Ukrainian waters made the list of “potentially dangerous”: will there be consequences?

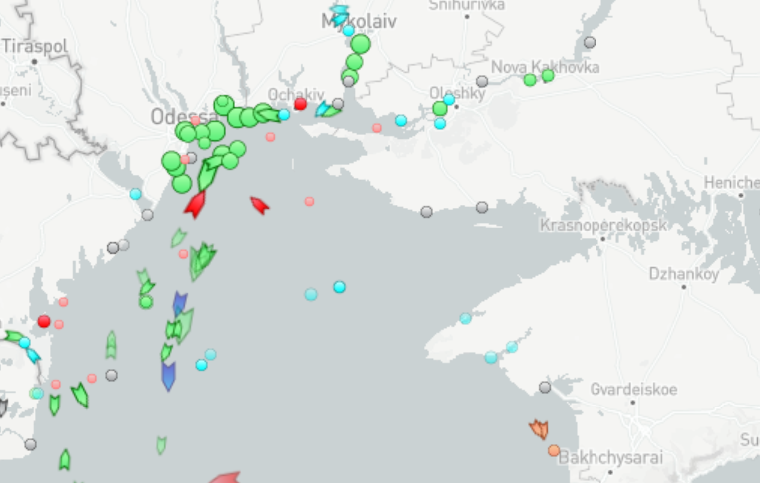

The Association of Insurers from London (which includes many of the largest insurers) has included Ukrainian waters in the Black and Azov Seas in the list of potentially dangerous areas for shipping. USM talked to a London-based insurer to find out how this will affect freight rates and whether it will affect cargo turnover at Ukrainian ports.

It all started when the Lloyd’s Market Association published Circulaire JMLA-028 on February 15th. It follows from the document that “Ukrainian and Russian waters in the Black and Azov Seas” were included in the list of potentially dangerous areas for navigation.

For the first time in the entire independence of Ukraine, our coastal waters have become on a par with the “pirate” areas: the Gulf of Guinea, Togo, Nigeria, Somalia, as well as some areas of the Persian Gulf. Moreover, the Ukrainian waters in this Circulaire are the only ones from Europe.

To understand how this precedent will affect the Ukrainian shipping industry, USM addressed to Heorhii Hrishyn, PhD, ACII and President of Oakeshott Insurance Group.

According to Hrishyn, the inclusion of Ukraine in this list is far from a scandal, but the normal operation of the insurance market.

“There are two or three types of insurance in marine insurance. One is war risk insurance. And so it happens that London is the legislator in this kind of insurance. There’s the London Joint War Committee on Naval War Risk Insurance, which decides which areas are high risk. It meets once every six months, as the situation changes,” Heorhii Hrishyn explained.

The analyst noted that the Black Sea ports are included in the list of these zones for the first time in the history of the Committee. Of the countries close to us – there was Georgia (in 2008-2013), Abkhazia (in the 90s), but there have never been Ukrainian ports.

“The timing of the introduction is a bit strange. A similar example could be observed in the Ukrainian aviation market. But in that case, the insurers had calmed down by February 15th, while in the maritime sector, on the contrary, everything had just begun.

It turns out that the Joint War Committee met in London on February 15th and decided that Ukrainian waters are a dangerous zone. I would understand if Ukraine was added to the list a few days earlier.”

In addition, Hrishyn notes, leaving the list of potentially dangerous zones is much more difficult than getting into it. For example, in Georgia the war lasted only a week, in August 2008. But the waters of the country were removed from the list only in March 2013.

Answering a USM question about the timing of Ukraine’s inclusion in the list, Heorhii Hrishyn noted that “we can get stuck for a long time.”

“This is some kind of unfriendly decision, it’s hard to even comment. I have always been proud that the Black Sea, despite what is happening, was considered more or less peaceful. Even Crimea has never been entered into a high-risk zone since 2014. Of course, the insurers read their English newspapers, in which the situation was escalated to the limit, especially on February 14th-15th. I think the tone of the media field has greatly affected the decision of London,” said Hrishyn.

But let’s get back to the point – this situation will undoubtedly stimulate the growth of freight rates for the transportation of goods to/from Ukrainian ports. After all, shipowners will include in their rates additional costs for insurance of war risks.

And the first case was not long in coming. Hennadii Ivanov, Head of BPG Shipping & Kronos Bulkers, told about the first example of a vessel call that received a $2,500 insurance premium.

Heorhii Hrishyn noted that inclusion in the Lloyd’s Market Association Circulaire really raises the cost of shipping — but not much, because vessels continue to sail to Ukrainian ports.

“Although this list is valid “for the whole world”, but we already find insurance companies that understand that the risk is not really significant. This will be comparable to the risk of a vessel calling at Israel, maybe even less – and the extra charge for calling at Israel is not gigantic.

In general, a lot depends on the shipowner and the owner of the cargo. On how they relate to the news and how they understand the real situation. After all, some people will just ignore the insurers, and some won’t go without extra insurance.”

Hrishyn noted that now it is more like ordinary volatility.

“Let’s just hope that nothing more terrible, political and military, will happen. Of course, there is a slight increase. But if there is peace, which we all want, then everything will work out,” Heorhii Hrishyn summed up.

Heorhii Hrishyn, PhD, ACII and President of Oakeshott Insurance Group. Author of the book on insurance “One should go to sea with a policy in his hand”.