The complete analysis: Ukranian grain exports in numbers and names

Stark Shipping, together with USM, analyzed the rating of Ukrainian grain terminals in 2020. We present an analysis of grain exports by countries, distribution of cargoes, as well as ratings of terminals and shippers.

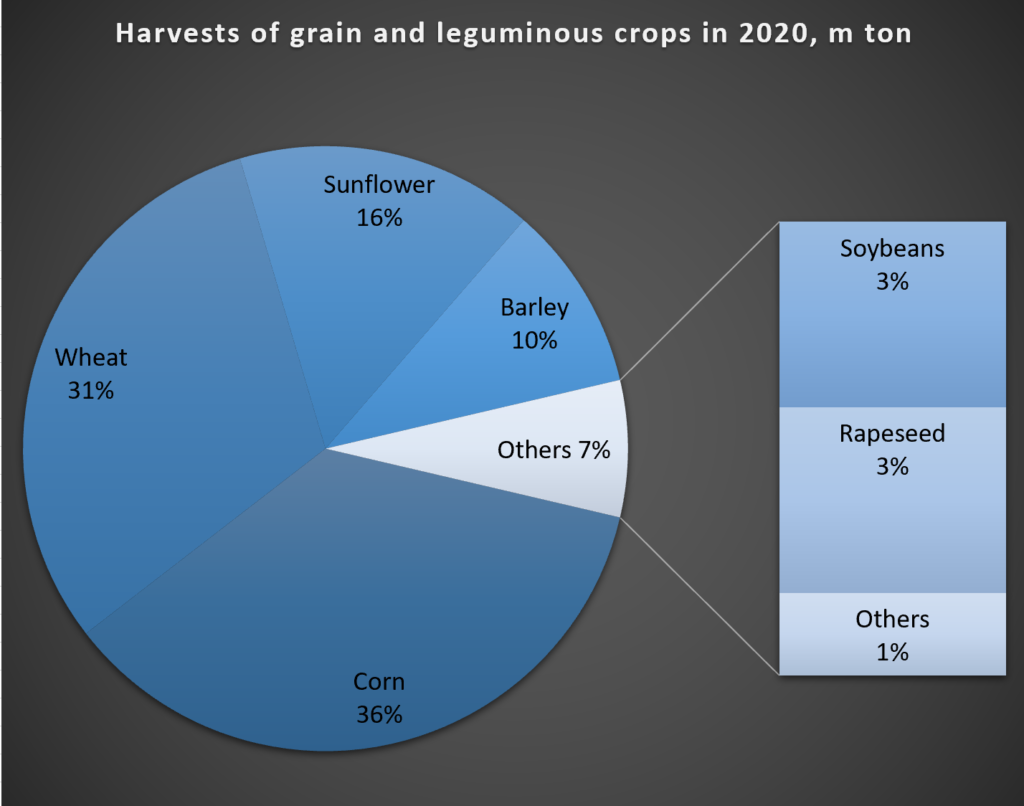

The results of transshipment of grain and leguminous crops by Ukrainian terminals in 2020 were influenced by the seasons 2019-2020 and 2020-2021. The second season in terms of yield was worse than the first, which negatively affected the volumes of terminal transshipment. According to the results of the harvesting campaign in 2020, Ukrainian farmers harvested 82 million tons of grain and leguminous crops (according to the joint project of Latifundist Media and Soufflet Agro Ukraine “Harvest Online 2020”). This is 6.9 million tons more than in 2019.

In the context of grain crops, they collected:

· Corn – 29.8 million tons;

· Wheat – 25.1 million tons;

· Sunflower – 13.1 million tons;

· Barley – 7.8 million tons;

· Peas – 516.2 thousand tons;

· Millet – 244 thousand tons;

· Buckwheat – 106.5 thousand tons;

· Soybeans – 2.8 million tons;

· Rapeseed – 2.6 million tons.

According to Stark Shipping, the total export of grain crops from the seaports of Ukraine in 2020 reached 53.5 million tons. Compared to 2019, exports decreased by 7.4 million tons.

The export structure is as follows:

· Corn – 27.1 million tons (51%);

· Wheat – 17.7 million tons (33%);

· Barley – 5 million tons (8%);

· Rapeseed – 2.2 million tons (4%);

· Soybeans – 1.2 million tons (3%).

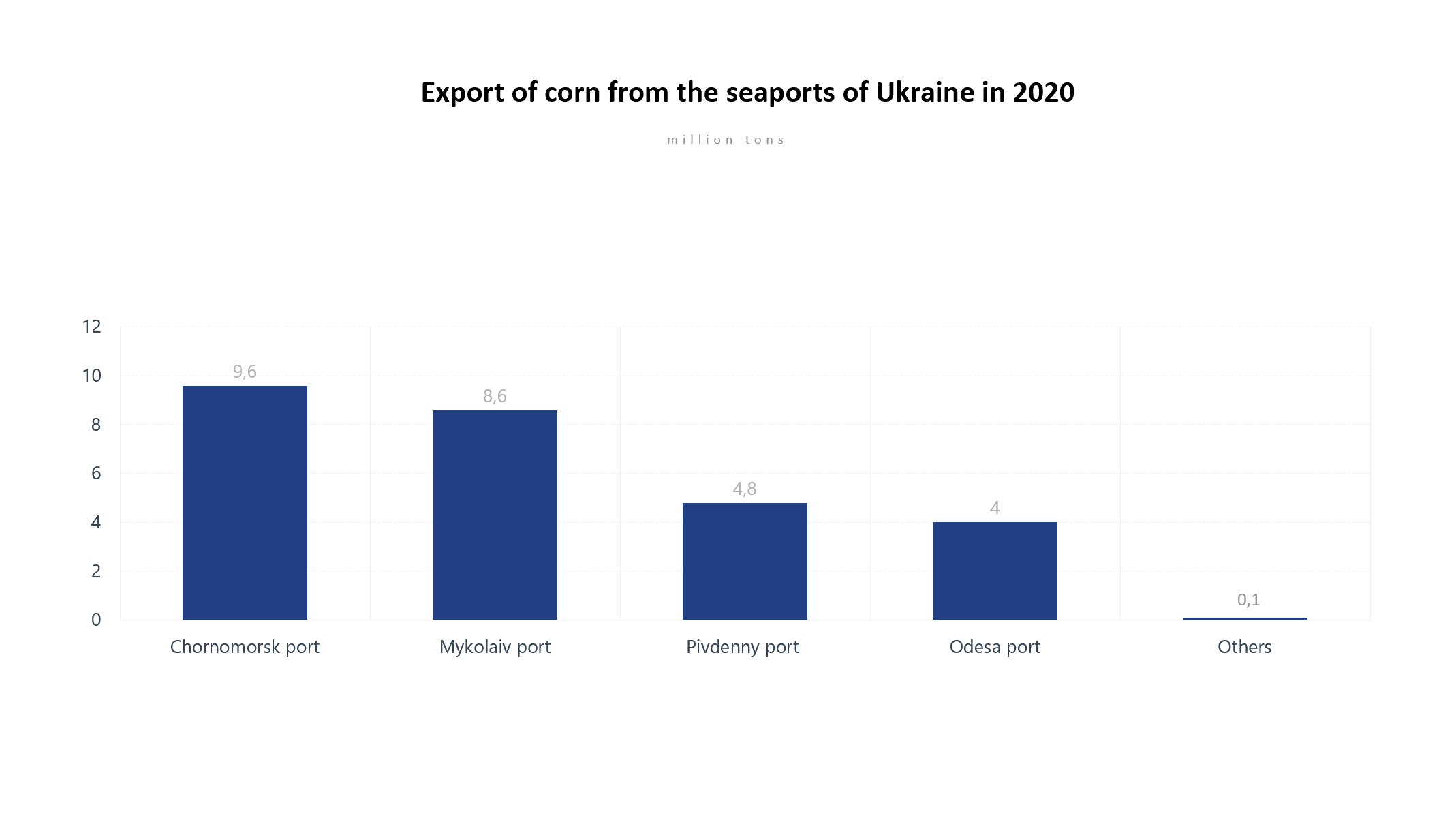

In 2020, corn was leading in Ukraine in terms of supplies, with the result of shipment of 27.1 million tons, which accounted for half of all grain exports. Exports of corn, compared to 2019, decreased by 4.3 million tons, or 13.7%.

Among the ports, most of the corn was shipped from Chornomorsk and Mykolaiv – 9.6 and 8.6 million tons respectively. 4.8 million tons were exported from Pivdenniy and 4 million tons from Odesa.

The main shippers of corn in 2020 were the following companies:

· Kernel – 5.7 million tons;

· COFCO – 2.8 million tons;

· ADM – 1.7 million tons;

· Nibulon – 1.6 million tons;

· Louis Dreyfus – 1.6 million tons;

· Agroprosperis – 1.5 million tons;

· Bunge – 1.5 million tons.

USM asked Volodymyr Humeniuk, CEO of BarvaInvest, a consulting company and provider of global analytical information on the financial and commodity markets, to comment on the situation with Ukrainian grain imports to other countries in 2020.

China was the leader among corn-importing countries: in 2020, the country purchased a record 7.9 million tons, 3.6 million tons more than in 2019. The Chinese pig farming branch has been actively recovering, creating a high demand for fodder crops, especially corn. For the first time, China’s corn purchases in foreign markets exceeded the annual import quota.

European Union countries significantly reduced imports of Ukrainian corn last year. The Netherlands ranked second on the list of importers with 2.9 million tons. Compared to 2019, the volume of purchases decreased by 900 thousand tons Spain ranked fifth in the ranking with imports of 2.4 million tons. Imports of corn to Italy decreased 2.3 times (660 thousand tons), Germany – 4.7 times (299 thousand tons).

Denmark and France have stopped purchasing altogether.

Comment of expert: “Wheat harvest problems in Eastern Europe, as well as delayed shipments due to the restraint of sales by farmers from the very beginning of the season, have led EU exporting countries to focus primarily on meeting demand within the Union. When the Ukrainian corn harvest problem had arose, which began to rise sharply in price, wheat in the EU remained a more profitable and affordable alternative among the feed group.”

In 2020, India also did not buy Ukrainian corn. But Bangladesh and Vietnam re-entered the market, importing 113 and 196 thousand tons of corn, respectively.

Comment of expert: “For Ukrainian corn (unlike wheat), India has never been a significant market. Even when India needs imported corn, which happens during crop failures, it prefers South African corn, which is more economically viable to import.”

After a break of more than three years, purchases of Ukrainian corn resumed in Saudi Arabia (71.7 thousand tons), Jordan (38 thousand tons) and Kuwait (21.6 thousand tons).

Comment of expert: “At first glance, everything is simple in Saudi Arabia. Their key supplier is Argentina, and the United States and Brazil are also closing supply holes. Ukraine takes a couple of vessels there, and it could be over. But I don’t understand why Saudi Arabia has reduced its imports so much in recent months, even though their feed is 95% dependent on imports and growing year by year.”

Turkey has reduced corn imports by 3.2 times to 668 thousand. tons.

Comment of expert: “This is true: compared to previous seasons, today we see a decrease in corn imports to Turkey. It should be noted that this country itself is a fairly large producer and covers about 75% of its consumption (which is growing mainly due to increased demand for fodder). Thus, having obtained a record harvest in 2020 (while Ukraine faced crop failures and logistical problems), Turkey’s consumption objectively does not require a constant chain of vessels plying from the north of the Black Sea. The peak of shipments took place at the beginning of winter, and Turkey covers part of its needs from Brazil. Although Ukraine has problems with the realization of crop residues, in the coming months we do not expect such a strong surge of activity from Turkey, which was observed in previous seasons.”

Exports of wheat from seaports in Ukraine in 2020 amounted to 17.7 million tons, which is 8.5% (or 1.66 million tons) less than a year earlier. At the same time, wheat supplies as of February 1, 2021 reached 74.3% of the volume of exports provided for in the Grain Memorandum for the marketing year 2020/2021.

The largest volumes of wheat in 2020 were shipped from the port of Mykolaiv (7.5 million tons), Chornomorsk (2.9 million tons), Pivdenny (2.7 million tons) and Odesa (2.2 million tons).

The main shippers of Ukrainian wheat were the following companies:

· Kernel – 2 million tons;

· Nibulon – 1.8 million tons;

· Louis Dreyfus – 1.6 million tons;

· Cargill – 1.5 million tons;

· Sierentz – 1.1 million tons;

· COFCO – 882 thousand tons.

The main importer of Ukrainian wheat in 2020 was Egypt – 3 million tons. In second and third place – Indonesia (2.6 million tons) and Bangladesh (1.5 million tons).

In 2020, imports of wheat from Ukraine resumed Pakistan, which has refrained from purchasing for the past two years. Pakistan’s Economic Coordination Committee has allowed the private sector to import 2.5 million tons of wheat to stabilize domestic prices and build up stocks, and Ukraine became a key supplier of grain to the market. Imports of 1.2 million tons of wheat gave Pakistan fourth place in the ranking of importers of Ukrainian grain.

Comment of expert: “Pakistan’s production volume almost corresponds to the consumption of the population from year to year. In recent seasons, the harvest has stopped growing, and there was a gap between needs and opportunities. As a result, stocks began to rapidly “erode”. The pandemic, as in many other countries, has led to an additional increase in demand for bakery products. As a result, domestic supply ceased to cover demand, which for the first time in 6 years led to the need to import significant volumes of grain. The peak of shipments from Ukrainian ports fell in the fall. It is expected that part of the volume will settle in the warehouses of processors, who will try to avoid problems in case of further troubles with the shortage of wheat.”

Wheat supplies to Tunisia, Morocco, Turkey and Yemen remained at the 2019 level.

Demand for Ukrainian barley in foreign markets increased to 5 million tons, which is 798 thousand tons (or 16%) more than the previous season.

1.6 million tons of barley were shipped from the port of Mykolaiv, 1.5 million tons – from Pivdenny, 943 thousand tons from Chornomorsk and 377 thousand tons from Odesa.

The largest volume of barley was shipped by Louis Dreyfus (976 thousand tons), followed by Kernel (728 thousand tons) and Nibulon (612 thousand tons).

In 2020, China took the first place among the countries-importers of Ukrainian barley, increasing the volume to 2.6 million tons. For comparison, in 2019 China imported only 868 thousand tons of grain.

Comment of expert: “In 2020, China significantly increased imports of the entire feed group (corn, barley, sorghum) in order to support the recovering livestock sector. Ukraine is one of the largest exporters of barley, respectively, has a longterm opportunity to ship barley to China by Panamax during the season. As a result, we see stable demand from Chinese importers, who offer higher prices than competitors – the maximum premium for China reached $ 30 per ton. The main requirement – the accreditation of Ukrainian exporters trading with China – is easily solved by the purchase of barley by trading companies from producers for the hryvnia.”

The traditional importer of Ukrainian barley, Saudi Arabia, last year reduced purchases to 773 thousand tons, compared to 1.1 million tons in 2019.

Comment of expert: “For Saudi Arabia, there is no significant difference where to get barley. Suppliers in recent seasons are Russia, Ukraine, EU countries (Romania and France), as well as Argentina. The choice is based on price parity, and for this reason we do not see a clear seasonality in the choice of suppliers. As Ukraine concentrated on China, the vacated niche was occupied by Russia, and during the winter several vessels even came from Australia (which interrupted the three-year crop failure period).”

It is worth noting the increase in shipments to Tunisia to 370 thousand tons, while in 2019 exports to this country amounted to only 24 thousand tons.

In 2020, 2.2 million tons of rapeseed were exported from Ukraine, which is 672 thousand less than last year’s shipments. tons, or 23.2%.

The main ports that have been exporting rapeseed are: Mykolaiv (684 thousand tons), Odesa (693 thousand tons) and Chornomorsk (693 thousand tons).

The five largest exporters of rapeseed include companies such as ADM (693 thousand tons), Cargill (588 thousand tons), as well as Nibulon (344 thousand tons), COFCO (304 thousand tons) and Viterra (Glencore) – 114 thousand tons.

The main share of shipments (96% of the market), as usual, fell on EU countries. The Netherlands (638 thousand tons), Belgium (636 thousand tons), Germany (395 thousand tons), Great Britain (253 thousand tons) and France (183 thousand tons) imported the most rapeseed.

Last year soybeans exports from Ukraine has decreased by 1.6 million tons compared to 2019 and amounted to 1.1 million tons.

Most soybeans were shipped from the port of Mykolaiv (535 thousand tons), Kherson (224 thousand tons) and Pivdenny (217 thousand tons).

The main exporters of soybeans in 2020 were Sodrugestvo (169 thousand tons), Agroprosperis (165 thousand tons), Grainexpo (139 thousand tons) and Bunge (127 thousand tons).

The main importers of Ukrainian soybeans in 2020 were Turkey, which bought 558 thousand. tons of grain, as well as Greece (117 thousand tons) and the Netherlands (114 thousand tons).

Note that in 2020, Ukraine for the first time in its history imported soybeans in the amount of 21 thousand tons to cover the internal deficit. The growth of soybean exports in 2019-2020 marketing year led to a decrease in raw material stocks in the country, in connection with which CJSC “Pologovsky oil extraction plant”, the third largest soybean processor in Ukraine, was forced to purchase 21 thousand. tons of Brazilian soybeans delivered to the port of Berdyansk to ensure the operation of the enterprise.

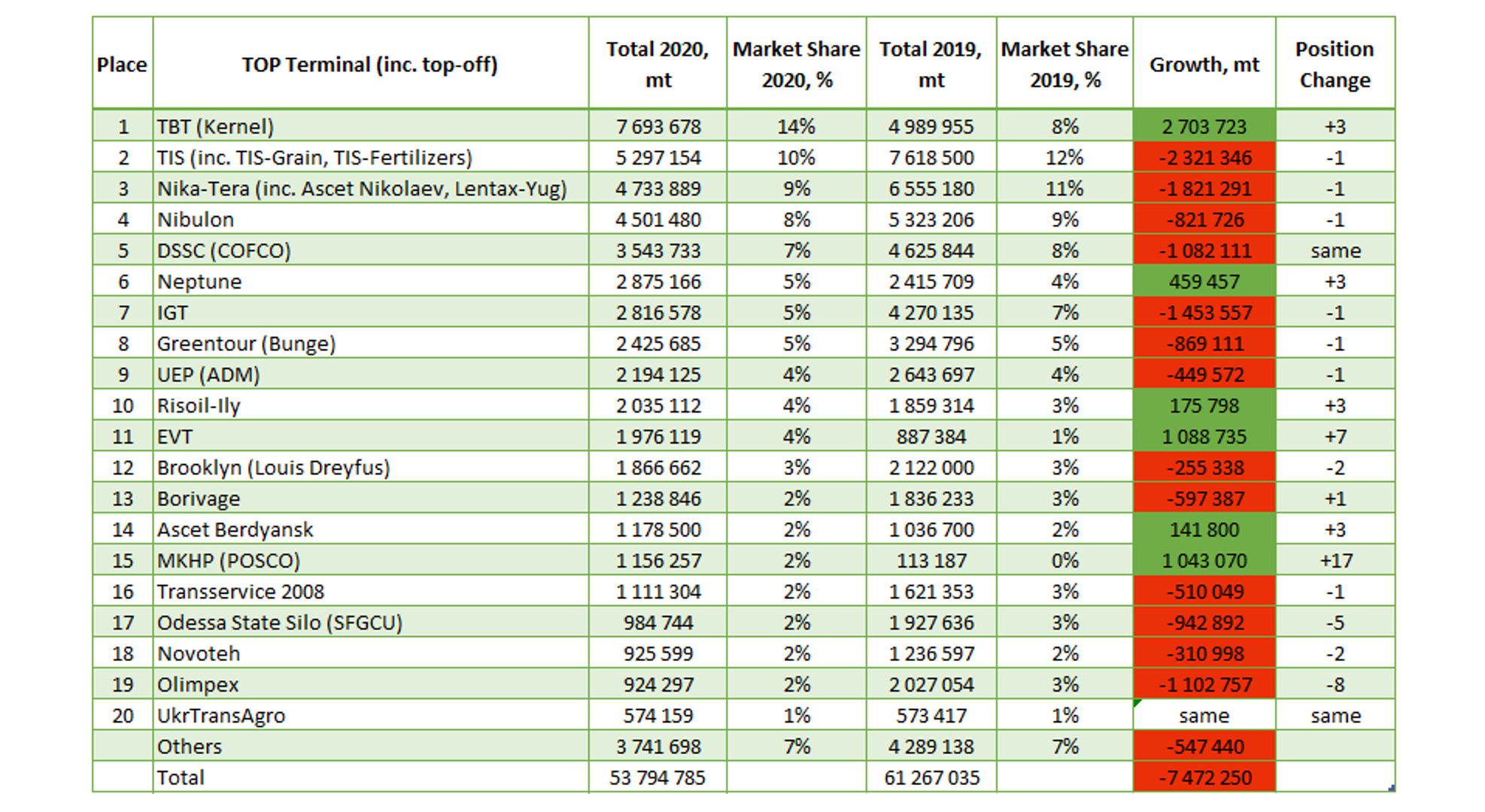

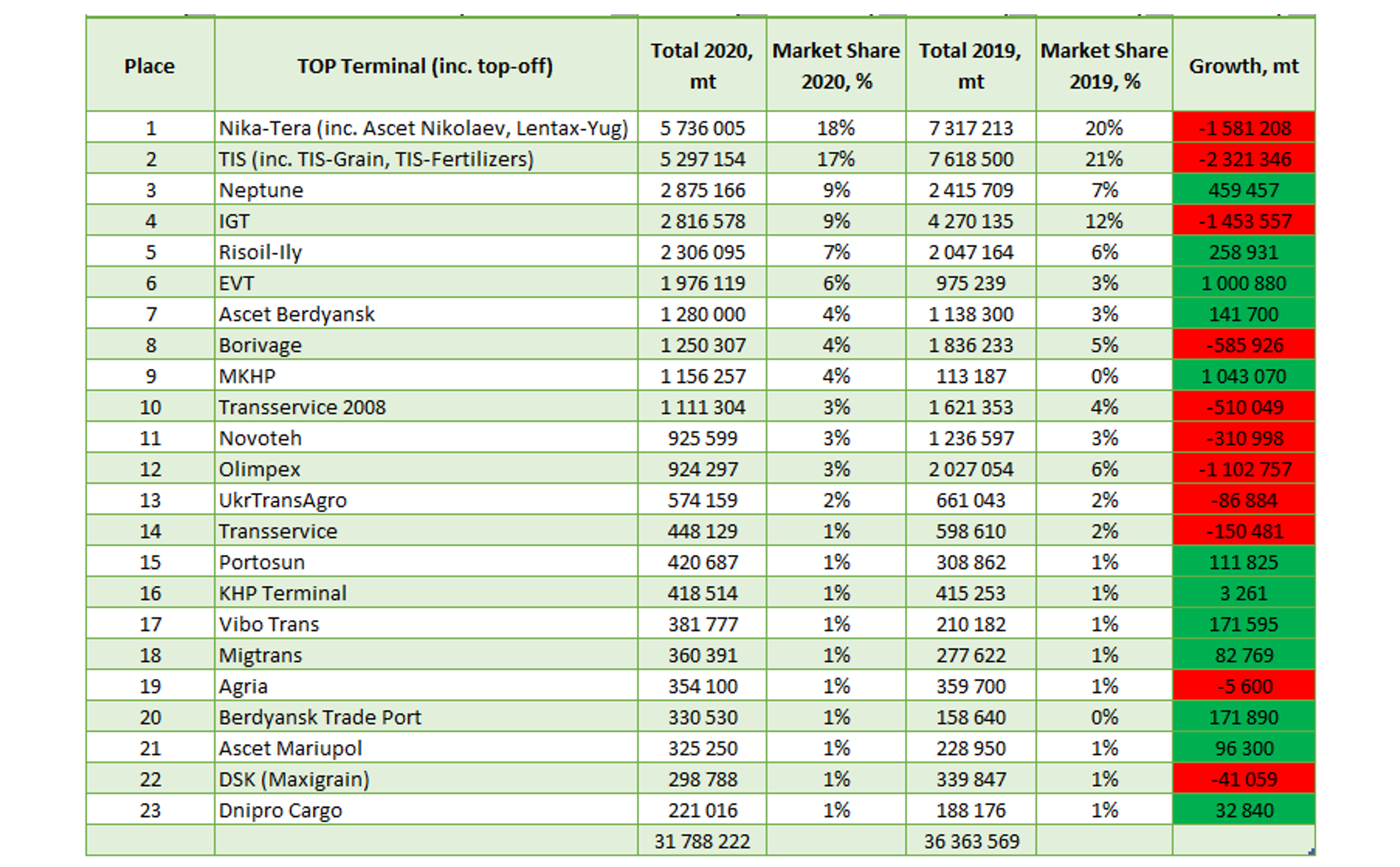

Rating of grain terminals of Ukraine

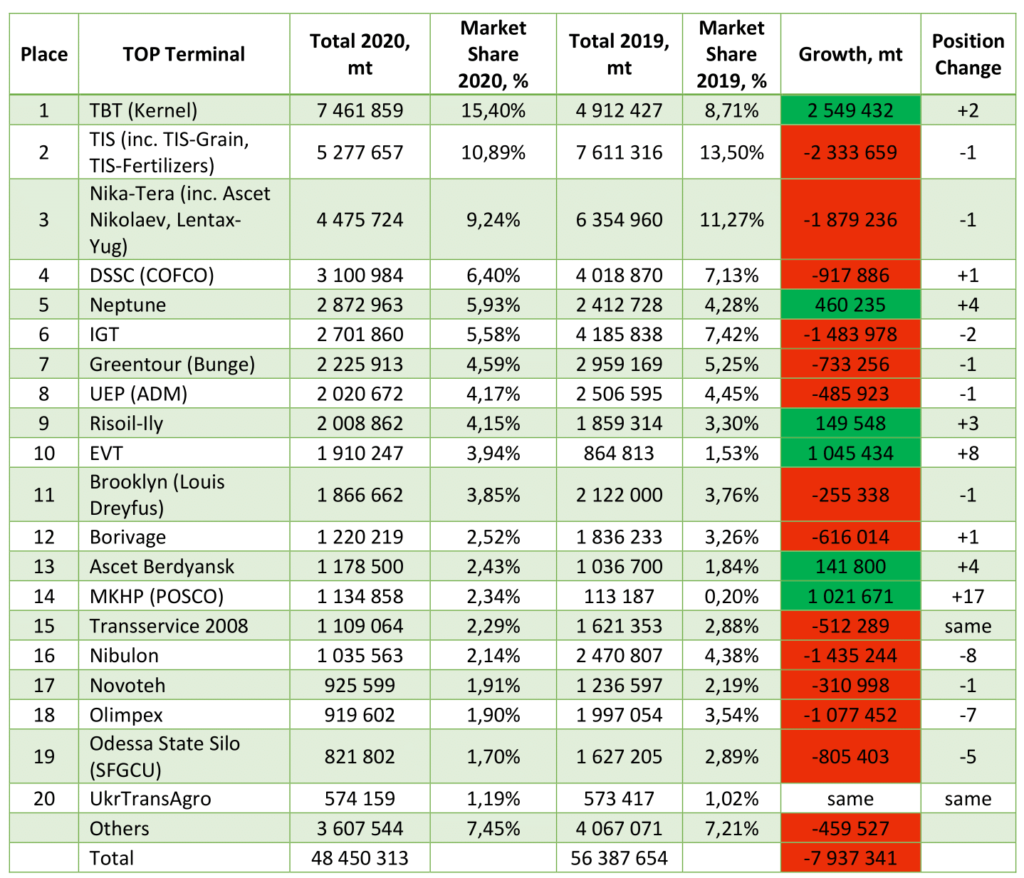

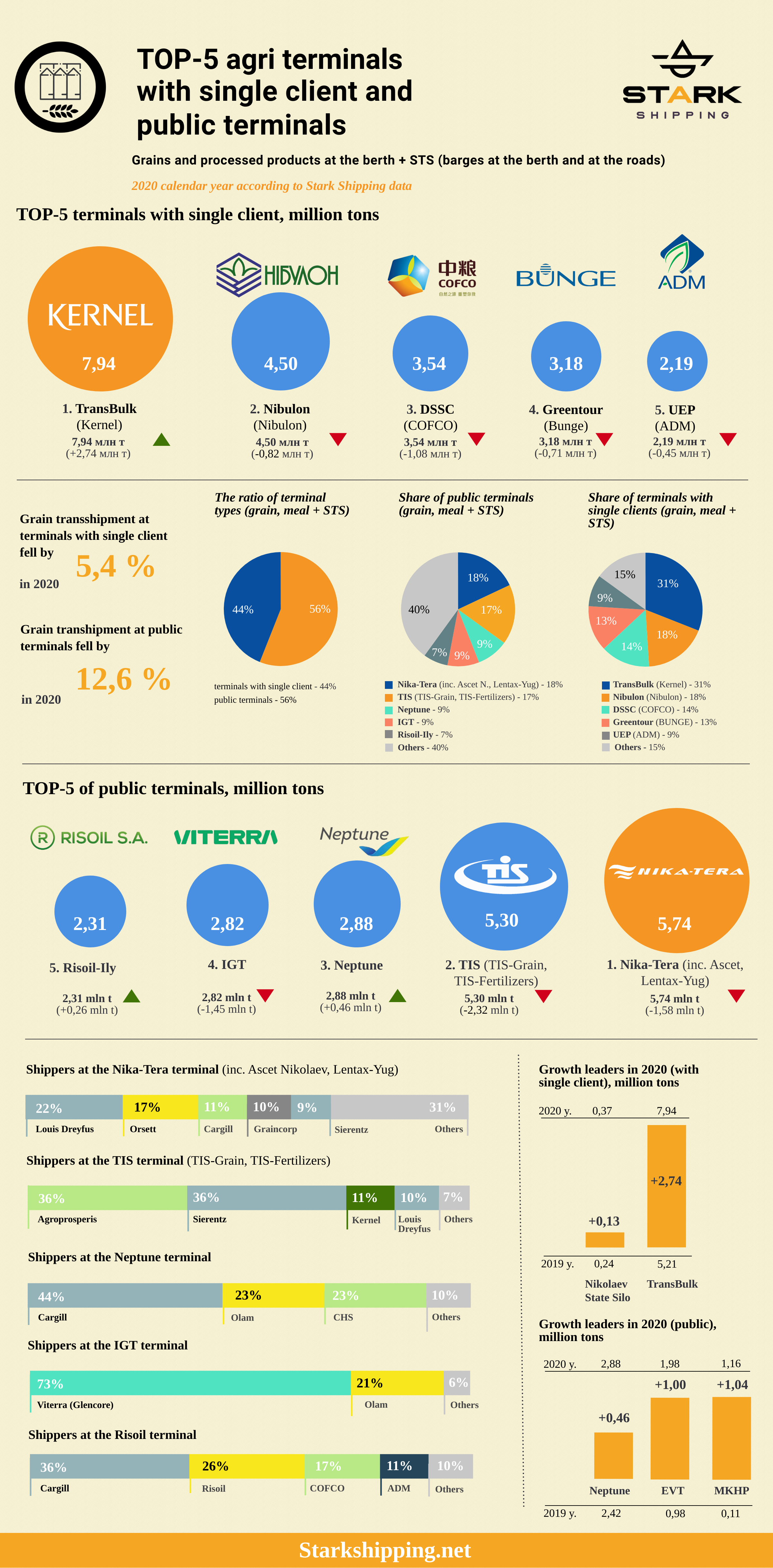

2020 has become a difficult year for Ukrainian grain terminals. Only 6 companies in the ranking managed to increase grain transshipment, the rest showed a decline compared to 2019.

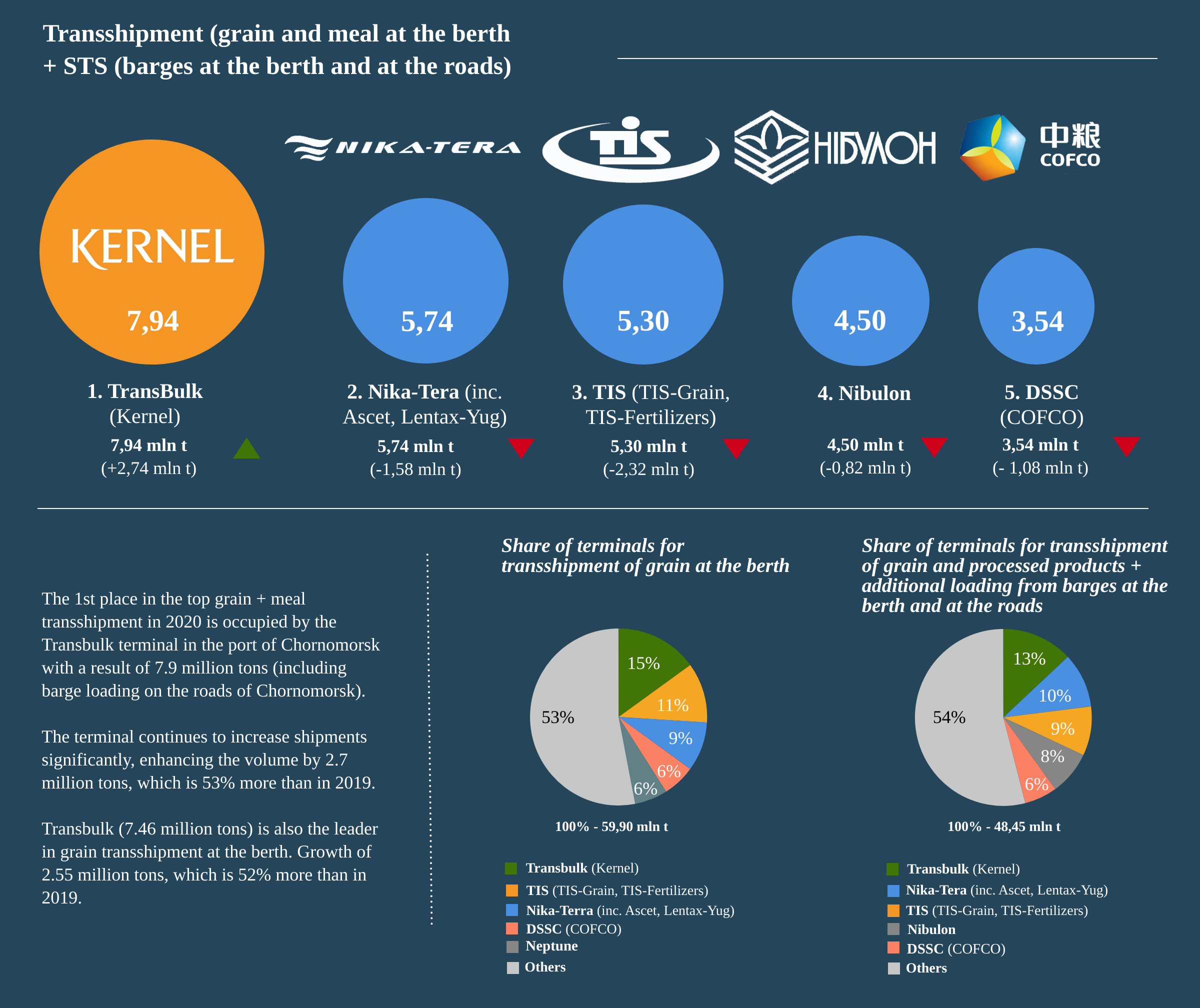

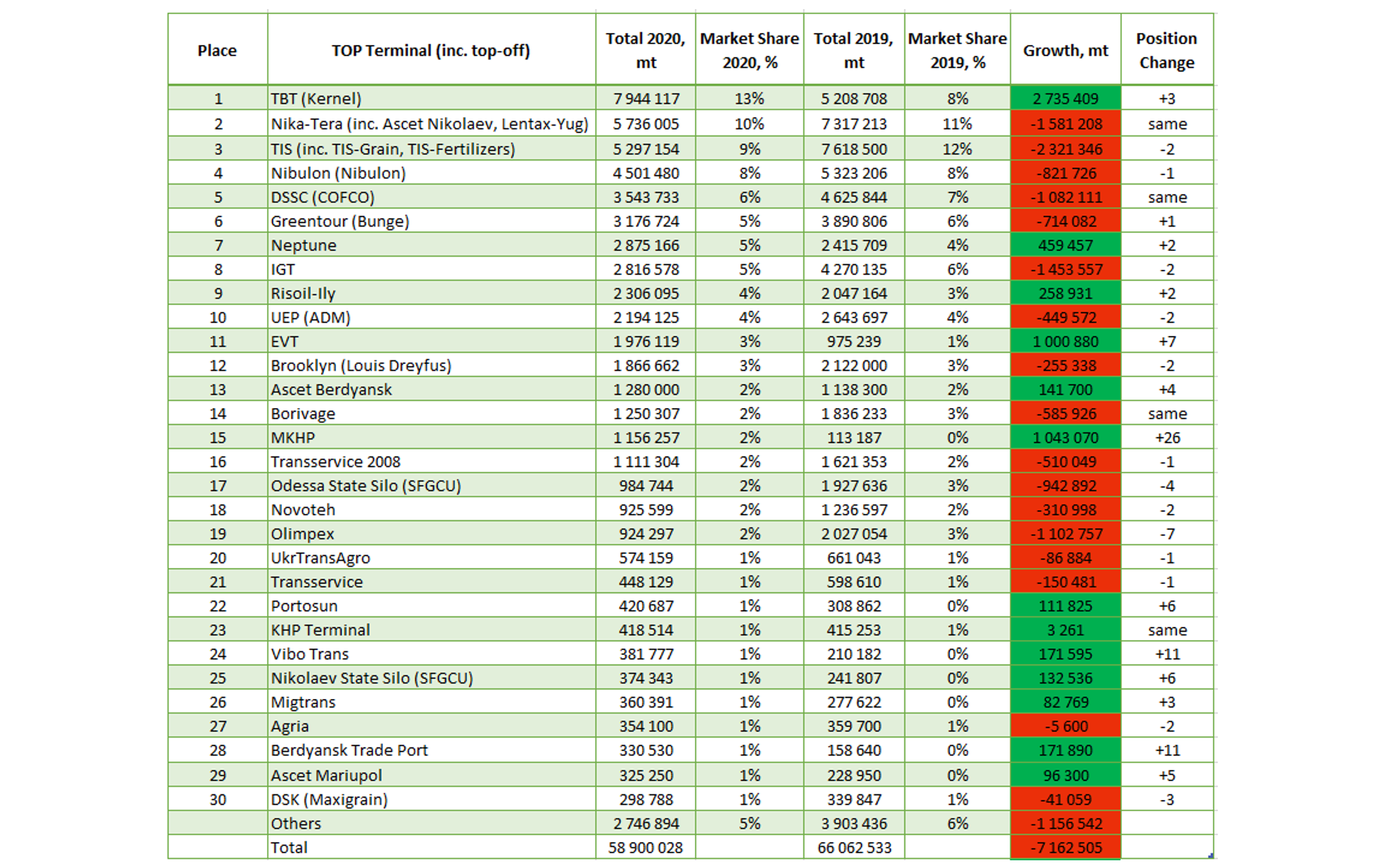

Transshipment of grain at the terminals at the berth

Transshipment of grain at the terminals at the berth + STS (barges at the berth and at the roadstead)

The calculation took into account the volumes of grain crops transshipment (corn, wheat, barley, rapeseed, soybeans, peas, sunflower seeds, sorghum, malt, rye, alfalfa, millet).

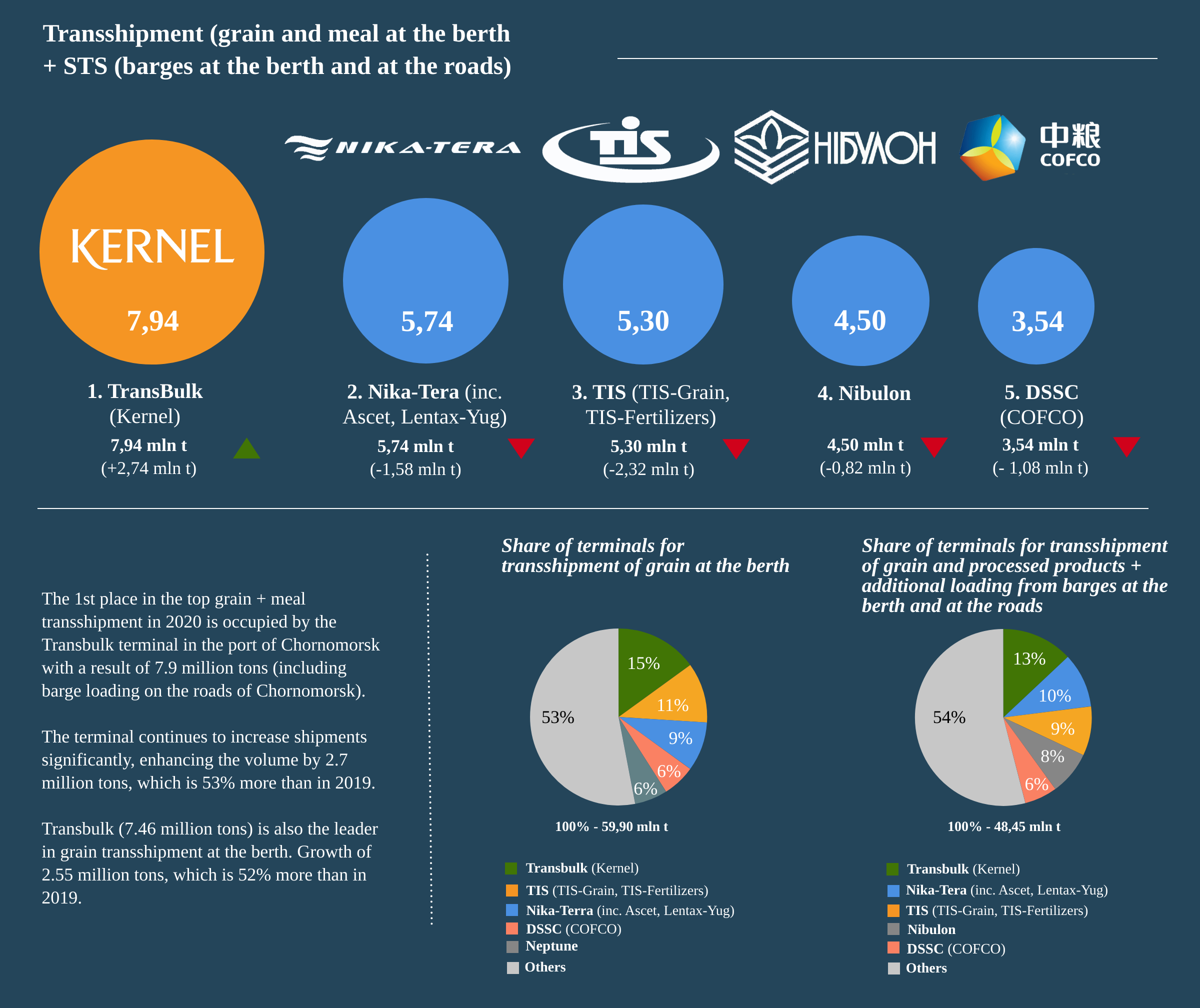

Transbulk, the group of such terminals as TIS, Nika-Tera, DSSC and Neptune made it to the top five in terms of transshipment volumes at berths.

Transbulk increased transshipment volumes by 2.7 million tons, compared to 2019. TIS showed the most significant decline (by 2.3 million tons). Nika-Tera ranks third in the rate of fall in grain transshipment: the company’s performance decreased by 1.8 million tons.

EVT terminals, as well as MKHP of POSCO group (+ 1.04 and 1.02 million tons, respectively) are among the terminals that did not get into the top five, but were able to significantly increase transshipment. The latter was able to rise by 17 points in the general list of terminals.

Significant decreases in transshipment volumes at berths were recorded at IGT (- 1.48 million) and Olimpex (- 1.07 million tons) terminals. Nibulon, in turn, was able to compensate for the drop in transshipment at berths by 1.43 million tons by increasing STS shipments.

The general rating of transshipment at berths + STS

If we take into account the general rates of transshipment at berths and STS (from barges at berths and at the roads), the final list of leaders looks a little different. Nibulon rises to the fourth place in the TOP-5 of grain terminals, which transshipped 4.5 million tons of grain by the STS method. Although, compared to 2019, the company’s results deteriorated by 821 thousand tons, this did not prevent it from taking its place among the leading terminals of Ukraine.

Apart from Nibulon transshipment rates, the overview of the STS market remains the same in terms of growth and decline. Transbulk, TIS and Nika-Tera retain the lead in terms of grain transshipment at berths and the STS method. Together with the Nibulon and DSSC terminals, the top five accounted for 48% of the total grain transshipment market.

1st place

The 1st place in the TOP terminals in terms of transshipment volumes in 2020 is occupied by the Transbulk terminal in the port of Chornomorsk, owned by the Kernel. Transbulk continues to significantly increase its shipments, increasing its volume by 2.7 million tons (or 54%) compared to 2019.

The result of the terminal for transshipment, including additional loading by barges on the roads of Chornomorsk, is 7.6 million tons, or 14%, of the market volume. Thus, Transbulk not only reached the desired mark, but also exceeded the volumes it planned for 2020.

A significant contribution to transshipment was made by a new asset – Transgrainterminal, launched in 2020 at berths 14 and 15. During the year, the terminal was integrated into the company’s port infrastructure.

One of the important competitive advantages of the Transbulk terminal is the stake on the large-tonnage fleet (Ultramax and Supramax Cargo vessels) loader. Kernel prefers to ship vessels off with a deadweight of 50 to 85 thousand tons. The average shipment is 43.6 thousand tons.

A record growth in transshipment was also ensured by the modernization of the terminal’s facilities. The complex and organizational measures at Transbulk contributed to an increase in the rates of discharge of grain from road and railway transport, receiving grains rhythmically and stable and optimizing the possible detentions. Optimization of processes, the correct distribution of routes within the terminals, an increase in the efficiency of the port, road and rail infrastructure, as well as road reconstruction and modernization allow Transbulk to increase its transshipment capacity annually by about 1 million tons: over the past three years, the company’s cargo turnover has grown by 60%.

The policy of Kernel has also become an important point in increasing the transshipment of Transbulk. In 2020, the company switched to a strategy of centralizing exports at its own terminal and redirected grain flows to Transbulk, which had previously been transshipped at other facilities, in particular, at the terminals of the TIS.

97% of Transbulk transshipment operations in 2020 were carried out at the berths, another 3% fell on additional barge loading on the roads of the port of Chornomorsk. The main crop transshipped at the terminal is corn, which accounts for 71% of the volume. Wheat accounts for 22% and barley 7%. The share of corn in the terminal’s transshipment has increased compared to year 2019, in line with market conditions.

2nd place

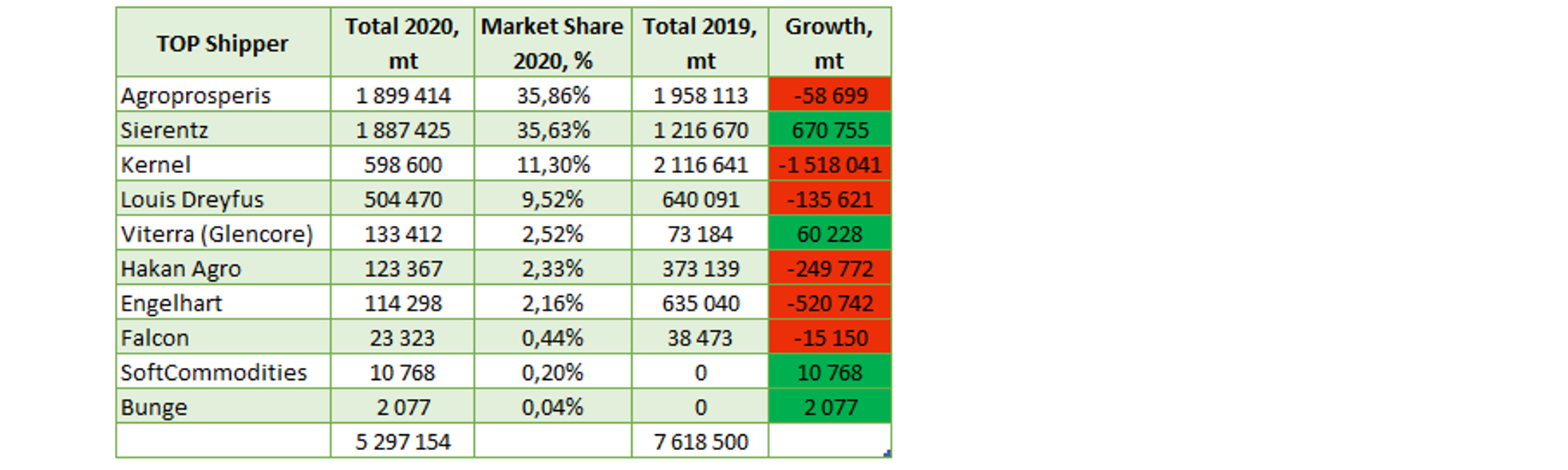

The group of TIS (including TIS-Grain and TIS-Fertilizers, as well as additional loading by barges on the roads of the port of Pivdenny) in 2020 took 2nd place in the rating of terminals, with a result of 5.2 million tons.

In 2020, the TIS terminals shipped 2.3 million tons of grain less than in 2019: with TIS-Grain – 4.5 million tons, with TIS-Fertilizers – 678 thousand tons.

Distribution of goods by terminals

The drop in transshipment volumes at TIS occurred, first of all, due to the termination of shipments of two large shippers – Kernel and CHS.

In 2020, Kernel reduced shipments from TIS by 3.5 times, concentrating all cargo at the Transbulk terminal. As a result, TIS lacked tangible 1.5 million tons of grain.

CHS has completely stopped shipments from TIS, distributing its cargo traffic through the Neptune (MV Cargo) and Nika-Tera terminals. For the TIS, the transfer of the shipper to these terminals resulted in the loss of another 860 thousand tons of freight traffic.

Agroprosperis (1.8 million tons) and Sierentz (1.8 million tons) shipped the largest amount of grain from TIS (71.5% of the total cargo turnover). At the same time, Sierentz increased transshipment volumes by 670,755 tons.

Kernel retained a part of shipments through TIS in the amount of 598 thousand tons, Louis Dreyfus provided another 504 thousand tons.

TIS shippers rating

The most TIS terminals handled in 2020 is corn – 45.2% of the total transshipment volume. Wheat occupied 29.06%, barley – 20.1%, soybeans – 4.01%, rapeseed – 1.4%, legumes – 0.24%.

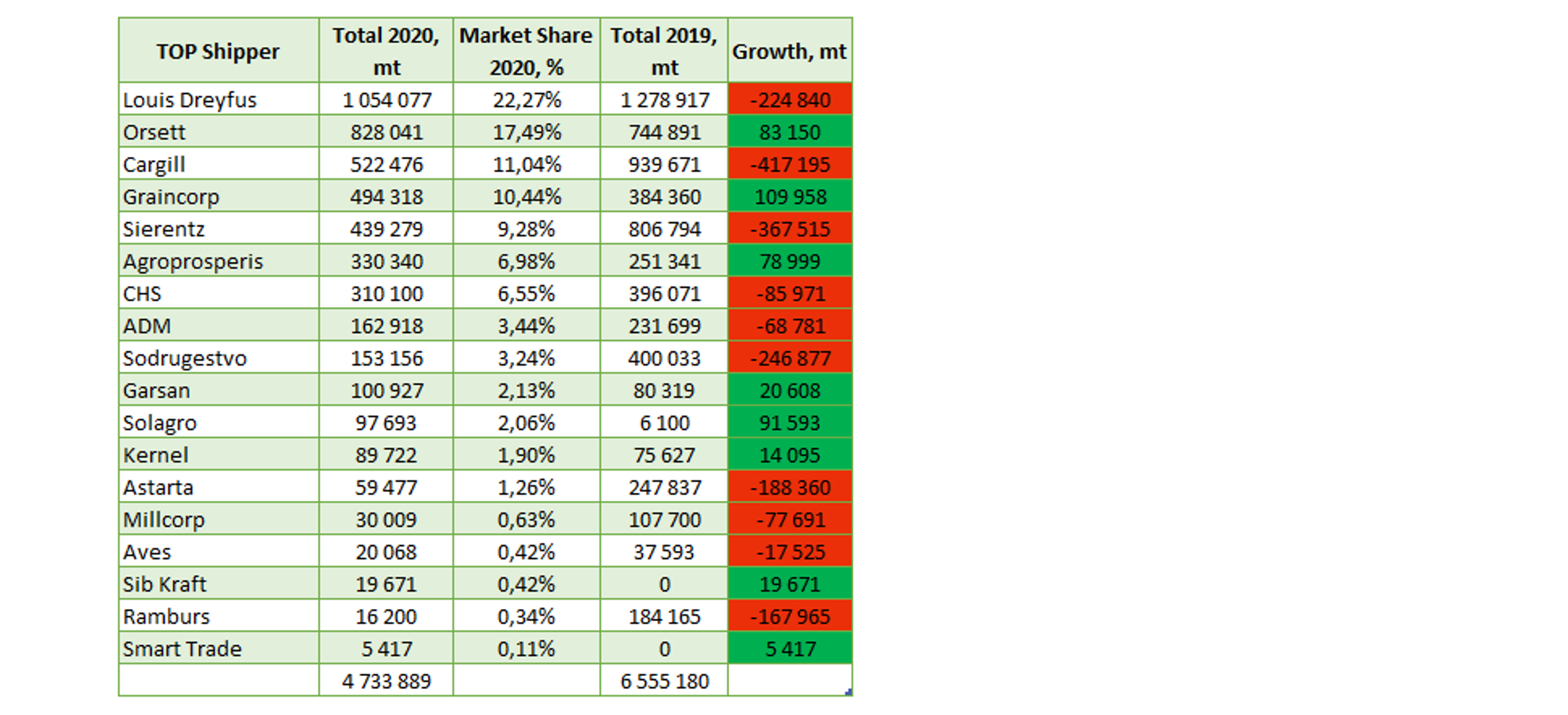

3rd place

Nika-Tera terminal ranks 3rd in the rating of terminals. In total, 4.7 million tons of grain were exported from the terminal, which is 1.8 million tons less than in 2019. This figure includes cargo from the Ascet and Lentax-Yug terminals, as well as additional loading by barges at the Trutaev bank. In particular, 258 thousand tons of grain, or 5.45% of the total turnover of the terminal, were transshipped using the STS method.

Distribution of goods by terminals

Louis Dreyfus, Orsett and Cargill are the shippers that exported the most grain from Nika-Tera, accounting for 50.8% of the terminal’s grain shipments. At the same time, Cargill showed the largest reduction in shipments: shippings decreased by 417 thousand tons. Louis Dreyfus, the main shipper of the terminal, has reduced transshipment volumes by 225 thousand tons.

In 2020, Sierentz, Sodrugestvo and Astarta shippers have significantly reduced the volume of shipments through the terminal.

The Bunge company, which shipped 172 thousand tons of grain through Nika-Tera in 2019, did not work at the terminal in 2020. It should be noted that the 2019 shipments were Nika-Tera’s first collaboration with Bunge in four years and, given 2020, this episode can be called an exception rather than a long-term relationship.

Nika-Tera terminal shippers rating

Wheat was the leading crop at the terminal in 2020, accounting for 53.94% of grain handling volumes. corn provided 32.1% of shipments. In addition to the two main export crops, Nika-Tera shipped barley (8.5%), soybeans (5.12%) and legumes (0.33%).

4th place

The Nibulon terminal shipped 4.5 million tons of grain in 2020 (including loading at the Trutaev bank), and took 4th place in the ranking. At the same time, the terminal’s shipments decreased by 821 thousand tons, compared to the results of 2019.

In 2020, Nibulon continued its strategy of increasing barge loading and reducing road traffic. The company actively used additional loading of vessels on the roads of Ochakov, and for the first time the volume of grain loaded by barges exceeded the volume of shipments at berths: 3.4 million tons (77% of shipments) versus 1 million tons (23% of shipments). Such successes were achieved, inter alia, due to the use of the new self-propelled floating crane NIBULON MAX with cargo holds in 2020.

Wheat turned out to be the main crop at the Nibulon terminal, with transshipment volumes of 41.05%. Corn lagged slightly behind – 36.3%. Barley accounts for 13.6% of grain handling, rapeseed – 7.36%, sorghum and sunflower – 1% each, soybeans – 0.27%.

Other rating terminals

Among other terminals, which are included in the list of the largest in terms of transshipment volumes, the following are worth noting.

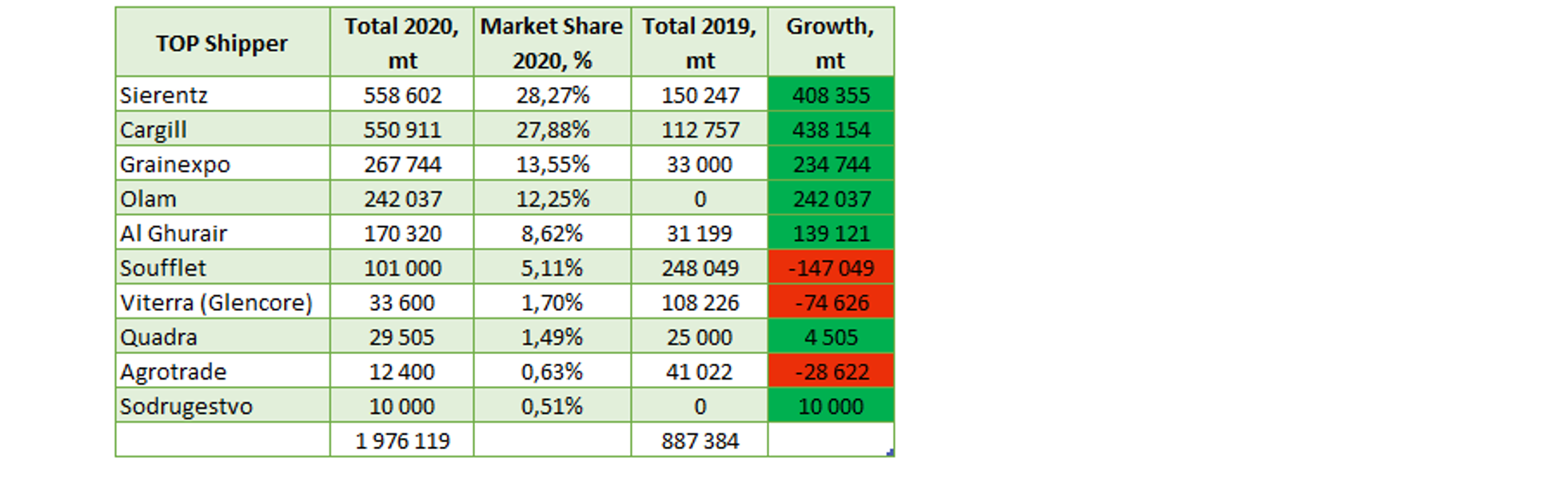

Evrovneshtorg terminal has shown good growth in 2020. The company shipped almost 2 million tons of grain – about 1 million tons more than in 2019, and rose by 7 points in the ranking, taking 11th place.

Distribution between loading at berth and from barges

96.67% of grain cargo was handled at the terminal berths, another 3.33% fell on additional loading from barges.

The largest amount of grain from the terminal was shipped to Sierentz (558 thousand tons) and Cargill (551 thousand tons).

Grainexpo in 2020 significantly increased the volume of grain transshipment at the terminal – 267 thousand tons, compared to 33 thousand tons in 2019. Olam started work with Evrovneshtorg: the shipper shipped 241 thousand tons of grain through the terminal (at the berths and at Trutaev’s bank).

Shippers rating of Evrovneshtorg terminal

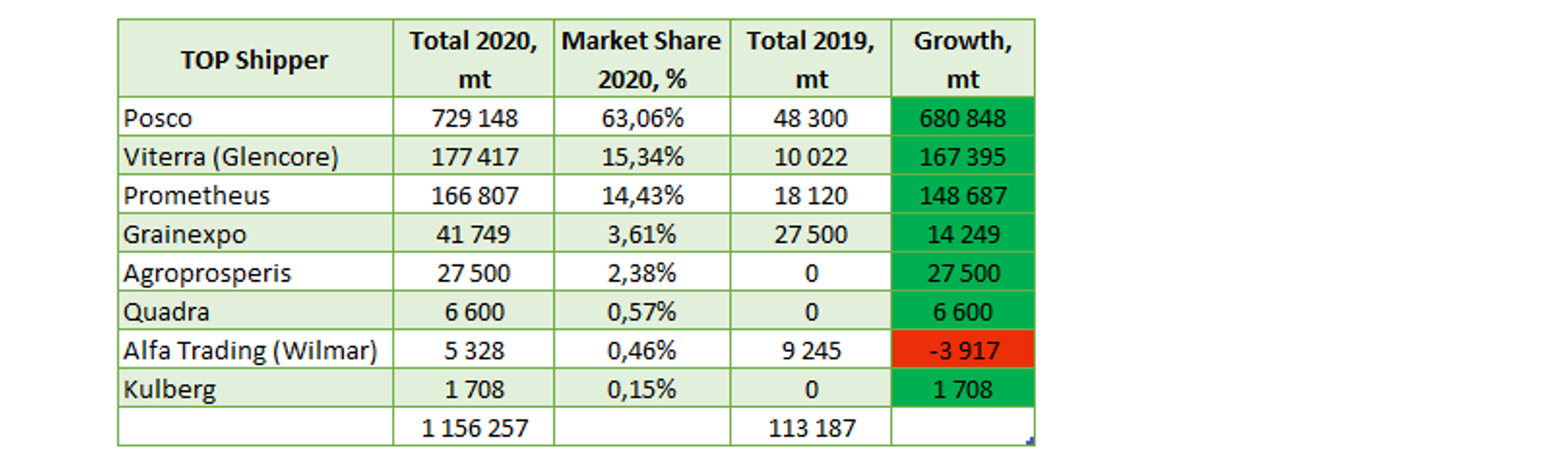

Terminal MKHP (POSCO) – last year’s debutant among the Mykolaiv grain terminals. The terminal was put into operation in September 2019, and in 2020 the company summed up the results of the first season and the first full year of operation.

At the end of the year, MKHP ranked 15th in the ranking, with the result of 1.15 million tons of grain transshipment. 98% of the grain (1.13 million tons) was shipped from the terminal berths, 1.85% (21 thousand tons) – from barges using the STS method.

Distribution between loading at berth and from barges

In addition to the main shipper Posco, which provided 63.06% of transshipment (729 thousand tons), the terminal also operates Viterra (provided 177 thousand tons of transshipment) and Prometeus (166 thousand tons).

MKHP terminal shippers rating

Most of all corn handled at MKHP in 2020 is 44% of shipments. Another 40% was wheat, 15% – barley, and 1% – soybeans. Mainly Handysize and Handymax vessels were used for shipment at the terminal.

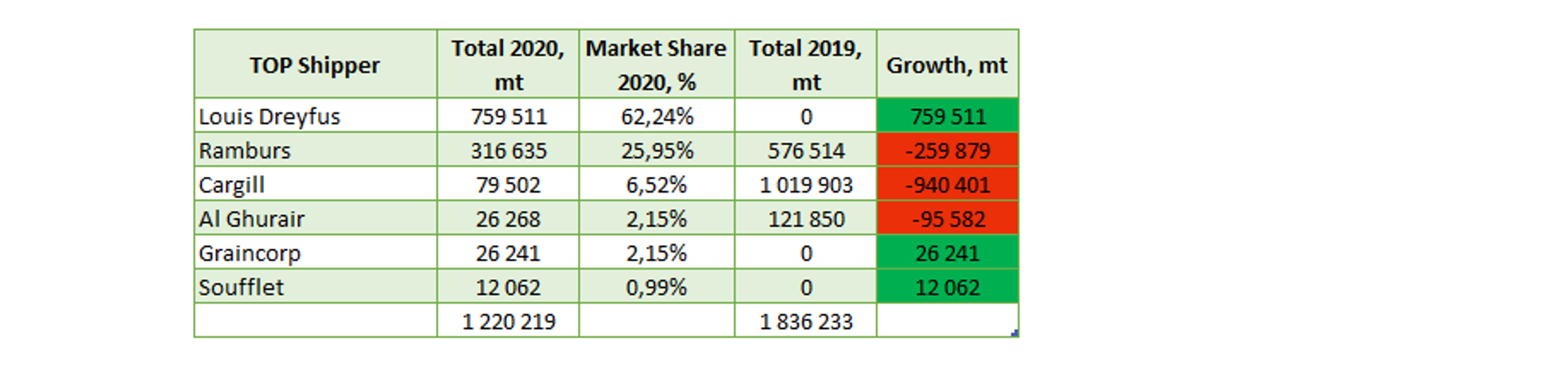

Borivage terminal in 2020 increased its lead by one point, and was in 13th place with a result of 1.2 million tons, despite a drop in transshipment volumes by 597 thousand tons.

The transshipment volumes were influenced by significant changes among the shippers working at the terminal. Borivage lost two major shippers in 2020. The shipper Cargill, which provided Borivage with a volume of cargo in the amount of 1 million tons at the end of 2019, stopped working at the terminal. Now in Yuzhny the company uses only the services of the Neptune (MV Cargo) terminal. In 2019, at Borivage, Cargill transshipped only 79.5 thousand tons of grain. In July 2020, he was replaced by a new shipper for the terminal – Louis Dreyfus, who managed to export 759.5 thousand tons of grain in 6 months.

Al Ghurair shipper also redirected their shipments. In general, the shipper has reduced shipments from the Port of Pivdenny in favor of the terminals of the Port of Mykolaiv, and now instead of Borivage uses the capacities of Evrovneshtorg and Nikmorservice.

Shippers at Borivage Terminal

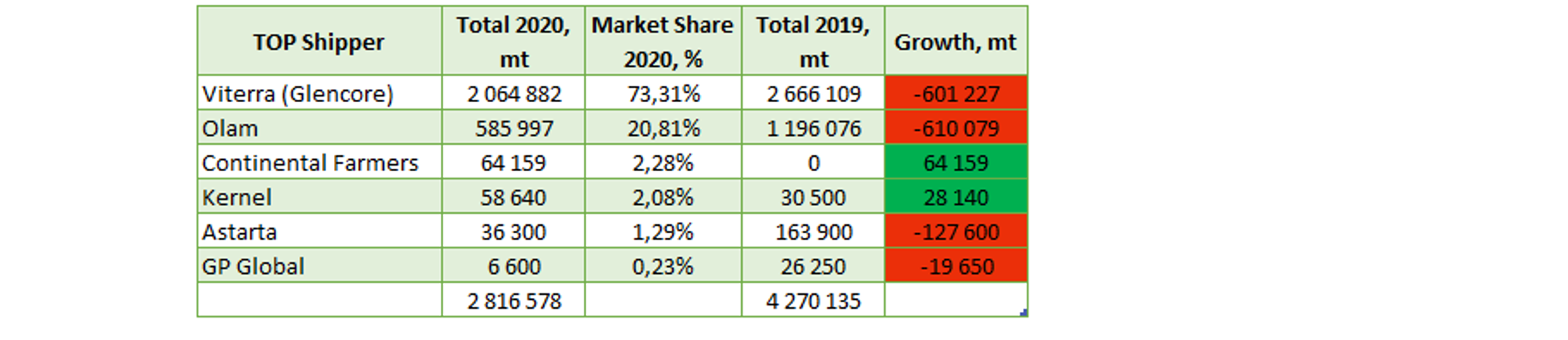

The IGT terminal in Chornomorsk took the 7th line of the rating with a result of 2.8 million tons, dropping one position in 2020. The volume of grain shipments from the terminal decreased by a tangible 1.4 million tons.

In 2020, Agroprosperis, which had transshipped 187 thousand tons of grain on IGT a year earlier, left the terminal and started working with Neptune (MV Cargo), shipping 209 thousand tons.

Olam has reduced shipments through its IGT terminal by 610,000 tonnes. In addition to IGT, it now also operates through Neptune (671,000 tonnes) and Evrovneshtorg (242,000 tonnes).

The transshipment volumes of the main shipper of the terminal, Vittera, also fell by 601 thousand tons.

Shippers at IGT Terminal

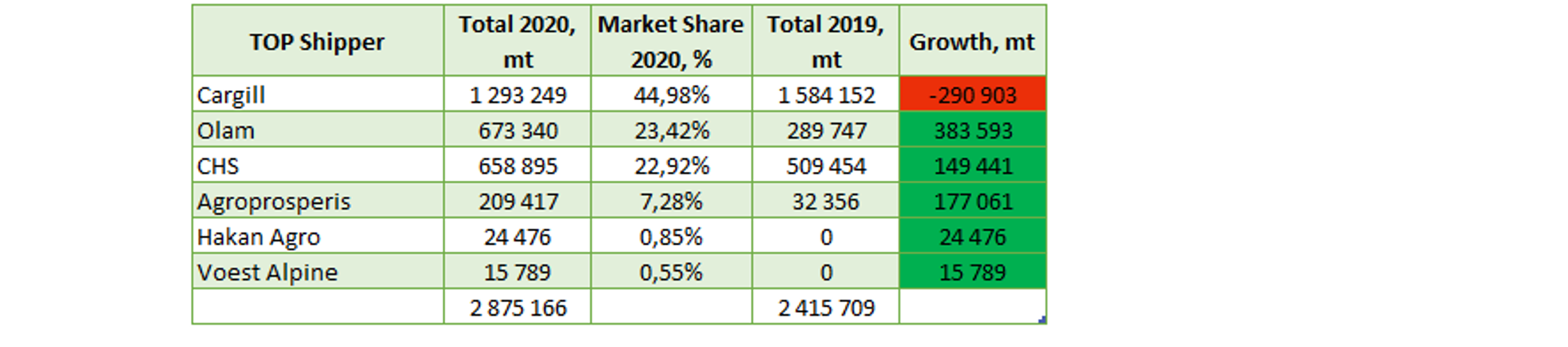

The Neptune (MV Cargo) terminal moved up by three positions in 2020, and with a result of 2.8 million tons took the 6th line in the overall ranking of grain transshipment. The growth in the terminal’s transshipment amounted to 459.5 thousand tons.

The main shipper of the terminal is its co-owner Cargill, which provided 44.9% of grain shipments in 2020. Last year, the company, inter alia, redirected freight traffic from the Yuzhny Borivage terminal to Neptune.

Last year, Agroprosperis and Olam shippers began to actively work with Neptune.

Shippers at Neptune Terminal

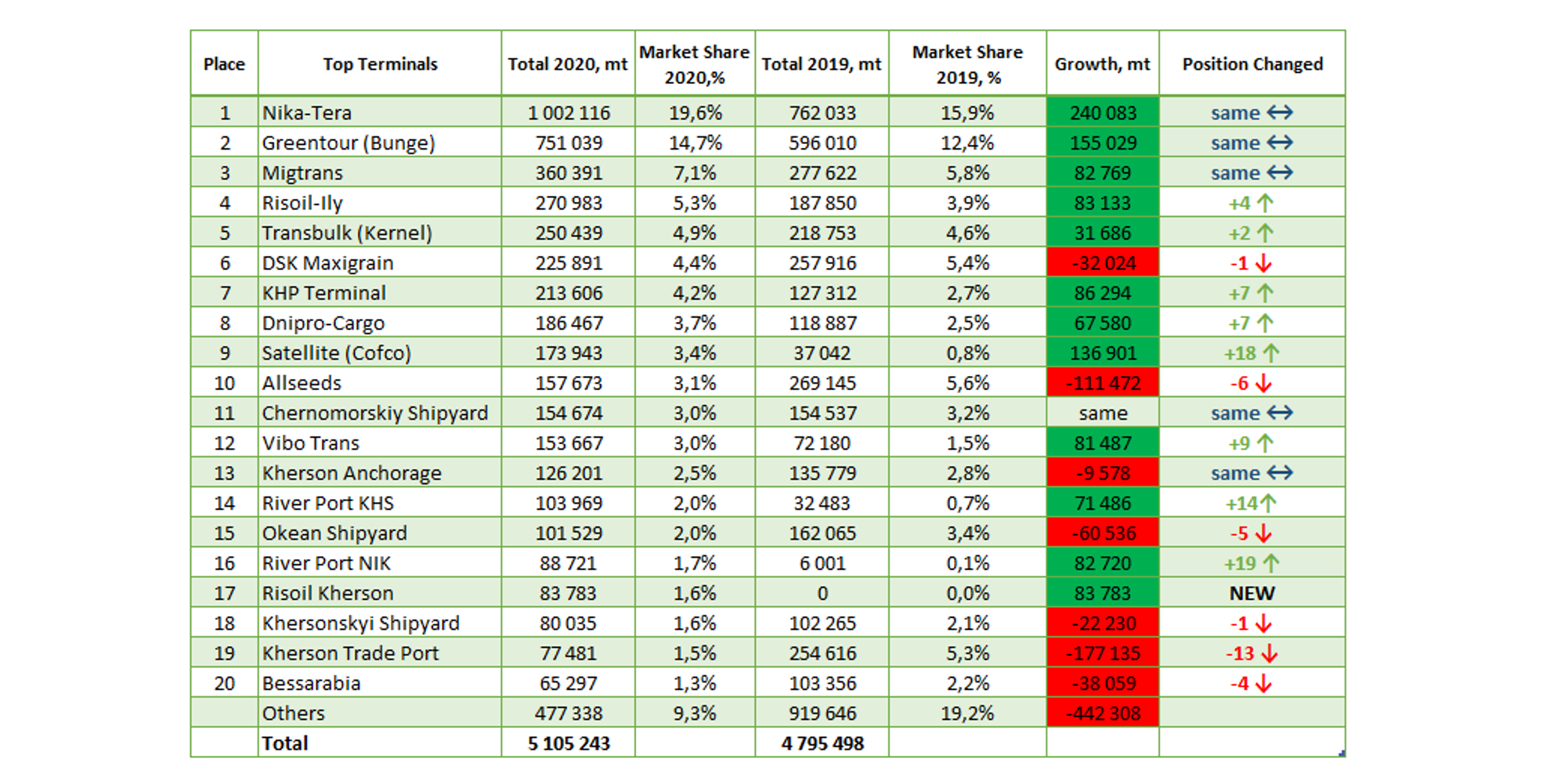

Rating of terminals for transshipment of flakes, bagasse and processed products

When calculating the rating, the volumes of transshipment of meal, cake (flakes of sunflower, soybeans, rapeseed) and processed products (wheat bran, corn, pea, corn feed, sunflower husk, soybeans husk, beet pulp, brewer’s grain) were taken into account.

TOP-3 terminals for transshipment of meal, cake and processed products has remained unchanged since 2019.

In the rating of transshipment leaders, the Nika-Tera terminal is consistently occupying the 1st place, which shipped from the berths + STS, 1 million tons of cargo (meal / cake + bran) in total. The number of cargo that was handled increased by 240 thousand tons compared to 2019. STS-transshipment in the total volume amounted to 107.6 thousand tons – 1.07%.

The Greentour and Migtrans terminals also occupy the 2nd and 3rd places in this calendar year, respectively. Both terminals showed an increase in transshipment compared to 2019. Greentour transshipped 751 thousand tons of processed products, which is 155 thousand tons more than in 2019. 40.04% of those (300.7 thousand tons) were loaded using the STS method. The terminal loads barges for additional loading of vessels both at its own berth and at the outer roads of the Port of Mykolaiv.

Migtrans terminal, which handled 360 391 tons of cargo concludes TOP-3.

Risoil-Ily managed to move up to 4th position in the ranking. In 2020, the terminal transshipped 271 thousand tons of processed products, which exceeds the number for 2019 by 83 thousand tons.

The Transbulk terminal, which is the leader in grain handling, took 5th place in terms of transshipment of processed products with a result of 250.4 thousand tons.

Over the past 2020, Satellite (Mariupol) increased its transshipment volumes by 137 thousand tons, thanks to which it moved up 18 positions in the ranking, taking 9th place.

In the 10th place is the Allseeds terminal, which this year dropped immediately by 6 positions, having processed 157.6 thousand tons (111.4 thousand tons less than in 2019).

The River Port Kherson terminal significantly increased its transshipment – from 32.4 thousand tons in 2019 to 104 thousand tons in 2020. This allowed it to rise 14 positions in the ranking and take 14th place.

The River Port NIK showed a similarly significant increase in transshipment. With the result of 88.7 thousand tons, it rose 19 positions and took 16th place in the rating.

The rates declined at the Pallada Shipyard terminal in 2020. Having reduced the transshipment volumes by 132.6 thousand tons, the terminal dropped down by 11 positions, taking the 18th line in the rating of terminals for transshipment at berths. Taking into account STS the terminal did not enter the top twenty of the overall transshipment rating,.

Also, the transshipment volume of Fish Port of Chernomorsk decreased significantly in 2020 – 59.6 thousand tons, compared to 139 thousand tons in 2019.

Overall rating of terminals for transshipment of grain, meal, cake and processed products. Transshipment of terminals at the berth + STS (barges at the berth and at the roads)

The calculation took into account the transshipment volumes of grain, meal, cake and processed products.

The 1st place in the TOP of terminals in 2020 is occupied by Transbulk in the Port of Chornomorsk, with a result of 7.9 million tons (including additional barge loading on the roads of Chornomorsk), or 13% of the market volume. The terminal continues to significantly increase shipments, increasing the volume by 2.7 million tons.

The company shipped 7.7 million tons of grain and 250 thousand tons of flakes.

Nika-Tera terminal takes 2nd place in the rating of terminals. The terminal exported 5.7 million tons (including cargo from the Ascet and Lentax-Yug terminals, as well as additional barge loading at the Trutaev Bank). This figure is 1.5 million tons less than last year.

The company shipped 4.7 million tons of grain and 1 million tons of meal.

The third place is taken by the TIS group (including TIS-Grain and TIS-Fertilizers, as well as loading by barges on the roads of the Pivdenny port) with the result of transshipment of 5.3 million tons. In 2020, TIS terminals handled only grain, and showed the most significant drop in transshipment of all the companies in the rating – 2.3 million tons.

The Greentour terminal shipped 3.1 million tons in 2020 (including loading on Trutaev’s bank) and ranks 6th. The terminal shipped 714 thousand tons less than in 2019. The terminal shipped 2.4 million tons of grains and 751 thousand tons of meal and processed products.

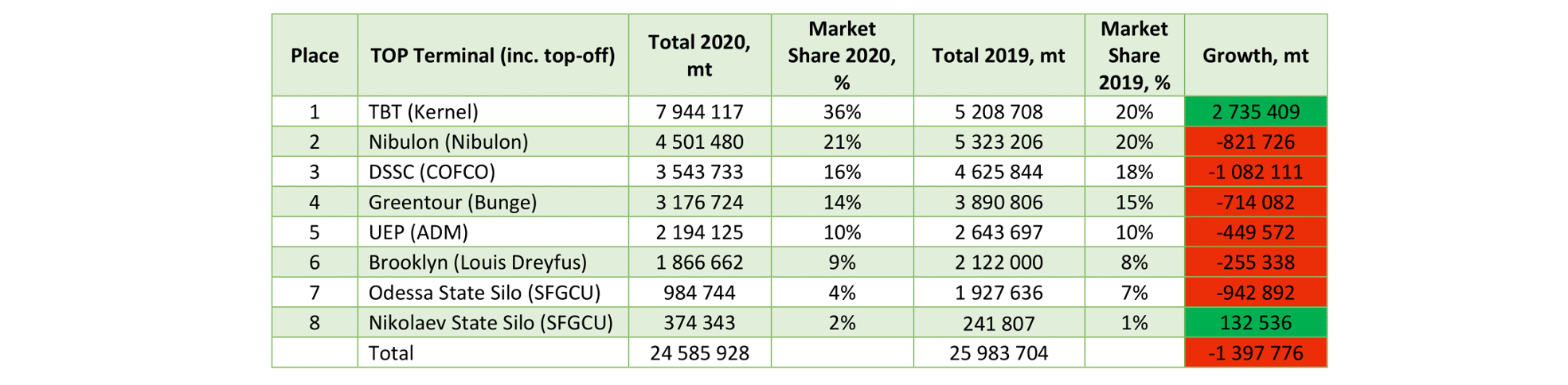

Rating of mono-terminals (owned by traders). Transshipment at the berth + STS (barges at the berth and at the roadstead)

The calculation took into account the transshipment volumes of grain, meal, cake and processed products.

The 1st place among the terminals owned by traders is occupied by the Kernel terminal – Transbulk. In 2020, Transbulk surpassed Nibulon (the leader of 2019) by exporting 8 million tons, which is 2.7 million tons more than in 2019.

Kernel is the only trader that have increased exports on its terminal. The rest of the traders who own the terminals that entered the TOP-8 have reduced their transshipment volumes in 2020. The State Food and Grain Corporation of Ukraine (SFGCU) increased its cargo turnover at its terminal in Mykolaiv, and decreased – at the terminal in Odesa, which in total is also less than in 2019.

Public terminals. Transshipment of terminals at the berth + STS (barges at the berth and at the roads)

The calculation took into account the transshipment volumes of grain, meal, cake and processed products.

In 2020, the Nika-Tera terminal, which exported 5.7 million tons of agricultural products, is the leader among the publicly accessible terminals that work with many clients-traders. Despite the fact that the terminal shipped 1.5 million tons less than in 2019, it managed to come out on top and outstrip the TIS terminal group, the leader of 2019.

TIS also cut its transshipment by 2.3 million tonnes. In 2020, grain exports amounted to 5.3 million tons.

Neptune (MV Cargo) and IGT terminals occupy the 3rd and 4th places in the rating with practically the same results. The terminals exported 2.8 million tons each. The Neptune(MV Cargo) terminal has increased its cargo turnover by 459.5 thousand tons, while exports from the IGT terminal decreased by 1.4 million tons.

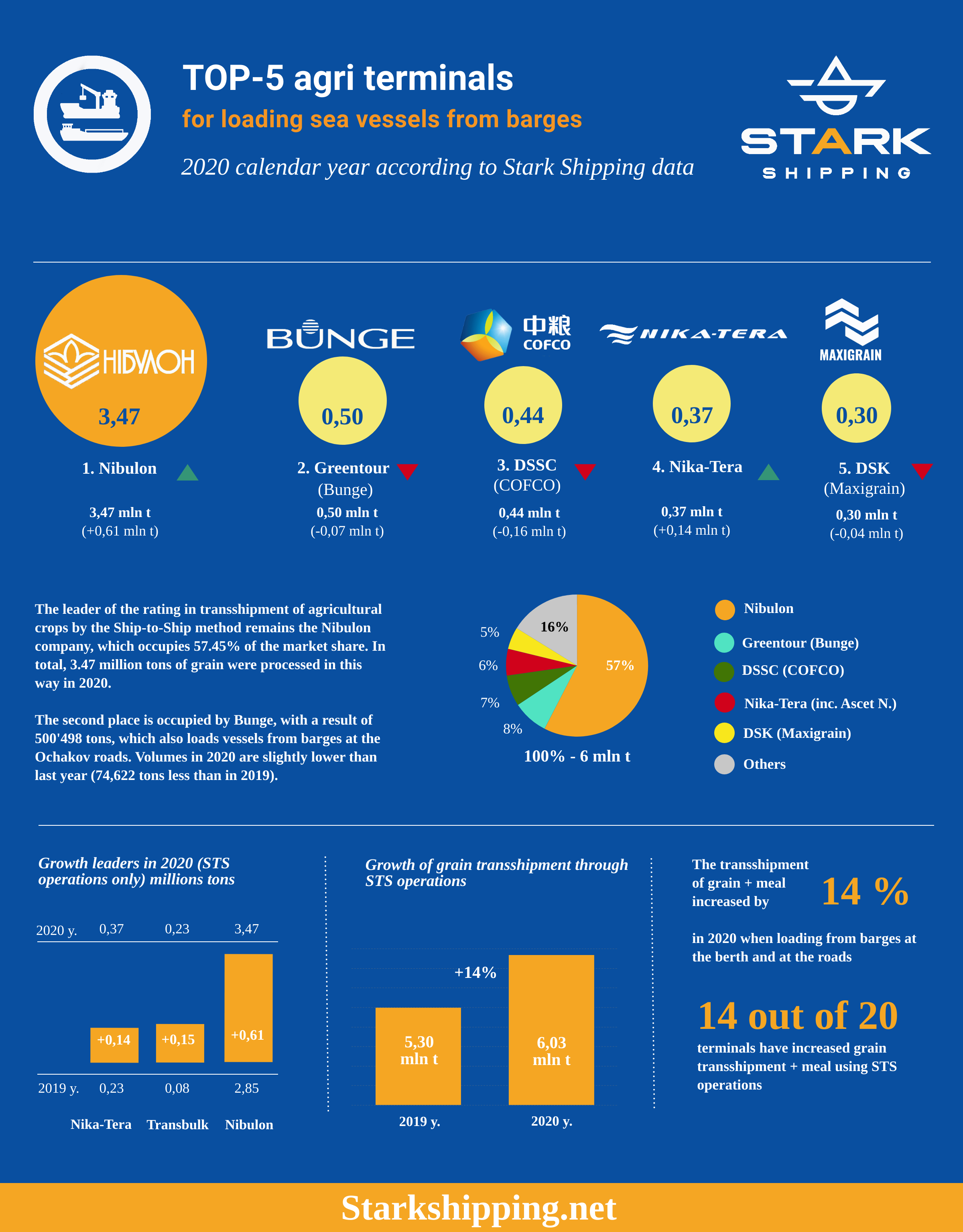

Rating of terminals for transshipment of grain, meal, cake and processed products. STS operations only (loading by barges at the berth and at the roadstead)

The calculation took into account the transshipment volumes of grain, meal, cake and processed products.

The Nibulon, which occupies 57.45% of the market share, stays at the leading positions in the transshipment of agricultural crops by the ship-to-ship method. Thus, in total, 3.4 million tons of grain were processed in 2020.

The second place is taken by Bunge, with a result of 501 thousand tons, which also loads vessels from barges in the Ochakov roads. The indicators for 2020 are slightly lower than last year’s (74.6 thousand tons less than in 2019), but this still allows the Greentour terminal to occupy a top position.

The rating of the largest terminals for transshipment by the ship-to-ship method is concluded by the COFCO company: for the entire 2020, the terminal managed to transship 442.8 thousand tons.