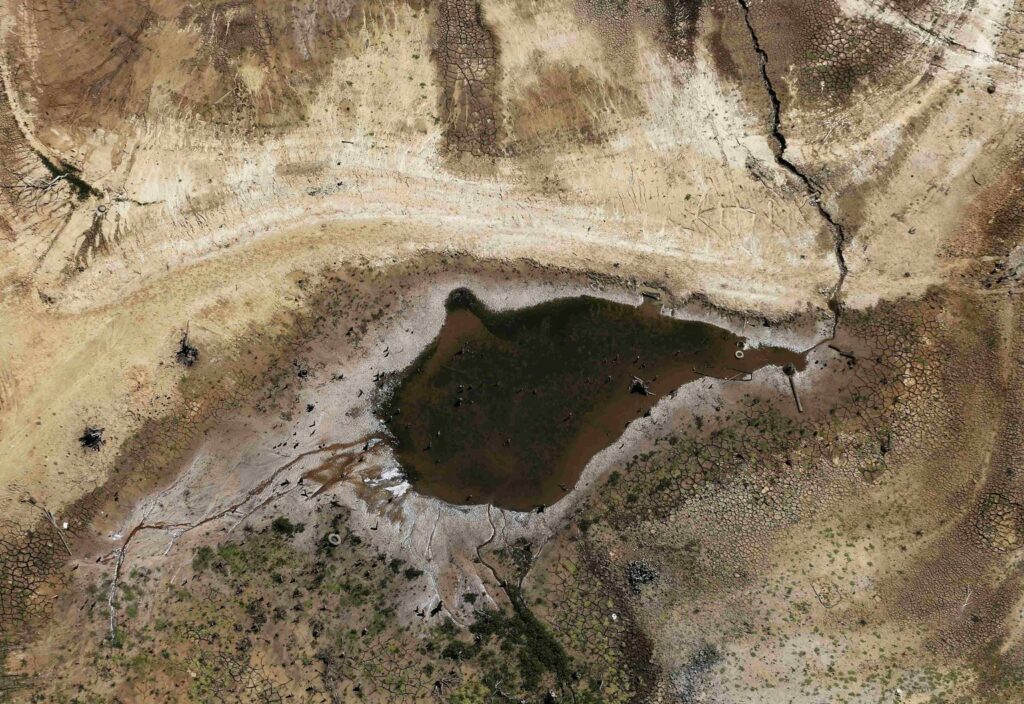

Severe drought in Brazil: how will this affect Ukrainian exports?

Brazil’s government warns that the country is facing its worst drought in 91 years. USM explains how this caused the price of corn to rise and whether it will affect exports from Ukraine.

What’s going on in Brazil?

According to Reuters, the Brazilian weather monitoring agency affiliated with the Agriculture Ministry issued the first “extreme drought warning” from June to September. The department said that in five states of Brazil during this period, most likely there will be little rain.

Lack of rain in the large part of Brazil has negative implications for crops, livestock and power generation.

Important to note: The drought in Brazil has been going on since last fall. In this regard, the Brazilians later had sowed soybeans, respectively, later have removed soybeans and sowed corn. Due to this shift in dates (May-August in Brazil is predominantly dry), corn crops hit the peak of drought.

Drought is now burning out the central regions of Brazil. And there is grown corn of the second crop, accounting for 2/3 of the total corn crop in the country. According to USDA estimates, the forecasts for the corn harvest have decreased to 90 million tons (a more depressive scenario – to 65-70 million tons), but they can reduce even more if there is no rain.

Note: before the drought, a harvest of 100 million tons was predicted. The reduction in production is significant, and this has already affected the market.

How did the drought in Brazil affect the market?

The fact that the price of corn has been on the rise lately is just an example of the impact of the situation in Brazil. Farmers have contracted the harvest, corn is shipped, but prices on the domestic market are record high.

Since April 15th, corn futures on the Chicago stock exchange have risen in price by 25%, including the July futures – up to $ 283.2/ton, December – up to $ 248.4/ton.

Brazil has revised import duties on corn to curb record domestic prices and boost the supply of raw materials for the industry. The grain market is also fueled by speculation that Brazil has purchased a shipment of US corn for the first time in two decades.

And, as a bonus, the drought has already damaged the production of sugar and coffee in Brazil, which is the world’s largest supplier of these products that in turn, led to an increase in commodity futures prices.

What does this mean for Ukraine?

USM contacted Elena Neroba, Business Development Manager at Maxigrain, for comment. She said that due to record prices in the domestic Brazilian market, the country is ready to buy corn even in Ukraine.

“If Ukraine were a little more flexible in terms of price, we could sell corn to Brazil, which we have not sold out. We do not export the volume that we set for ourselves in the Memorandum (24 million tons), we are far from it yet,” said Olena Neroba and added that traditionally this crop from Brazil replaced supplies from Ukraine in the EU market, “changing seasonally”

“Now there is no Brazilian corn, and Europe could buy corn from Ukraine. This will somehow support the prices on the market,” the expert noted.

Elena Neroba noted that Europe is the only market where Brazilian and Ukrainian corn intersect. Otherwise, the markets are practically different.

“But we are all starting from the same foundation. This general wave will definitely affect Ukraine as well,” Olena Neroba summed up.