What was happening to the oil this summer?

Tomorrow, on September 1st, an OPEC+ members meeting will take place. It depends on the new meeting whether oil production will remain at the same level or decrease. And, of course, this will affect the tanker fleet.

USM tells what was happening to the oil market in the hot summer of 2021.

June

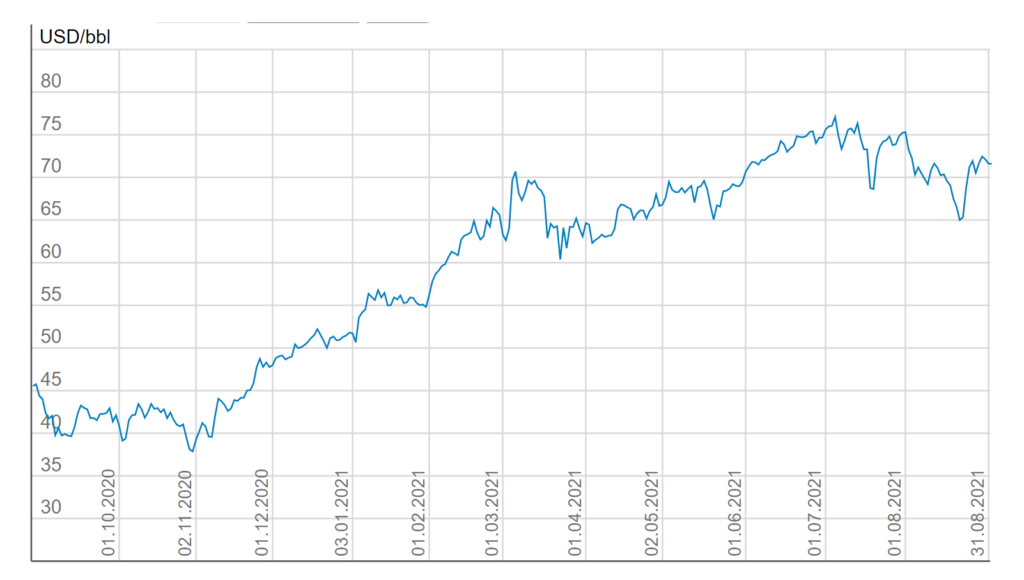

In June, the May “sluggish growth” of oil prices gave way to a strong rally. The price of Brent oil in June soared by 5.9% to $74.53 per barrel, reaching price ceilings in 2018 and did not secure a footing above $75. And the price of Texas WTI in June increased by 7.9%, having risen in price to $73.16 per barrel.

The meeting of the ministers of the countries participating in the OPEC+ agreement, scheduled for July 1st, did not take place. The United Arab Emirates refused to vote on a proposal to increase oil production unless their alternative proposal was accepted. The UAE has offered to increase oil production only under condition of refusal to extend the OPEC+ deal after April 2022.

At the same time, the UAE Ministry of Energy has considered that the risk of an increase in oil exports by Iran (by 2 million b/d) is quite high. In this regard, a significant increase in production by the members of the alliance may lead to both the loss of market shares by other OPEC and OPEC+ members, and to a new collapse in prices. The UAE’s opinion was supported by Iraq and Mexico.

Another opinion came: on June 29th, at a scheduled meeting of the OPEC+ technical committee, a forecast of a possible oil deficit in 2021 of 1.1 million b/d was published. The UAE and some members of the alliance has ignored this forecast and the OPEC+ ministerial meeting was postponed.

A number of media outlets has noted that the obstruction of the meeting of the OPEC+ countries was influenced by the statement of representatives of the US presidential office that the United States would not allow a sharp increase in oil prices.

“Such statements from the White House unequivocally hint that political pressure could be exerted on the UAE, Iraq and, possibly, on some other members of the OPEC+ alliance,” the media wrote in June.

There were no objective prerequisites for disagreements in OPEC+: for example, in May, the alliance members fulfilled the oil production plan by 125%.

The increase in oil prices in June, as reported in the monthly OPEC report, was facilitated by a collapse in oil and petroleum product inventories in the OECD (Organization for Economic Cooperation and Development) countries below the five-year average; and news about the closure of the Keystone XL pipeline from Canada to the United States.

Analysts has reacted differently to the disruption of the OPEC+ meeting. Some of them suggested that by the beginning of September, Brent oil could increase in price to $80 per barrel, if OPEC+ does not agree on an increase in production. Other analysts reckoned up that by 2022 Brent price will rise up to $100 per barrel due to investments reduction in oil production and a simultaneous increase in demand for oil.

“We believe that a price movement of Brent oil to $100 is more likely than a move back to $40 a barrel. In our opinion, the reasons are related not only to fundamental factors, but also to the position of the UAE. They are probably tired of being “in the shadow” of Saudi Arabia in terms of OPEC and OPEC+, to reduce production, and hence budget revenues,” said Bank of America analysts.

Another of the June “highlights” – in the United States, the court lifted the ban of President Joe Biden on the exploration of new areas. In addition, the US Department of Energy in June has raised its forecast for oil production in the country in 2021 by 20 thousand b/d to 11.1 million b/d. And the lifting of sanctions by the United States in June against some influential officials of the Iranian oil ministry has become a factor that slightly restrains the growth of the oil market.

In general, in June, analysts predicted that Brent would rise in price to $100 by 2023.

July

In July, the increase in oil prices has stopped. An uncertain decrease followed. The price of Brent in July decreased by only 0.53% to $74.9 per barrel, although during the month it rose above $75 more than once. The price of Texas WTI in July decreased slightly more, by 1.5%, to $73.28 per barrel.

In July, the meeting of the OPEC + countries was supposed to take place on the first day of the month, but postponed for several days, and as a result remained undone. The United Arab Emirates demanded special conditions for themselves, threatening to vote against the extension of the agreement after April 2022.

However, the break in OPEC+ meetings did not last long. After negotiations between Russia and Saudi Arabia with the dissenting member states of the alliance, the meeting nevertheless took place on July 18th.

As a result, the OPEC+ countries has decided to increase oil production by 400 thousand barrels per day from August 1st until the end of the year. The meeting on July 18th also made a unanimous decision to extend the OPEC+ deal until the end of 2022.

The deal took place due to the fact that the alliance gave in to some participants – the UAE, Iraq, Kuwait, as well as Russia and Saudi Arabia, softening for these countries quotas for the reduction of oil production. OPEC+ has raised the oil production quota for the UAE from the current 3.18 to 3.5 million b/d. For Russia and Saudi Arabia, quotas were increased from 11 to 11.5 million b/d, and for Iraq – from 4.65 to 4.8 million b/d.

As early as August 1st, OPEC+ began a monthly increase in oil production by 400 thousand b/d, which by the end of the year contributes to the return to the market of 2 million barrels of oil per day. It is expected that by the fall, oil production will increase by 5.8 million b/d, returning to the pre-crisis level.

The market perceived the new agreements OPEC+ ambiguously. After reaching an agreement on Monday, July 19th, the price of Brent crude immediately crashed by 6.2%, dropping below the significant level of $70 per barrel. To be fair, then the price quickly recovered, but after July 19th, it was not possible to step over the mark for Brent of $75 per barrel.

Also in July, global oil corporations has published reports for the second quarter and first half of 2021. Almost all giants have shown very strong results. The average price of Brent oil in the second quarter was $69.5 per barrel, while the average price of the Texas WTI crude increased to $67.2 per barrel.

August

At the end of July, the OPEC+ countries has decided to increase production from August by 400 thousand b/d each month. At the same time, they agreed to conduct monthly consultations to assess the market situation and the feasibility of increasing production.

Granted, a new month means new changes. The decision to increase production, agreed in July by the OPEC + countries, may be revised at a meeting on September 1st. This was announced by the Minister of Oil of Kuwait, Mohammad Abdulatif al-Fares.

As of August 31st, the cost of October futures for Brent oil is $72.87 per barrel, which is 0.74% lower than the price at the close of the previous session. In general, oil prices were decreasing during August.

There were at least two more important events in August. The first is the spreading of a new strain of coronavirus in China.

Data from China shows that the spreading of the new COVID-19 strain and the quarantine measures introduced to contain it have limited business activity in the industrial sector. Over the past month, oil has dropped nearly ten dollars from its July highs. It is widely assumed that the situation is worsened by China, which has imposed restrictions on rail and air travel, and records for infection with a new strain of coronavirus have recently been broken in Australia, Japan and the United States.

In addition, the Financial Times highlights that the strengthening of the dollar made oil more expensive for companies that settle in other currencies. At the same time, the outlet believes that there are few objective reasons for the weakening of oil, and the danger looks exaggerated, since the OPEC+ policy really affects the situation.

And at the end of August, there was another shake-up for the oil market: Hurricane Ida. Oil companies almost completely stopped operations in the Gulf of Mexico due to the hurricane. Quotations are rising due to news of the aftermath of Hurricane Ida.

Please note that due to the hurricane, almost 90% of the US oil production facilities located in the Gulf of Mexico stopped working. As a result, production fell down by 1.65 million barrels per day.

The hurricane season in the Atlantic lasts from June 1st to November 30th and traditionally affects the production facilities of US oil companies. Hurricane Ida has reached the US coast on Sunday, August 29th. By that time, it had risen to the fourth category out of five, thereby becoming one of the strongest in history, and this is always reflected on oil.

It is also worth adding here the nervous atmosphere due to the upcoming OPEC+ meeting and rumors about the suspension of the increase in production.

How was the logistics?

Over the past month, the shipping of oil and gas has been closely monitored. It all began on July 29th when the Liberian-flagged tanker Mercer Street was attacked in the Arabian Sea.

The operator of the vessel Zodiac Maritime is owned by Israeli entrepreneur Eyal Ofer. Two crew members, a Romanian national and a British national, were killed in the incident.

Further, on August 3rd, the Organization for the Coordination of Maritime Trade Transport (UKMTO) has informed that a group of eight to nine armed men climbed aboard the Asphalt Princess, sailing under the Panama flag from the Emirati city of Haur Fakkan to the port of Sohar in Oman. The tanker has changed its route and headed towards Iran.

The tanker’s crew has managed to block the engines in time, and the invaders had to retreat when the US and Oman warships approached. Almost at the same time, the captains of the tankers Golden Brilliant, Queen Ematha, Jag Pooja and Abyss in the same region announced the loss of control over the vessels.

After these incidents, harsh political statements followed – for example, the G7 countries has blamed Iran for everything. The British chief of defense, General Nicholas Carter, said that the UK and Western countries will have to take measures to contain Tehran after the attack on the tanker Mercer Street in the Arabian Sea. Israeli Defense Minister Beni Gantz has warned that his country is ready to conduct military operations against Iran.

Next to above mentioned, Tehran has issued a statement that the world community is trying to artificially provoke incidents in the Persian Gulf. The commander in chief of the Islamic Revolutionary Guards Corps (IRGC) Alireza Tangsiri emphasized that the IRGC ensures total security on the maritime borders of the Persian Gulf region and the Strait of Hormuz. But the situation did not stop at a peaceful discussion at the UN.

In mid-August, the Israel Defense portal reported that British Army special forces had arrived in Yemen. The agency planned to track down militants who allegedly used combat drones to attack the Mercer Street tanker.

Also on August 12th, it became known about the explosion on the tanker Wisdom, which was undergoing maintenance in the Syrian port of Latakia. On August 15th, in northern Lebanon, a fuel tank exploded on board of a gas tanker, containing 60,000 liters of heating oil. According to Agence France-Presse, at least 28 people died.

It is worth noting that the sharp rise in prices for the transportation of goods from Asia to Europe did not greatly affect tankers. In mid-August, tanker freight rates on the main Middle East to Asia route fell down to their lowest level since March. The International Energy Agency notes that this was due to a decrease in oil shipments coupled with an increase in the cost of marine fuel.

Separately, it is worth noting the low freight rate of tankers. While other shipping sectors are enjoying super profits, tanker owners continue to endure months of paltry rates and accumulating losses.

In mid-August, Belgian tanker owner Euronav has published a new report. According to it, asset prices have become stronger, with prices for VLCC and Suezmax rising 9% in the second quarter alone.

On the other hand, steel prices has reached their highest level since August 2008, which was one of the factors prompting, for example, that in Bangladesh recycling rates exceeded $600 per tonne, and more tankers are being scrapped. Nine VLCCs have been sold for recycling this year, more than double the 2020 figure, the company said.

Also in the report, shipowners have noted that 9% of the VLCC fleet is now over 20 years old. As emissions regulations tighten and new carbon reduction measures come into effect, further tanker scrapping is likely to take place in the coming months.

There is also a positive opinion: oil production is gradually returning to the “pre-covid” level. And this is an important factor in stimulating demand for tankers through more stable import and export of crude oil. Another positive thing for tanker owners is a phased increase in OPEC+ production by the end of the year, which is likely to lead to additional oil supplies by two million barrels per day. This can create demand for 60 VLCCs. Crude oil demand, meanwhile, is likely to rise by the end of the year as more countries exit due to Covid-19 restrictions.

Ruslan Soroka.

Sources: Reuters, Euronav, Agence France-Presse, Financial Times, Enkorr, USM, Oil and Capital, National Association of the Oil and Gas Servicing Companies.